Headlines

- Recent Stock Surge Marks a Shift for Advance Auto Parts

- EPS Declines vs Stock Growth: What’s Behind the Trends?

- Can Advance Auto Parts Maintain Momentum After Setbacks

Advance Auto Parts: A Look at Recent Developments and Future Prospects

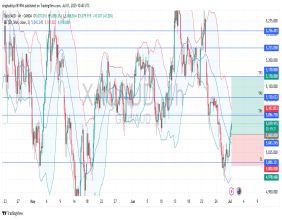

Advance Auto Parts, Inc. (NYSE:AAP) has experienced a tumultuous period, marked by a significant decline in both stock price and earnings. However, in recent weeks, there has been a noticeable rebound, with stock prices increasing by a substantial margin. This sudden surge raises questions about the company’s prospects moving forward, especially after such a prolonged period of underperformance.

In the past quarter, Advance Auto Parts has posted a significant rise in its stock value, reflecting a positive shift in sentiment. Despite this, the company’s long-term shareholders have had to endure a steep decline in stock price, which has plummeted substantially over the last few years. The drop in stock value during this period is a point of concern for those who have held their investments through the ups and downs. While the recent increase offers some hope, the question remains whether this growth will be sustained or if the challenges of the past will continue to weigh on the company’s future.

To understand the root causes of this downturn, it’s essential to examine the relationship between the company’s stock price and its earnings over time. A closer look at the figures reveals that the company’s earnings per share (EPS) experienced a sharp decline during the same period that the stock price faltered. Specifically, Advance Auto Parts saw a yearly drop in EPS, which resulted in a compounding effect on the company’s overall financial performance. This consistent decline in earnings has significantly impacted investor confidence and, by extension, the stock price.

However, it’s important to note that the drop in stock value was not as severe as the fall in EPS. The company’s share price declined at a slower rate compared to its earnings, indicating that investors may still retain a level of optimism about the company’s long-term earnings potential. This suggests that while the immediate financial results have been poor, there may be belief in a future recovery or a potential stabilization in earnings.

The company’s current price-to-earnings (P/E) ratio further reflects the market's optimistic view of the business. A relatively high P/E ratio, when compared to industry standards, typically indicates that investors have a favorable outlook on the company’s prospects, even in the face of past struggles. It suggests that the market is valuing the potential for future growth, even if the company’s earnings have not been as robust in recent years.

The challenge for Advance Auto Parts moving forward is whether it can continue to build on the positive momentum generated by recent stock gains. The company will need to show sustained improvements in its earnings and operational efficiency to justify the optimism reflected in its stock price. Long-term holders, in particular, will be watching closely to see if the company can maintain its recovery or if it will face another cycle of setbacks.

For now, while there are still many uncertainties surrounding the company’s financial future, the recent uptick in stock value provides a glimmer of hope. The company's ability to turn around its performance will depend largely on its capacity to deliver consistent results and prove that its past challenges are behind it. Whether or not the company can overcome the hurdles of the past will become clearer in the coming months as the market continues to react to its financial reports and strategic decisions.

In conclusion, while Advance Auto Parts has faced significant challenges over the past few years, there are signs of hope emerging as the company works toward a possible recovery. The market’s reaction to its recent performance, as well as its relatively high P/E ratio, suggests that there may be belief in its long-term stability and growth. However, only time will tell whether the company can build on this momentum and recover from its past declines.