Highlights

- EV stocks are companies that manufacture and sell electric vehicles and accessories.

- For 2022, Tesla Inc. achieved a total income of US$ 81.5 billion, up 51 per cent YoY.

- Rivian Automotive manufactured 10,020 and delivered 8,054 EVs in Q4’2022.

Automobiles that run on electricity instead of gas are known as electric vehicles commonly referred to as EVs. Electric car stocks, as the name represents, are companies that produce and distribute electric cars. At the same time, the businesses that produce the batteries, electric motors, and other components used in EVs are also seen as a part of the electric vehicle industry.

EV stocks have gained immense popularity over the last few years as the world is transitioning to a greener future. It is anticipated that electric vehicles will be crucial in the energy shift needed to combat climate change and reduce greenhouse gas emissions.

Also, with more and more companies implementing rules to curb carbon emissions, the US government has introduced a maximum US$ 4,000 tax credit for people buying a qualified used electric vehicle for US$ 25,000 or less, beginning January 1, 2023.

With all that said, let’s flick through the recent developments and financial performances of these two US EV stocks:

Tesla Inc. (NASDAQ:TSLA)

Austin, Texas-headquartered electric vehicle manufacturer Tesla Inc. operates as a vertically integrated sustainable energy company. The company had sold more than 1.3 million electric vehicles worldwide as of 2022. Tesla’s total market share is a little over US$ 589.9 billion.

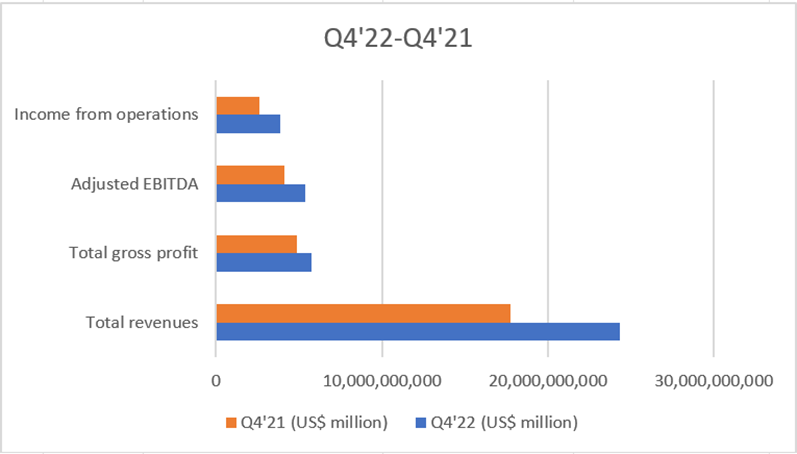

In addition to a record-breaking year, Tesla recently witnessed another record-breaking quarter. The company recorded its highest-ever quarterly sales of US$ 24.3 billion, operating income of US$ 3.9 billion, and net income of US$ 3.7 billion in the fourth quarter of 2022. On the other hand, total revenue in 2022 increased by 51 per cent year-over-year (YoY) to US$ 81.5 billion.

Apart from this, the company had US$ 22.2 billion cash in hand, cash equivalents, and investments by the end of the fourth quarter. The TSLA stock surged by 16.2 per cent in a month.

Tesla’s other financials are summarized below:

Image Source: © 2023 Krish Capital Pty. Ltd.

Rivian Automotive Inc. (NASDAQ:RIVN)

Rivian Automotive Inc. is involved in designing and manufacturing products and services useful to fight climate change, including its category-defining electric vehicles and accessories. The company has a market capitalization of US$ 19.23 billion.

Rivian Automotive produced 10,020 electric vehicles in the fourth quarter of 2022 and delivered 8,054 in the same time frame. The company produced 24,337 vehicles and delivered 20,332 vehicles for the full year 2022.

By delivering 6,584 vehicles in the third quarter of 2022, the company generated US$ 536 million in revenue. As of November 7, 2022, Rivian has a backlog of over 114,000 net R1 preorders, alongside an initial order from Amazon of over 100,000 electric vans. In a month, RIVN stock returned 3.5 per cent to investors.

Bottom Line

Even if the electric vehicle industry is predicted to flourish in the coming years, nothing is guaranteed on the stock market. Therefore, before investing in stocks, investors should do extensive market research.