Headlines

- US stock environment influenced by tariff concerns and policy announcements.

- Notable decline seen in prominent retail company (ticker WMT) amid cautious market sentiment.

- Steady weekly jobless claims data and shifts in Treasury yields and the dollar observed.

Sector Overview and Market Sentiment

The domestic equity scene has experienced a period marked by cautious trading and subtle shifts in sentiment as various economic factors exert their influence. The financial sector, along with a range of other industries, has been reacting to policy statements and international trade discussions that have contributed to an environment of uncertainty. Market participants are observing the effects of these developments as they unfold throughout the trading session. Recent activity in several key sectors reflects a sense of vigilance among those monitoring economic indicators and government policy announcements. Global trade dynamics and ongoing political discourse have been at the forefront, affecting the overall atmosphere in financial centers. The interplay between domestic fiscal measures and international policy pronouncements has yielded a trading environment characterized by restrained optimism, where measured responses can be seen in the behavior of equity prices. Amid this backdrop, the sentiment across the sector remains tempered, with economic conditions and geopolitical factors combining to create a market that is alert to external influences.

Macroeconomic Factors and Global Influences

The current trading session reveals a market influenced by an array of macroeconomic elements and global developments. A series of official policy pronouncements from the nation’s leadership has contributed to a climate where caution prevails among market participants. Global trade considerations have surfaced as a significant factor, with tariff-related discussions playing a central role in shaping market behavior. International counterparts are also closely monitoring the situation, resulting in a broader sense of vigilance that spans across continents. Currency fluctuations and shifts in the international monetary framework further add to the complexity of the environment. While domestic financial centers are processing these developments, overseas markets are exhibiting similar patterns of tempered trading activity. The interplay between fiscal policy and international trade discussions is evident, and the resulting market mood reflects an awareness of the multifaceted nature of the current economic landscape. Each piece of policy information and trade-related announcement contributes to a broader narrative where the interconnected nature of global finance becomes ever more apparent.

Retail Sector Movements and Impact

Within the broader market landscape, the retail segment has experienced its own set of challenges amid the prevailing economic conditions. A well-known retail company (WMT) has registered a notable decline as external trade discussions and tariff concerns have weighed on market sentiment. This particular movement underscores the sensitivity of the retail sector to broader economic forces and policy decisions. The dynamics at play in the retail market highlight how shifts in consumer sentiment and international trade policies can have immediate effects on company performance. In recent trading sessions, retail enterprises have seen adjustments in their stock valuations as market participants process information coming from both domestic economic data and international trade updates. The interplay between the firm’s performance and the evolving market conditions has led to observable shifts in pricing, with the retail environment remaining closely tied to external economic narratives. The development in this sector serves as an example of how widely disseminated policy matters can have a direct and measurable effect on individual companies, especially those with substantial exposure to both domestic and international consumer markets.

Labor Market Data and Its Implications

Attention has also been drawn to the labor market, where weekly jobless claims data has emerged as a key indicator amid a complex economic scenario. Consistent figures in this area have provided a measure of stability even as other market segments display signs of volatility. The reported data from the labor sector has remained steady, suggesting that the fundamentals of employment are holding steady in the current climate. Such information plays an important role in the overall market atmosphere, offering a glimpse into the operational state of the national workforce. While other segments of the financial sector are influenced by external policy pronouncements and international trade debates, the labor market presents an example of resilience. This steadiness in jobless claims contributes to the broader narrative of an economy that is managing to maintain equilibrium despite facing a variety of external pressures. In a context where fiscal and monetary policies are being closely scrutinized, the labor market’s performance remains an important barometer of economic health, reflecting a consistent level of activity that is monitored by both domestic and international observers.

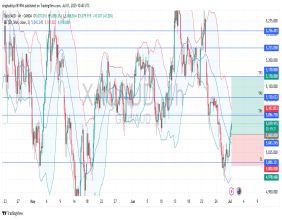

Currency Movements and Treasury Yield Shifts

Parallel to the fluctuations observed in equity prices, notable movements in currency values and Treasury yields have been recorded during recent trading sessions. The US dollar, which plays a central role in global finance, has experienced a downturn that aligns with the broader market sentiment. Treasury yields have also shifted in a manner that reflects the ongoing changes in economic outlook and investor sentiment. The observed movement in these areas is a part of the wider picture where fiscal policy and global trade discussions converge to create an environment of caution. Currency values and fixed-income instruments are both responding to an intricate mix of domestic policy actions and international economic conditions. Such developments underscore the interconnected nature of the financial system, where shifts in one area can resonate across multiple sectors. The movements in Treasury yields and currency valuations serve as a barometer for the underlying confidence in fiscal policies and the broader economic framework. As these elements continue to evolve, their behavior remains closely watched by observers who note the inherent connection between monetary policy and overall market dynamics.