US stocks kicked off the week lower on Monday, March 21, after Fed Chair Jerome Powell reiterated tough action on inflation and the EU weighed joining the US on banning Russian oil imports.

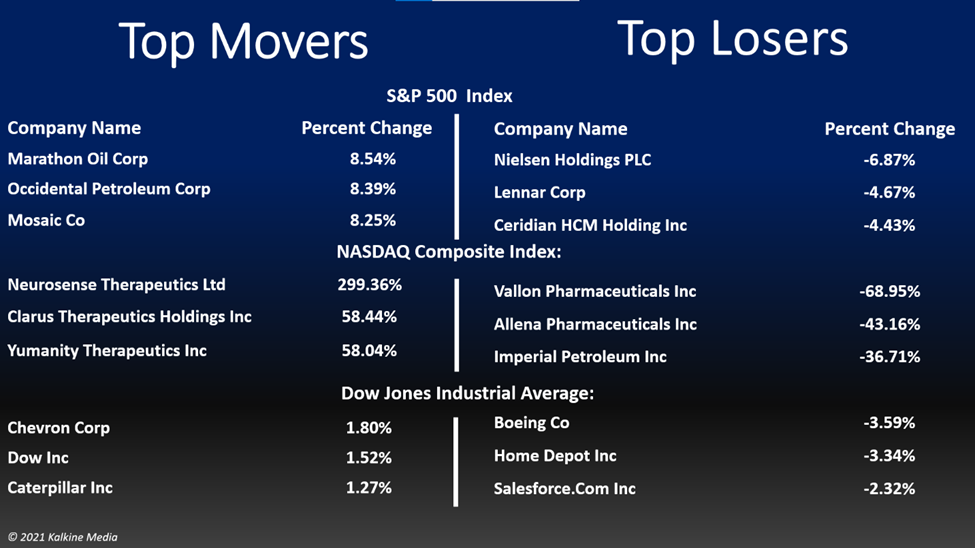

The S&P 500 fell 0.04% to 4,461.18. The Dow Jones declined 0.58% to 34,552.99. The NASDAQ Composite Index fell 0.40% to 13,838.46, and the small-cap Russell 2000 was down 0.97% to 2,065.94.

Crude benchmarks Brent and WTI were trading more than 7% higher to around US$116 and US$110, respectively, after the EU said it is weighing joining the US sanctions against Russian oil.

The yield on the 10-year Treasury note rose to 2.300% on Monday, the highest level since May 2019, from 2.153% in the previous session after Powell reiterated the bank's commitment to halt the spiraling high inflation through a series of interest rate hikes this year. The yields rise when prices fall.

Speaking at a meeting of the National Association for Business Economics, Powell added that the bank was prepared to increase the rate further to tame inflation. Last week, the bank had raised the rates by 25 basis points. Higher inflation and the Russia-Ukraine war have wreaked havoc on Wall Street.

On Monday, Energy and basic materials sectors led gains in the S&P 500 index. Communication services and consumer discretionary segments were the bottom movers. Seven of the 11 sectors of the index stayed in the negative territory.

In the energy sector, Exxon Mobil Corporation (XOM) rose by 4.49%, Chevron Corporation (CVX) gained 1.80%, and Shell plc (SHEL) rose by 4.46%. ConocoPhillips (COP) and TotalEnergies SE (TTE) advanced 3.17% and 1.00%, respectively.

In materials stocks, BHP Group Limited (BHP) surged 4.13%, Rio Tinto Group (RIO) jumped 3.00%, and Vale S.A. (VALE) grew 4.62%. Freeport-McMoRan Inc. (FCX) and Newmont Corporation (NEM) ticked up 2.97% and 3.16%, respectively.

In the communication services sector, Meta Platforms, Inc. (FB) fell by 2.31%, The Walt Disney Company (DIS) declined by 1.20%, and Netflix, Inc. (NFLX) fell by 1.58%.

In tech stocks, Nvidia Corporation (NVDA) and Advanced Micro Devices, Inc. (AMD) gained 1.06% and 2.17%, respectively. Ssalesforce.com, Inc. (CRM) declined 2.32%, while Microsoft Corporation (MSFT) and Apple Inc (AAPL) traded flat.

The Boeing Company (BA) stock fell over 3.5% after one of its 737-800 aircraft run by China Eastern Airlines crashed in southern China on Monday. The plane was carrying 132 people on board and was on its way from Kunming to Guangzhou when it went down in a forested area in Guangxi.

Shares of investment company Alleghany Corporation (Y) jumped 24.69% after Warren Buffett's Berkshire Hathaway said that it agreed to acquire the firm for US$11.6 billion.

NeuroSense Therapeutics Ltd. (NRSN) stock skyrocketed over 299% after the biotechnology company said it received FDA clearance for a pharmacokinetic study of PrimeC in adults.

The global cryptocurrency market was up 0.06% to US$1.87 trillion, while the 24-hour volume jumped 9.36% to US$89.25 billion at 4:37 pm ET. Bitcoin (BTC) price tumbled 1% to US$41,152.84, while Ethereum (ETH) rose 1.03% to US$2,917.76.

Also read: What is Ethereum Classic (ETC) crypto and why is it rising?

Also Read: Why is Aventus (AVT) crypto rising?

Also Read: Top cyber stocks to watch in 2022: PANW, CHKP, LDOS, TENB & NLOK

Futures & Commodities

Gold futures were up 0.29% to US$1,934.95 per ounce. Silver increased by 1.22% to US$25.392 per ounce, while copper fell 0.83% to US$4.7002.

Brent oil futures increased by 8.06% to US$116.63 per barrel and WTI crude was up 7.57% to US$110.89.

Also Read: Why is Fantom (FTM) crypto rising?

Bond Market

The 30-year Treasury bond yields were up 4.27% to 2.521, while the 10-year bond yields rose 6.93% to 2.297.

US Dollar Futures Index increased by 0.27% to US$98.493.