Headlines

- Retail sector remains in focus through noteworthy corporate financial reporting

- Pre-market update presents details directly from the NYSE trading floor

- Walmart’s recent financial disclosure offers key information on corporate performance

The retail industry, characterized by its dynamic operations and widespread consumer engagement, has experienced significant developments recently. Today’s update centers on key financial disclosures from one of the largest global retail corporations, offering insights into a sector that consistently plays a pivotal role in everyday commerce. A report issued early this morning delivers important details from the New York Stock Exchange trading floor, providing a glimpse into the early session activities. The discussion focuses on factual information regarding market conditions and corporate performance without any forward-looking assurances.

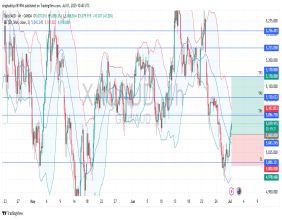

Market Environment

The current market environment reflects a stage of active trading and evolving operational patterns across various sectors. Early session developments on the trading floor have set a stage where detailed information from recent corporate disclosures is presented objectively. This environment is marked by the movement of stocks that represent various sectors, each demonstrating unique operational trends. Observers have noted that the retail domain is among those receiving heightened attention, following the release of important corporate financial disclosures. Market participants are closely examining the pre-market activities, which reveal fluctuations influenced by overnight developments and global economic factors. The atmosphere on the trading floor remains busy, with discussions focused solely on the factual events that have unfolded during the early hours of the session. Such information plays an essential role in providing a transparent view of the early trading dynamics that help frame the day’s overall operational context.

NYSE Trading Floor Dynamics

Within the expansive space of the NYSE trading floor, activities during the early session display a level of energy that resonates with the importance of timely corporate news. Details communicated directly from the trading floor illustrate the procedural flow of early session operations. This space continues to be a hub where corporate disclosures are integrated into the broader narrative of market operations. Recent details from this area have spotlighted the operational efficiency and communication methods utilized during pre-market hours. The process involves rigorous attention to factual reporting from the floor, where every piece of information is shared as it becomes available. The setup of the trading floor, along with the systems in place, provides a mechanism for updating participants about the latest financial reporting from key corporations. The procedures established ensure that every detail related to corporate activities is presented in an objective manner. This environment, marked by its vibrant and organized nature, serves as an essential resource for those seeking to understand the unfolding events at the start of the trading day.

Walmart Earnings Overview

In today’s early update, a major financial disclosure emanates from one of the world’s leading retailers. The corporation, known globally for its extensive retail network and comprehensive range of consumer services, has issued a report that adds an important dimension to the early session narrative. The disclosure, which has garnered attention for its comprehensive depiction of corporate performance, offers details that have been received with a high degree of factual clarity. Within the report, various operational metrics and key performance indicators are outlined. An important note includes a reference to the company’s ticker (NYSE:WMT), which appears just once to maintain clarity in reporting. This report serves as a crucial factual resource that contributes to the understanding of how a leading corporation in the retail sector has performed in its latest financial period. The details provided focus exclusively on corporate performance, shedding light on the company’s operational strengths without engaging in any forward-looking assertions. Information from the report is shared to enhance transparency and to detail the current state of corporate reporting in a clear and objective manner.

Sector Developments and Trends

The retail domain continues to capture significant attention due to its broad impact on economic activity and consumer engagement. Developments within this sector are rooted in operational transparency and detailed corporate reporting. Recent disclosures have underscored the importance of maintaining an informed perspective on corporate financial performance. In this context, the focus on the retail industry offers a window into the everyday commerce that drives broader economic activity. Observers note that the mechanisms used for reporting and the systems implemented on trading floors contribute to a more comprehensive understanding of how the retail sector operates. These mechanisms are underpinned by a commitment to factual communication, ensuring that every aspect of corporate performance is relayed in an objective manner. This adherence to factual reporting supports the overall integrity of the financial landscape. Information shared on the trading floor, especially through pre-market updates, offers a snapshot of the operational environment where each corporate disclosure is integrated into the broader economic narrative. Such detailed reporting reinforces the role of the retail sector as a vital component of overall market operations.

Pre-Market Operational Highlights

The early session on the NYSE trading floor is marked by an emphasis on objective factual reporting and detailed communication. The update shared this morning reflects a comprehensive approach to conveying information directly from the trading floor. Procedures in place ensure that every disclosure, particularly those involving major corporations in the retail sector, is shared with clarity and precision. The early operational dynamics have been shaped by the timing of corporate disclosures, which, when combined with detailed pre-market reporting, form an essential aspect of the day’s trading environment. The structured approach to sharing information reinforces the importance of factual updates that detail current corporate performance without engaging in any forward-looking projections. Such an approach underscores the commitment to transparency and the value of accurate information that is made available to all market participants. As the trading day unfolds, the focus remains on providing a clear depiction of operational events as they occur, with a special emphasis on maintaining the integrity of factual reporting. The detailed view provided by the early session activities serves as a reminder of the organized and systematic processes that support the overall trading environment, ensuring that every detail is presented in an objective and transparent manner.