Bitcoin wiped a notable chunk of its early week gains as it slipped below $100,000 just 48 hours after settling above that mark for the first time in 2025.

Hopes for a post-holiday market rebound are facing setbacks, with the global cryptocurrency market capitalization dropping over 7% in a day, from $3.68 trillion to $3.4 trillion at the time of writing.

Fear crept back into the market, with macroeconomic concerns pushing the crypto fear and greed index down to 70 from 78 the day before.

Losses were more pronounced in the altcoin sector, with most top cryptocurrencies showing red candles across the board.

Why did Bitcoin crash today?

Bitcoin is down over 5% at press time, with an intraday low of $94,541.19 and over $522 million long positions liquidated in the past 24 hours.

It was a tough day for both traditional and cryptocurrency markets as fears of inflation and rising US bond yields weighed heavily on investor sentiment.

Traders grew cautious amid signals from the Federal Reserve hinting at prolonged higher interest rates, dampening risk appetite across the board.

However, the primary catalysts behind today’s crash were two key economic reports.

First, the Institute for Supply Management’s (ISM) December PMI came in hot at 54.1, beating November’s 52.1 and hinting at stronger-than-expected economic activity.

Meanwhile, the November JOLTS report showed a rise in job openings, but hiring slowed compared to the previous month.

The quit rate—often seen as a measure of worker confidence—dipped to 1.9% from October’s 2.1%.

These numbers have investors rethinking their expectations for interest rate cuts.

Traders now see less than a 50% chance of cuts before June, and most expect the Federal Reserve to keep rates steady at its mid-January meeting.

The current market scenario favors a deeper correction, according to some experts.

According to analyst pseudonymous analyst Skew, $95,000 is a key support level for now that could decide Bitcoin’s short-term price action.

If the price breaks below, it could trigger further downside momentum, potentially driving Bitcoin toward the $92,000–$88,000 range as significant buy liquidity is waiting in that zone.

The market naturally gravitates toward areas with high liquidity.

However, others were not so concerned, with analyst Josh Rager speculating that the market could rebound by the end of the week.

On the other hand, analyst Markus Thielen says tightening global liquidity, driven by a stronger US dollar post-Trump re-election, could push Bitcoin into a consolidation phase as dollar-denominated liquidity weakens.

Will Bitcoin go up again?

Some indicators suggest Bitcoin could be set for a strong rebound shortly.

For instance, Bitcoin’s hourly Relative Strength Index had dropped to oversold levels last seen when its price was trading around $60,000 in early 2024.

Such levels mean Bitcoin is heavily undervalued right now, making it likely for buyers to step in and push the price back up.

Another factor is the long-short ratio on Binance, one of the world’s largest exchanges by trading volume and an influential platform in shaping the flagship crypto’s price.

Currently, the long-short ratio on Binance stands at 1.69, showing more traders are betting on Bitcoin’s price going up than down.

This buying pressure could help push prices higher if market sentiment stays positive.

Another positive indicator for Bitcoin is the TD Sequential, which, according to analyst Ali Martinez, is showing a buy signal on the 4-hour chart.

The TD Sequential is a technical indicator used to spot trend reversals.

A buy signal suggests Bitcoin’s price might be ready to bounce back in the short term.

Altcoin market suffers

Over the past 24 hours, the overall altcoin market capitalization dropped by 9.6%, from $1.67 trillion to an intraday low of $1.51 trillion.

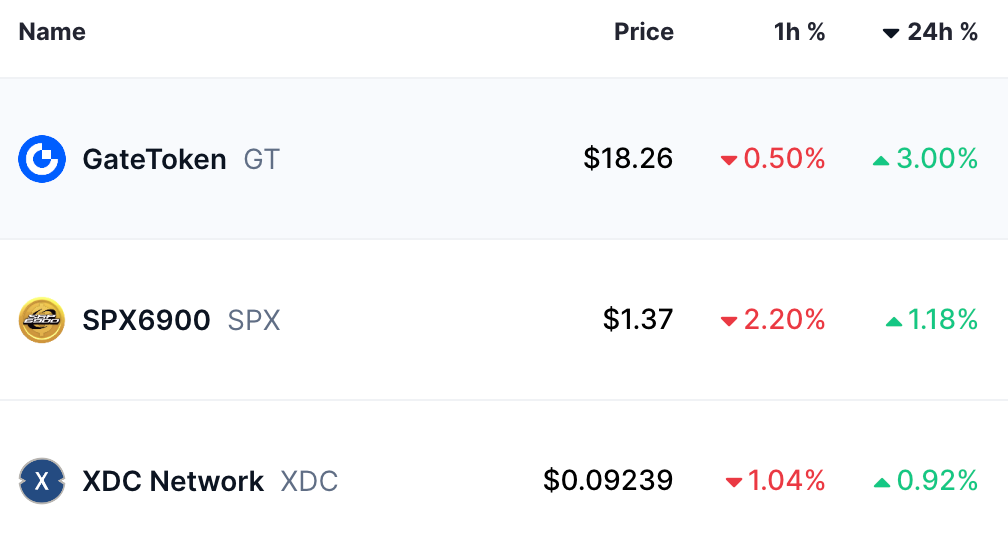

Most of the top altcoins suffered, with the best performer, GateToken (GT), gaining just 3%, followed by SPX and XDC, with gains below 2%.

Source: CoinMarketCap

It’s common for altcoin market crashes to be more severe, as their price movements are often heavily tied to Bitcoin’s performance.

When Bitcoin experiences volatility, altcoins tend to react with amplified swings in both directions.

The Altcoin Season Index has also dipped by one point to 46, signaling weakening momentum in the broader altcoin market.

For a recovery to take shape, Bitcoin would need to stabilize and regain upward momentum to restore confidence across the altcoin sector.

Traders are also bullish over the long-term performance of altcoins this bull season. According to Crypto Rover, the broader trend remains intact. See below.

The post Bitcoin crashes below $100K as recovery signals emerge; GT leads altcoin gains appeared first on Invezz