Highlights

- Comerica Bank significantly reduced its stake in Fox Factory during the latest quarter.

- Fox Factory surpassed revenue expectations with strong quarterly results.

- Mixed evaluations from market watchers reflect diverse outlooks on Fox Factory’s valuation.

Factory Corp. (NASDAQ:FOXF), a key player in the transportation products sector. It significant changes among major stakeholders and examines how these movements reflect the evolving trading landscape for Nasdaq companies by market cap.

Market Movements and Share Adjustments

In the most recent quarter, a major bank decreased its shares by over eighty percent, ending with a relatively small position. Several other entities made their presence known either by increasing their shares or entering the stock for the first time. For example, one financial entity boosted its position by more than eighty percent, while others such as different funds acquired stakes, illustrating a varied engagement with the company’s shares.

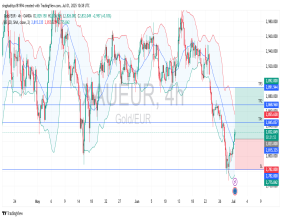

Fox Factory’s stock opened recently at a price noticeably above its fifty-day moving average and below its two-hundred-day average. The price-to-earnings ratio signals a high valuation relative to earnings, a metric worth noting when reviewing the company’s financial metrics.

Financial Performance and Revenue Highlights

During the recent quarter, Fox Factory reported earnings per share that slightly exceeded expectations. The company’s revenue also surpassed estimates by a significant margin, indicating stronger sales performance than anticipated. Key financial indicators such as return on equity and net margin reveal the company’s profitability metrics, though the net margin remains relatively modest compared to the overall revenue scale.

The earnings and revenue figures illustrate Fox Factory’s capacity to maintain operations and deliver results in a competitive market environment. These figures are central to understanding how the company is positioned financially and how it manages profitability against costs and revenues.

Diverse Market Opinions and Valuation Perspectives

Market evaluations regarding Fox Factory vary. Some entities have adjusted their valuation levels downward, reflecting a more conservative stance, while others have increased their valuation outlooks, signaling optimism about the company’s trajectory. The consensus rating leans towards a neutral stance, with the average valuation figure remaining above the current market price.

This variance in assessments highlights the differing perspectives on Fox Factory’s future prospects within the transportation and performance suspension sector. The company’s broad product range and global operations contribute to these diverse viewpoints, especially as market conditions evolve.

Industry Position and Operational Scope

Fox Factory (NASDAQ:FOXF) operates globally, offering a variety of performance-defining products tailored to different transportation categories. The company’s portfolio includes suspension systems designed to enhance ride quality and durability for vehicles used both on and off the road. The firm’s engineering expertise and product innovation position it within a specialized niche in the transportation sector.

This operational focus ensures the company remains relevant to various markets and customer segments, maintaining its role as a key player in the design and manufacturing of advanced vehicle components.