Benchmark US indices edged higher on Wednesday, December 15, after Federal Reserve has approved plans to accelerate the winding down of its asset-buying program. Meanwhile, the move to curb inflation paved a way for hikes in interest rates through next year.

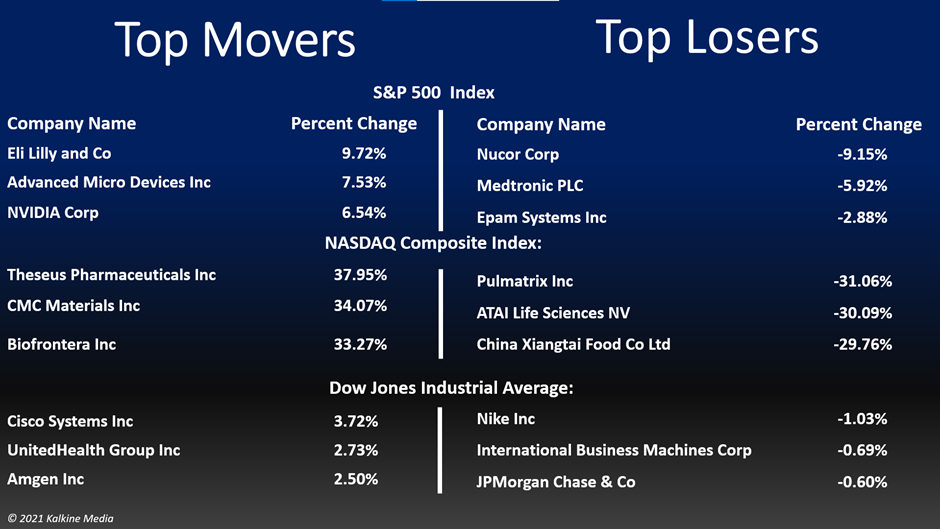

The S&P 500 was up 1.63% to 4,709.85. The Dow Jones Industrial Average increased by 1.08% to 35,927.43. The NASDAQ Composite Index rose 2.15% to 15,565.58, and the small-cap Russell 2000 was up 1.55% to 2,193.11.

The Federal Reserve officials have intensified their moves to curb the hottest inflation in a generation by turning their focus to accelerate the tapering of its asset-buying program while indicating their intention to raise the interest rates faster in 2022, than the economists' anticipation.

The US retail sales surged 0.3% in November, after increasing 1.8% in October, the Commerce Department reported on Wednesday.

The Central Bank said that it would double the pace of winding down its asset-buying program, intending to conclude it in early 2022, rather than mid-2022 as planned earlier. However, the market participants seemed to cheer the Fed's decision of controlling the inflation, evident by the rally in the indices, following choppy trading this week.

The utilities and healthcare sector have topped the S&P 500 index on Wednesday. Nine of the 11 critical sectors of the S&P 500 index stayed in the positive territory, with the energy and material sector as the bottom movers.

The stocks of Eli Lilly and Company (LLY) increased by 8.61% in intraday trading, after the firm has raised its guidance for the current fiscal year. Eli Lilly now expects its revenue for 2022 to be between US$27.8 billion and US$28.3 billion, up from its previous forecast of US$27.4 billion.

The stocks of Albemarle Corporation (ALB) and Livent Corporation (LTHM) tumbled 1.78% and 0.83%, respectively, after Goldman Sachs has cut its rating on the stocks. Goldman Sachs has downgraded the rating of both the lithium firms from "neutral" to "sell".

The Medtronic plc (MDT) slumped 7.10% after the firm announced that it has received a warning letter from the US Food and Drug Administration (FDA) on December 9, for the firm's headquarters of its Diabetes segment in Northridge, California facility.

In the utility sector, NextEra Energy, Inc. (NEE) increased by 2.10%, Duke Energy Corporation (DUK) rose 1.12%, and The Southern Company (SO) surged 1.27%. Dominion Energy, Inc. (D) and Exelon Corporation (EXC) ticked up 1.95% and 1.23%, respectively.

In healthcare stocks, UnitedHealth Group Incorporated (UNH) gained 2.84%, Pfizer Inc. (PFE) jumped 5.95%, and Novo Nordisk A/S (NVO) soared 3.16%. AbbVie Inc. (ABBV) and Merck & Co., Inc. (MRK) advanced 2.39% and 2.10%, respectively.

In the energy sector, Chevron Corporation (CVX) decreased by 0.96%, EOG Resources, Inc. (EOG) fell 1.08%, and Pioneer Natural Resources Company (PXD) declined by 2.87%. Schlumberger N.V. (SLB) and Devon Energy Corporation (DVN) plummeted 1.69% and 1.98%, respectively.

Also Read: Best US ETFs that returned over 55% in 2021

Also Read: CMC Materials (CCMP) stock soars 26% on Entegris (ENTG) acquisition

Also Read: Genenta Science IPO: GNTA stock set to debut on NASDAQ

Futures & Commodities

Gold futures were up 0.36% to US$1,778.70 per ounce. Silver increased by 0.68% to US$22.073 per ounce, while copper fell 0.05% to US$4.2553.

Brent oil futures increased by 1.09% to US$74.50 per barrel and WTI crude was up 1.20% to US$71.58.

Bond Market

The 30-year Treasury bond yields was up 1.80% to 1.852, while the 10-year bond yields rose 1.22% to 1.457.

US Dollar Futures Index decreased by 0.24% to US$96.305.