Highlights

- Plug Power Inc. (NASDAQ:PLUG) stock rating has been upgraded to “overweight”.

- Plug Power’s revenue jumped 83% YoY in Q2, FY21.

- FuelCell Energy, Inc. (NASDAQ:FCEL) reported a revenue of US$26.8 million in Q3, FY21.

Plug Power Inc. (NASDAQ:PLUG) stock was up 9%, and FuelCell Energy, Inc. (NASDAQ:FCEL) shares gained around 2% on Wednesday as they gained significant traction in intraday trading.

The PLUG stock traded at US$32.64, up 9.60%, while the FCEL stock traded at US$7.07, up 2.17% at around 11 am ET from their previous closing prices.

Let's look at the performances of the stocks.

Also Read: Earnings update: Infosys revenue up 20%, Wipro net income jumps 18%

Plug Power Inc. (NASDAQ:PLUG)

Plug Power is an electric equipment manufacturing company that develops hydrogen fuel cell systems for electric vehicles. It is based in Latham, New York.

The stock rallied after Morgan Stanley analysts upgraded its rating to "overweight" with a price target of US$40 per share. In addition, the firm advanced a green hydrogen deal with Airbus and Phillips 66 to help decarbonize air travel and boost hydrogen fuel use in airport operations.

Plug Power market cap is US$19.05 billion, and the forward P/E one year of -63.36. The EPS is US$-1.53. The 52-week highest and lowest stock prices were US$75.49 and US$13.69, respectively. Its trading volume was 28,217,490 on October 12.

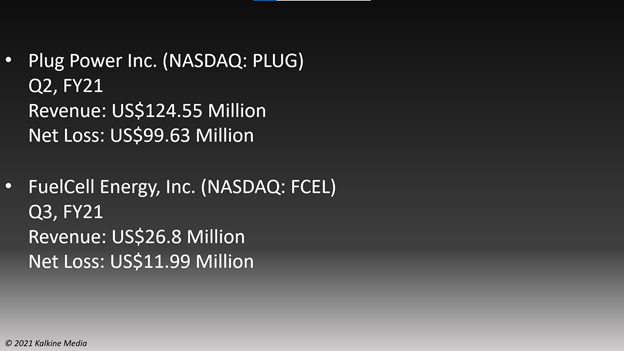

The revenue surged 83% YoY to US$124.55 million in Q2, FY21. However, its net loss was US$99.63 million compared to a loss of US$9.40 million in the same quarter of the previous year.

Also Read: Delta Air’s (DAL) net income falls, expects faster recovery in Q4

FuelCell Energy, Inc. (NASDAQ:FCEL)

FuelCell Energy is a Connecticut-based clean energy company that has interests in designing and manufacturing efficient fuel cell power plants.

The stock soared on Wednesday for no apparent reason. It was gaining traction in recent days. Still, it has been an underperform compared to its rivals. The market cap is US$2.56 billion, and the forward P/E one year is -40.71. The EPS is US$-0.33.

The stock saw the highest price of US$29.44 and the lowest of US$1.98 in the last 52 weeks. Its share volume on Oct 12 was 18,894,620.

The revenue was US$26.8 million in Q3, FY21, against US$18.7 million in the year-ago quarter. It reported a net loss of US$11.99 million compared to a loss of US$15.33 million in Q3, FY20.

Also Read: Q3 Earnings Snapshot: Pinnacle’s (PNFP) net income jumps to US$136.5 Mn

Bottomline

Both the stocks saw significant growth in recent months, driven by the clean energy trend. The PLUG stock rose by 23.01% in one month, while FCEL stock rose 23.13% in the same period. However, investors should evaluate the companies carefully before considering an investment.