Summary

- Blue-chip companies have a longstanding record of successful operations in the market and are generally industry leaders.

- AbbVie and 3M Company are blue-chip stocks that pay quarterly dividends of over US$ 1 to their investors.

- Merck & Company is a blue-chip pharmaceutical company that offers its investors a dividend of US$ 0.73.

Blue-chip companies comprise some of the largest corporations in the market, with a longstanding record of successful business operations. These blue-chip companies are generally in the top tier of publicly listed companies and often have high market capitalization and strong financials.

Many of these blue-chip stocks are well-known regular household brands that consumers use daily. However, there are certain blue-chip companies that you may not have heard of. Check these blue-chip stocks that have maintained a stable track record and are leaders in their industry.

AbbVie Inc. (NYSE:ABB)

Pharmaceutical companies are some of the largest global ventures, with a high market capitalization. AbbVie is one such pharma giant that is a part of the world’s largest medical companies in terms of revenue.

© 2023 Krish Capital Pty. Ltd.

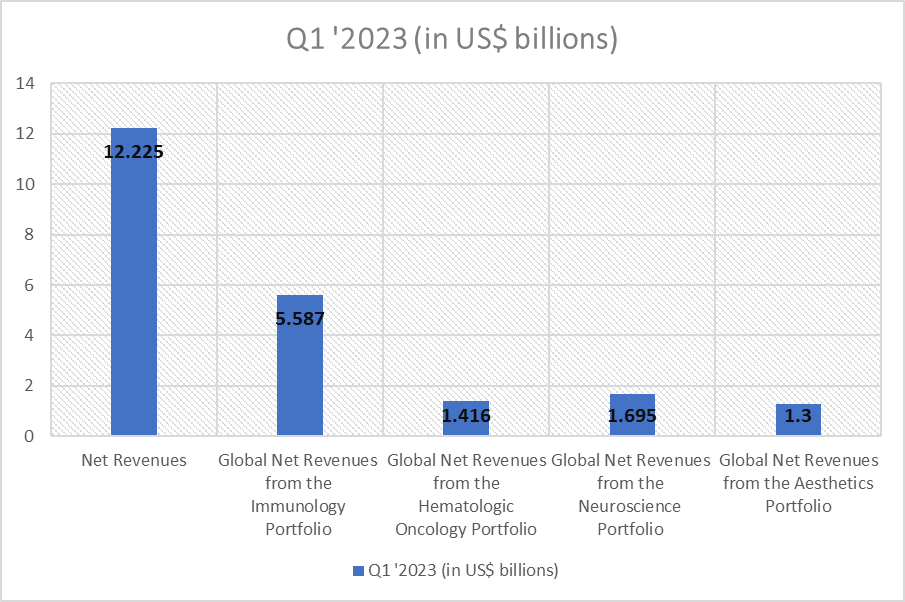

The company is well-known for its efforts in therapeutic areas such as immunology and oncology and has products and services in its Allergan Aesthetics portfolio. AbbVie recently announced its Q1 2023 results, which showcased a dip in revenues for the company. ABB’s net revenue during Q1 2023 was US$ 12.25 billion, which was 9.7% lower on a reported basis. The company pays a quarterly dividend of US$ 1.48.

The stock closed at US$ 36.01 on May 2, 2023.

Merck & Company Inc. (NYSE:MRK)

Merck & Company is another blue-chip company that is engaged in the development of medicines and vaccines. The company is also a medical research organization that utilizes science to help arrive at solutions. MRK offers its investors a quarterly dividend of US$ 0.73.

The company recently published its financial results for Q1 2023, which showcased the impact of the ongoing economic slowdown. During the quarter, MRK reported total worldwide sales of US$ 14.5 billion. However, the company expects the full-year 2023 worldwide sales to range between US$ 57.7 billion and US$ 58.9 billion.

The stock closed at US$ 117.89 on May 2, 2023.

3M Company (NYSE:MMM)

3M is virtually everywhere, with its vast range of businesses spanning industries. This offers the company a high level of diversification and a stable revenue stream. Some of their products include respirators, automotive parts, and personal protective equipment.

© 2023 Krish Capital Pty. Ltd.

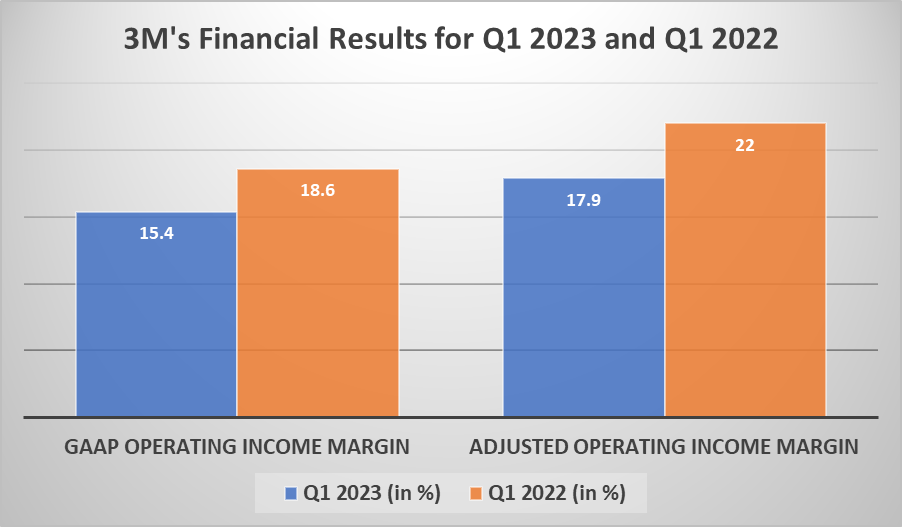

MMM pays its investors a quarterly dividend of US$ 1.50. The company reported its financial results for Q1 2023, in which it reported GAAP earnings per share of US$ 1.76. The adjusted earnings per share were US$ 1.97 for the quarter, while the sales were US$ 8 billion. The company reported that it returned US$ 856 million to shareholders.

The 3M stock closed at US$ 102.98 on May 2, 2023.

_05_03_2023_13_01_54_107609.jpg)