Highlights

- Apple Inc. (NASDAQ:AAPL) revenue rose 11% YoY in Q1, FY22.

- Visa Inc. (NYSE:V) revenue increased by 24% YoY in Q1, FY22.

- Coca-Cola Company (NYSE:KO) will report its fourth-quarter and fiscal 2021 results on February 10.

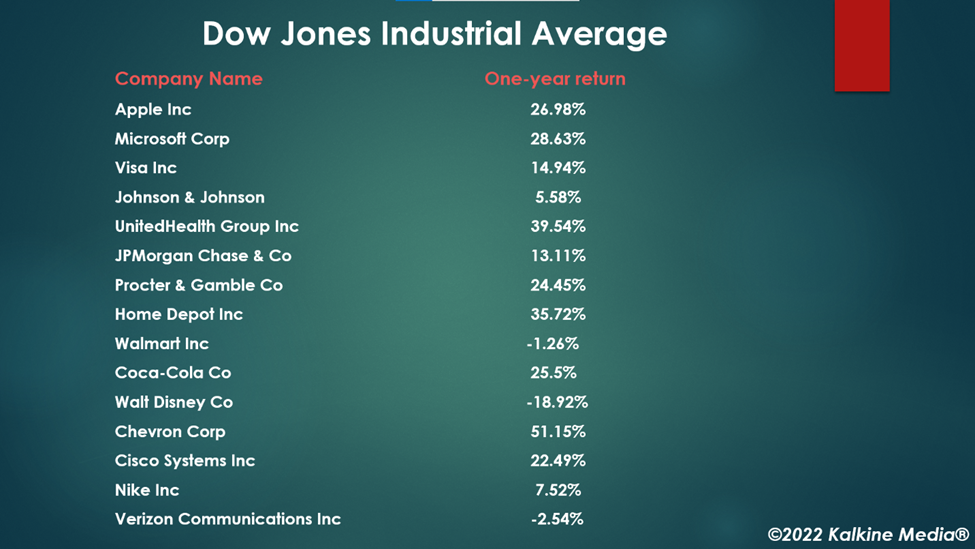

The Dow Jones Industrial Average rose 14.94% in the past 12 months. This year, though, it has plunged 5.08% as of January 28. It will be interesting to see how the index performs as the market braces for multiple interest rate hikes this year in the backdrop of record-high inflation.

We explore the top 30 stocks on Dow Jones by market capitalization in the two-part article.

Also Read: A look at top 50 stocks by market cap on NASDAQ Composite (Part I)

Apple Inc. (NASDAQ:AAPL)

Market Cap: US$2.97 trillion

Price close on January 28, 2022: US$170.33

One year return: 26.98%

Apple is one of the world’s leading technology firms focused on consumer electronics, software, and other related services. It is based in Cupertino, California.

The company's total net sales surged 11% YoY to US$123.94 billion in Q1, FY22, while its net income came in at US$34.63 billion, or US$2.10 per diluted share.

Its P/E ratio is 28.45, the forward P/E for one year is 28.25, the dividend yield is 0.52%, and the annualized dividend is US$0.88.

Microsoft Corporation (NASDAQ:MSFT)

Market Cap: US$2.33 trillion

Price close on January 28, 2022: US$308.26

One year return: 28.63%

Microsoft is a technology company that specializes in computer software, consumer electronics, and other related services. It is based in Redmond, Washington.

The company's revenue increased by 20% YoY to US$51.7 billion in Q2, FY22, while its net income came in at US$18.8 billion, or US$2.48 per diluted share.

Its P/E ratio is 33.21, the forward P/E for one year is 33.43, the dividend yield is 0.8%, and the annualized dividend is US$2.48.

Visa Inc. (NYSE:V)

Market Cap: US$482.16 billion

Price close on January 28, 2022: US$228.00

One year return: 14.94%

Visa is a financial services firm based in Foster City, California. It provides electronic funds transfer services globally through credit, debit, and prepaid cards.

The company's net revenue surged 24% YoY to US$7.05 billion in Q1, FY22, while its GAAP net income came in at US$3.95 billion, or US$1.83 per diluted share.

Its P/E ratio is 36.85, the forward P/E for one year is 32.25, the dividend yield is 0.66%, and the annualized dividend is US$1.50.

Johnson & Johnson (NYSE:JNJ)

Market Cap: US$451.62 billion

Price close on January 28, 2022: US$171.79

One year return: 5.58%

Johnson & Johnson is a holding company that manufacturers consumer and healthcare products. It is based in New Brunswick, New Jersey.

In the fourth quarter of fiscal 2021, the company's sales rose 10.4% YoY to US$24.80 billion, while its net earnings came in at US$4.73 billion, or US$1.77 per diluted share.

Its P/E ratio is 21.97, the forward P/E for one year is 16.39, the dividend yield is 2.47%, and the annualized dividend is US$4.24.

Also Read: Top 50 stocks by market cap on NASDAQ Composite (Part II)

UnitedHealth Group Incorporated (NYSE:UNH)

Market Cap: US$442.83 billion

Price close on January 28, 2022: US$466.06

One year return: 39.54%

UnitedHealth is a diversified healthcare and insurance firm that provides clients with a range of products and services. It is based in Hopkins, Minnesota.

The company's net earnings were US$4.19 billion on revenue of US$73.74 billion for the quarter that ended December 31, 2021.

Its P/E ratio is 26.01, the forward P/E for one year is 21.49, the dividend yield is 1.24%, and the annualized dividend is US$5.80.

JPMorgan Chase & Co. (NYSE:JPM)

Market Cap: US$433.41 billion

Price close on January 28, 2022: US$146.61

One year return: 13.11%

JPMorgan is a financial services company that offers a range of services like investment banking, asset management, and other related services to clients. It is based in New York.

In the fourth quarter of fiscal 2021, the company reported a net income of US$10.39 billion on net revenue of US$29.25 billion.

Its P/E ratio is 9.59, the forward P/E for one year is 12.95, the dividend yield is 2.73%, and the annualized dividend is US$4.00.

Procter & Gamble Company (NYSE:PG)

Market Cap: US$382.57 billion

Price close on January 28, 2022: US$160.5

One year return: 24.45%

Procter & Gamble is a consumer goods corporation based in Cincinnati, Ohio. It provides beauty, grooming, healthcare, and other consumer products.

The company's net sales increased by 6% YoY to US$20.95 billion in Q2, FY22, while its net earnings came in at US$4.24 billion, or US$1.66 per diluted share.

Its P/E ratio is 28.2, the forward P/E for one year is 27.16, the dividend yield is 2.17%, and the annualized dividend is US$3.479.

Source: Pixabay

Also Read: SEC gives nod to new US stock exchange with blockchain feed

Home Depot, Inc. (NYSE:HD)

Market Cap: US$380.05 billion

Price close on January 28, 2022: US$366.54

One year return: 35.72%

Home Depot is one of the leading home improvement retail companies that supplies construction tools and other consumer products and services. It is based in Atlanta, Georgia.

The company's sales rose 9.8% YoY to US$36.8 billion in Q3, FY21, while its net earnings came in at US$4.1 billion, or US$3.92 per diluted share.

Its P/E ratio is 24.33, the forward P/E for one year is 23.69, the dividend yield is 1.8%, and the annualized dividend is US$6.60.

Walmart Inc. (NYSE:WMT)

Market Cap: US$382.68 billion

Price close on January 28, 2022: US$137.52

One year return: -1.26%

Walmart operates a chain of departmental and grocery stores in various countries. It is based in Bentonville, Arkansas.

The company is expected to release its fourth-quarter and fiscal 2022 results on February 17.

The company's total revenue was US$140.52 billion in Q3, FY21, an increase of 4.3% YoY, and its consolidated net income came in at US$3.13 billion, or US$1.11 per diluted share.

Its P/E ratio is 48.24, the forward P/E for one year is 21.45, the dividend yield is 1.6%, and the annualized dividend is US$2.20.

Coca-Cola Company (NYSE:KO)

Market Cap: US$261.45 billion

Price close on January 28, 2022: US$60.84

One year return: 25.5%

Coca-Cola is a multinational beverage company that sells non-alcoholic beverages like branded soft drinks, sports drinks, etc. It is based in Atlanta, Georgia.

The company will report its fourth-quarter and fiscal 2021 financial results on February 10.

Meanwhile, in the third quarter of fiscal 2021, the company's net revenue soared 16% YoY to US$10.04 billion, while its consolidated net income was US$2.47 billion, or US$0.57 per share.

Its P/E ratio is 29.67, the forward P/E for one year is 26.68, the dividend yield is 2.76%, and the annualized dividend is US$1.68.

Also Read: Top 50 NYSE stocks in 2022 (Part 1)

Walt Disney Company (NYSE:DIS)

Market Cap: US$256.44 billion

Price close on January 28, 2022: US$138.63

One year return: -18.92%

Walt Disney is one of the leading entertainment and mass media companies globally. It is based in Burbank, California.

It will report its first-quarter fiscal 2022 results on February 9.

The company reported a net income of US$255 million on revenue of US$18.53 billion for the quarter ended October 2, 2021.

Its P/E ratio is 129.24, the forward P/E for one year is 33.32, and the EPS is US$1.09.

Chevron Corporation (NYSE:CVX)

Market Cap: US$251.73 billion

Price close on January 28, 2022: US$130.61

One year return: 51.15%

Chevron is an energy company specializing in integrated energy and chemical production. It is based in San Ramon, California. It explores and refines crude oil.

The company reported a net income of US$5.08 billion, or US$2.63 per diluted share on revenue and other income of US$48.12 billion for the quarter ended December 31, 2021.

Its P/E ratio is 16.04, the forward P/E for one year is 12.46, the dividend yield is 4.1%, and the annualized dividend is US$5.68.

Also Read: Top penny stocks to explore in February

Cisco Systems, Inc. (NASDAQ:CSCO)

Market Cap: US$234.54 billion

Price close on January 28, 2022: US$55.61

One year return: 22.49%

Cisco is a technology conglomerate firm that manufacturers networking hardware, software, telecommunications equipment, etc. It is based in San Jose, California.

For the quarter ended October 30, 2021, the company's total revenue was US$12.90 billion, while its net income came in at US$2.98 billion, or US$0.70 per diluted share.

Its P/E ratio is 20.67, the forward P/E for one year is 18.11, the dividend yield is 2.66%, and the annualized dividend is US$1.48.

Nike, Inc. (NYSE:NKE)

Market Cap: US$231.18 billion

Price close on January 28, 2022: US$145.91

One year return: 7.52%

Nike is a Beaverton, Oregon-based firm specializing in designing, manufacturing, and selling athletic footwear, apparel, equipment, primarily focusing on the sports and fitness industry.

The company reported revenue of US$11.35 billion in Q2, FY22, representing an increase of 1% YoY. Its net income came in at US$1.33 billion, or US$0.83 per diluted share, in the period.

Its P/E ratio is 38.27, the forward P/E for one year is 39.54, the dividend yield is 0.84%, and the annualized dividend is US$1.22.

Verizon Communications Inc. (NYSE:VZ)

Market Cap: US$221.47 billion

Price close on January 28, 2022: US$52.90

One year return: -2.54%

Verizon is a telecommunication conglomerate firm that offers communication, information, and other related services to individual clients, businesses, and government bodies. It is based in New York.

The company's operating revenue was US$34.1 billion in Q4, FY21, while its net income came in at US$4.7 billion. In fiscal 2021, the company's revenue was US$133.6 billion.

Its P/E ratio is 9.9, the forward P/E for one year is 9.67, the dividend yield is 4.84%, and the annualized dividend is US$2.56.

Also Read: What is Terra (LUNA) crypto? All you need to know

Bottomline

The Dow Jones saw its worst performance in January since 2009, plummeting by 8.8%. This year, all other indexes saw a significant decline as the market grappled with multiple challenges, from supply chain issues, labor shortages, and inflation to the Omicron crisis. Analysts expect markets to rebound strongly in the second quarter of 2022.

(Please refer to the second part of the article for the remaining stocks on the top 30 list.)