Summary

- GDP data released by the Bureau of Economic Analysis showed that the U.S. economy has expanded by 4.9% in the third quarter of 2023.

- Deckers Outdoor Corporation, a retailer of performance clothing and footwear, closed 19% higher on an intraday basis on Friday.

- com Inc., a globally recognized online retailer, closed 6.83% higher on an intraday basis and by around 50% higher on a YTD basis on Friday.

The latest advanced GDP estimate released by the Bureau of Economic Analysis showed that the U.S. economy has expanded by 4.9% in the third quarter of 2023. This marked the fastest growth of GDP increase in the US economy over the last two decades.

Consumer cyclical stocks are a category of stocks that are closely tied to the economic cycle and consumer spending patterns. These stocks belong to companies whose products and services are considered non-essential, meaning they are more likely to be purchased when consumers have disposable income.

ALSO READ: Examine these two consumer cyclical stocks priced under $20

With that, let us examine two consumer cyclical stocks that can be an interesting watch after the latest GDP release.

Deckers Outdoor Corporation (NYSE: DECK)

Deckers Outdoor is engaged in the creation and retail of performance footwear, clothing, and accessories. Most of its product distribution occurs via the wholesale channel, although it also maintains a significant direct-to-consumer presence.

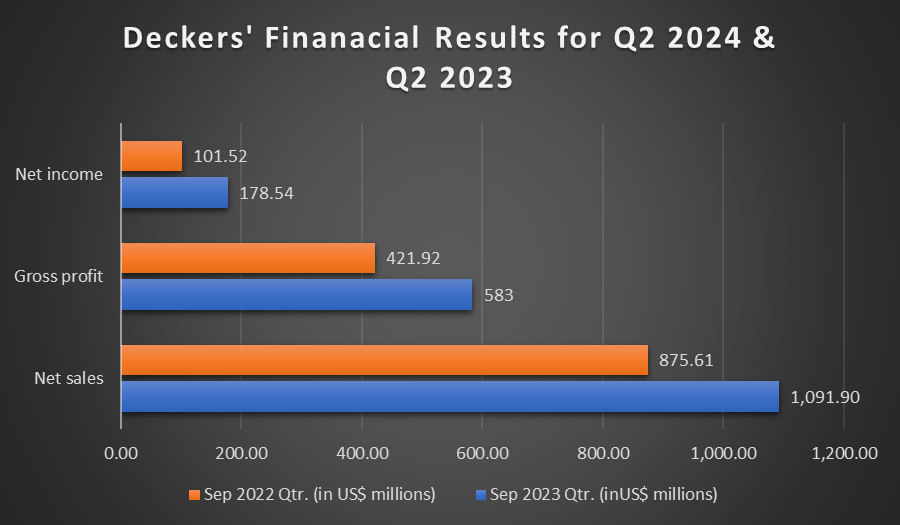

During Q2 2024, net revenue surged by 24.7% to reach US$1.092 billion, a notable increase from the previous corresponding period’s net revenue of US$875.6 million. When considering constant currency rates, the growth was still substantial at 24.2%.

The operating profit during the quarter saw a significant rise to US$224.6 million, surpassing pcp’s US$127.8 million. Diluted earnings per share also experienced an uptick in Q2 2024, standing at US$6.82 compared to the earlier US$3.80.

Image Source: ©2023 Kalkine®; Data Source: Company Reports

In terms of financial holdings, cash and cash equivalents grew to US$823.1 million from US$419.3 million. Moreover, inventories decreased to US$726.3 million from US$925.0 million. It's worth noting that the company had no outstanding debt at this time.

Based on Friday’s closing price of US$576.12, DECK has a P/E ratio of 20.90x. The stock was around 19% higher on an intraday basis at Friday’s close.

ALSO READ: Find out why these biotechnology firms surpassed market gains

Amazon.com Inc. (NASDAQ: AMZN)

Amazon is a prominent player in the online retail sector and ranks among the top performers in the e-commerce industry. In 2021, it achieved US$386 billion in net sales and an estimated total of around US$578 billion in online gross merchandise volume, encompassing both physical and digital goods.

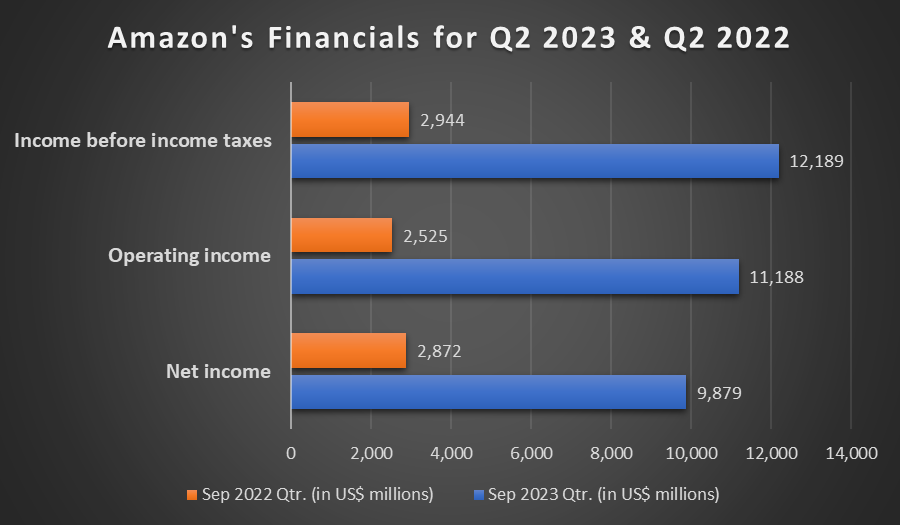

In Q3 2023, net sales saw a 13% rise, reaching US$143.1 billion. Operating income in the same quarter surged to US$11.2 billion, marking a substantial increase from the US$2.5 billion reported in Q3 2022.

Image Source: ©2023 Kalkine®; Data Source: Company Reports

Net income for the third quarter also grew to US$9.9 billion, equivalent to US$0.94 per diluted share, a significant improvement compared to the US$2.9 billion, or US$0.28 per diluted share, reported in Q3 2022.

Furthermore, operating cash flow experienced a remarkable 81% increase, amounting to US$71.7 billion for the trailing twelve months, compared to US$39.7 billion for the twelve months ending September 30, 2022.

Based on Friday’s closing price of US$127.74, AMZN has a P/E ratio of 62.43x. As at the close of trade on Friday, AMZN stock price grew by 6.83% on an intraday basis and by around 50% on a YTD basis.