Highlights:

- Investors are interested in learning about the potential profits of investing in this EV megatrend.

- In the first quarter of this year, Tesla produced more than 440,000 vehicles.

- As of writing, Rivian's market cap was US$ 14 billion.

One of the biggest challenges in the fight against global warming, particularly in the United States, is the use of fossil fuels for transportation. The good news is that over the past few years, we've made considerable strides with electric vehicles, or EVs, in order to decrease this effect. The number of EVs on US roadways has surpassed 3 million, and it is growing quickly, according to the White House.

Investors are interested in learning about the potential profits of investing in this EV megatrend while concerned individuals consider ways to lessen their carbon footprints. They can get exposure to this sector through EV stocks, and on that note, let's find out how these two EV stocks have been doing recently.

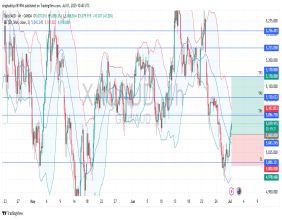

Tesla Inc. (NASDAQ:TSLA)

In the first quarter of this year, Tesla produced more than 440,000 vehicles and delivered over 422,000 vehicles. Meanwhile, in the fourth quarter of 2022, Tesla's automotive revenues amounted to US$ 21,307 million, reflecting a growth of 33 per cent year-over-year (YoY).

The total revenues of Tesla amounted to US$ 24,318 million in Q4 2022 compared to US$ 17,719 million in Q4 2021, which was an increase of 37 per cent YoY.

The electric vehicle maker's net income (GAAP) was US$ 3,687 million and improved significantly by 59 per cent YoY.

The adjusted EBITDA of the company also increased by 32 per cent YoY to US$ 5,404 million, and cash, cash equivalents, and investments increased by 25 per cent YoY to US$ 22,185 million.

Rivian Automotive Inc. (NASDAQ:RIVN)

On April 3, the company said it produced 9,395 vehicles at the end of the first quarter of this year. Meanwhile, it delivered 7,946 vehicles in the same period.

In 2022, Rivian's revenues were US$ 1,658 million, up from just US$ 55 million in 2021. However, the company's net loss increased to US$ 6,748 million from US$ 4,688 million in the same period.

As of writing, Rivian's market cap was US$ 14 billion and a negative price-to-earnings (P/E) ratio of 0.7.

Bottom line

Investors should study a company's business operations, balance sheet, and future prospects before investing in any stock. Research and analysis can help an investor in taking the right decision