Summary

- The S&P 500 index is widely used to gauge the overall market sentiment and is an aggregate measure of the performance of the largest 500 companies by market cap.

- The S&P 500 index has risen by 14.10% on a YTD basis and by 0.94% on a weekly basis as on June 29, 2023.

- Host Hotels, EOG Resources and ResMed are S&P 500 stocks that investors can examine.

The S&P 500 index has risen 4.02% in the one-month period ended June 29, 2023. The index, which is widely used to gauge the overall market sentiment, is an aggregate measure of the performance of the largest 500 companies by market cap.

Powered By: TradingView

The index has risen by 14.10% on a YTD basis. Meanwhile, the weekly growth for the index is 0.94% as on June 29, 2023.

The movement of the S&P 500 is positively correlated with the performance of the large cap stocks. Since these large cap stocks majorly form the S&P 500, the index mirrors their performance. Some of these large cap stocks include industry leaders such as Apple, Microsoft, and Amazon, which are household names.

ALSO READ: These financial stocks may be interesting to watch amid rate hike expectations

The following large cap stocks can be examined by investors as the S&P 500 moves higher:

Host Hotels & Resorts Inc. (NASDAQ:HST)

Market Cap as on June 29, 2023: US$11.8 billion

As the name suggests, Host Hotels is an REIT that owns a range of upscale and luxury resorts and hotel properties across the US. The fund’s portfolio includes the Marriott and Starwoods brands, which might resonate more with consumers as compared to the parent brand.

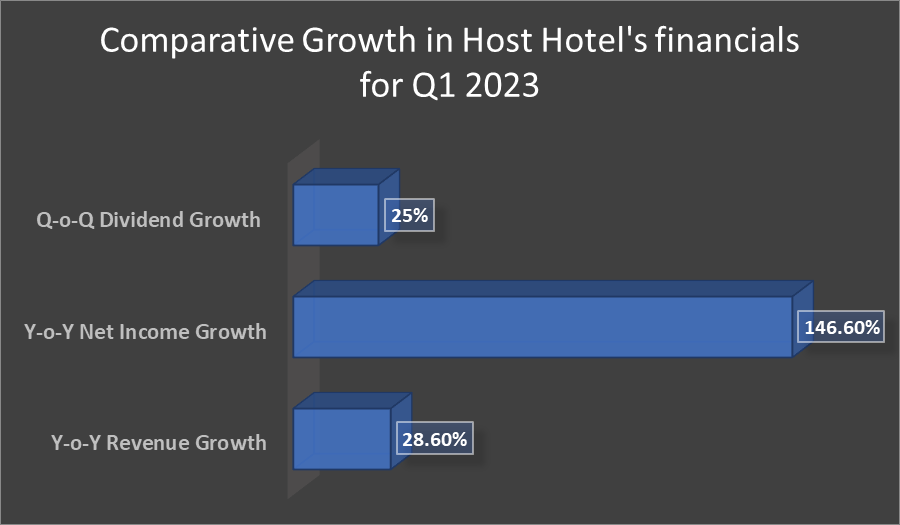

Host Hotels reported a year-on-year growth of 28.6% in its revenue for the March 2023 quarter. Its net income during the March 2023 quarter was US$ 291 million, rising 146.6% from that in the previous corresponding period.

Image source: ©2023 Kalkine®; Data source: Host Hotel’s Company Reports

The company recently announced an increase in its Q2 dividends for the investors of record on June 30, 2023. The dividend, payable on July 17, has increased by 25% from the prior quarter to US$ 0.15 per share.

Based on Thursday’s closing price of US$16.69, Host Hotels has a P/E ratio of 17.90x.

ALSO READ: KMX & DRI: Watch out for these consumer cyclical stocks as the market moves higher

EOG Resources inc. (NYSE: EOG)

Market cap as on June 29, 2023: US$ 66.08 billion

EOG is an oil and gas company that operates across the US shale gas plays in US. These include Permian Basin, Eagle Ford, and the Bakken.

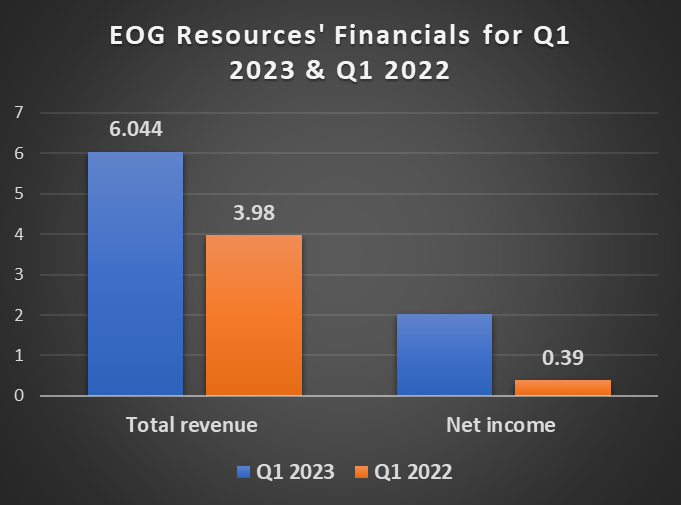

For Q1 2023, EOG reported total revenue of US$ 6.044 billion, compared to US$ 3.98 billion in Q1 2022. The net income was also significantly higher on a y-o-y basis for the quarter at US$ 2.023 billion, as against US$ 390 million in Q1 2022.

Image source: ©2023 Kalkine®; Data source: EOG’s Company Reports

The company also declared a dividend of US$ 0.825 per share on its common stock, which is payable on July 15, 2023.

Based on Thursday’s closing price of US$ 113, EOG’s P/E ratio stands at 6.80x.

ResMed Inc. (NYSE: RMD)

Market cap as on June 29, 2023: US$ 31.77 billion

ResMed is a respiratory care device company that primarily develops masks and accessories for sleep apnea. The company also aims to provide patients and medical care advisors with their clinical data to help with treatment.

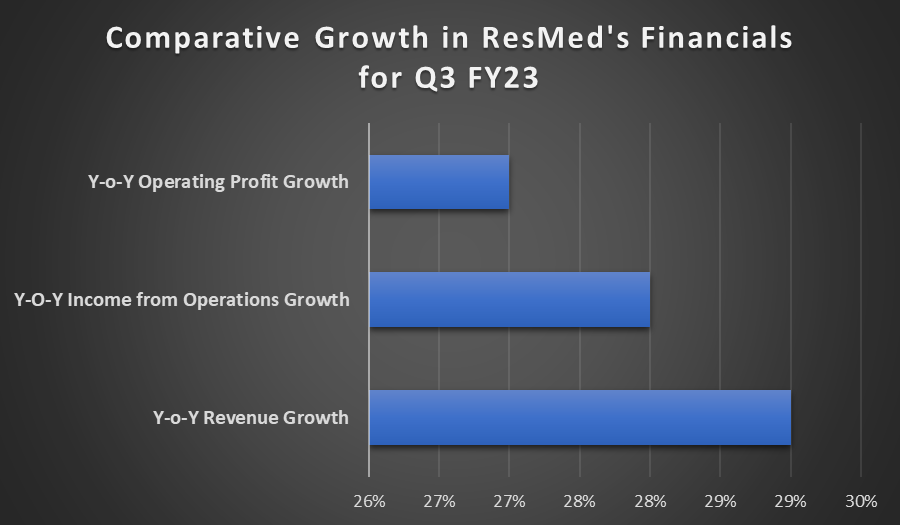

The healthcare company reported a y-o-y revenue growth of 29% to US$ 1.116 billion. Its income from operations increased 28%, while its operating profit grew 27%. The operating cash flow during the period was US$ 282.6 million.

Image source: ©2023 Kalkine®; Data source: ResMed’s Company Reports

Based on Thursday’s closing price of US$ 216.23, ResMed’s P/E ratio stands at 36.50x.