US stocks extended their losses on Monday, August 22, as investors continue to walk cautiously while keeping a distance from the risk-bet assets, ahead of Fed's annual symposium at Jackson Hole this week.

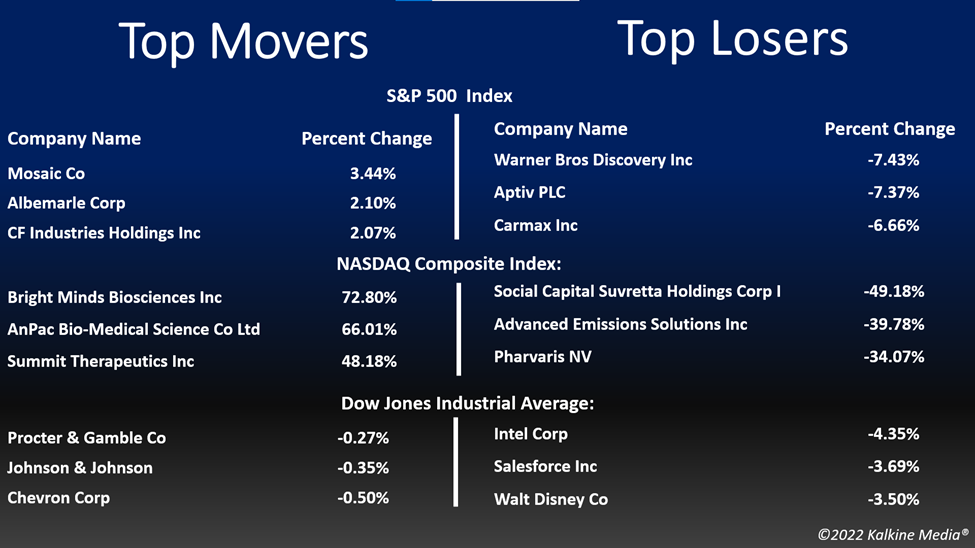

The S&P 500 fell 2.14 per cent to 4,137.99. The Dow Jones was down 1.91 per cent to 33,063.61. The NASDAQ Composite lost 2.55 per cent to 12,381.57, and the small-cap Russell 2000 fell 2.13 per cent to 1,915.74.

The market participants are would keep a close watch on Fed Chair Jerome Powell's comment on Friday, for cues on how aggressive Fed is likely to move ahead with its monetary plans to rein the inflation.

While several investors anticipate that the central bank would raise the interest rates by 50 basis points in September, some bet on another 75 basis point hike at Fed's upcoming meeting.

All the 11 segments of the S&P 500 index stayed in the negative territory on Monday, August 22. The information technology, consumer discretionary, and healthcare sectors were the bottom movers.

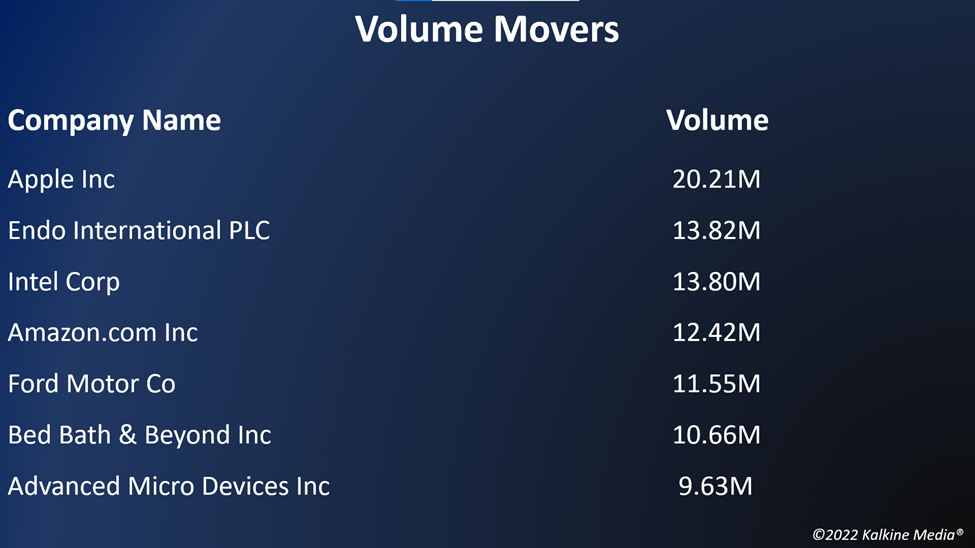

Shares of Signify Health, Inc. (SGFY) soared over 32 per cent in the intraday trading session on August 22, after reports that Amazon.com Inc. (AMZN), CVS Health Corporation (CVS), and UnitedHealth Group Inc. (UNH), are among the bidders to acquire the home healthcare services firm.

Ford Motor Company (F) tumbled nearly five per cent, following a US$ 1.7 billion jury verdict from August 19 questioning the roof strength of some of the automaker's trucks.

In the technology sector, Apple Inc. (AAPL) decreased by 2.30 per cent, Microsoft Corporation (MSFT) fell 2.94 per cent, and Taiwan Semiconductor Manufacturing Company Limited (TSM) dropped by 2.25 per cent. NVIDIA Corporation (NVDA) and ASML Holding N.V. (ASML) plunged 4.57 per cent and 4.62 per cent, respectively.

In consumer discretionary stocks, Amazon.com, Inc. (AMZN) plummeted 3.62 per cent, Tesla, Inc. (TSLA) dropped 2.28 per cent, and The Home Depot, Inc. (HD) declined 2.84 per cent. Toyota Motor Corporation (TM) and McDonald's Corporation (MCD) slumped 1.37 per cent and 1.35 per cent, respectively.

In the healthcare sector, AbbVie Inc. (ABBV) slipped 1.06 per cent, Merck & Co., Inc. (MRK) fell 1 per cent, and Thermo Fisher Scientific Inc. (TMO) plunged 2.11 per cent. Novo Nordisk A/S (NVO) gained 2.87 per cent, while Danaher Corporation (DHR) lost 2.21 per cent.

Futures & Commodities

Gold futures were down 0.79 per cent to US$1,748.95 per ounce. Silver decreased by 1.00 per cent to US$18.878 per ounce, while copper ticked down 0.30 per cent to US$3.6535.

Brent oil futures decreased by 0.07 per cent to US$96.65 per barrel and WTI crude was up 0.07 per cent to US$90.50.

Bond Market

The 30-year Treasury bond yields were up 0.22 per cent to 3.232, while the 10-year bond yields rose 1.35 per cent to 3.029.

US Dollar Futures Index increased by 0.72 per cent to US$108.873.