Benchmark US indices were down for the second consecutive session on Monday, February 14, amid rising Russia-Ukraine tension and lingering fears over Fed’s possible interest rate hikes.

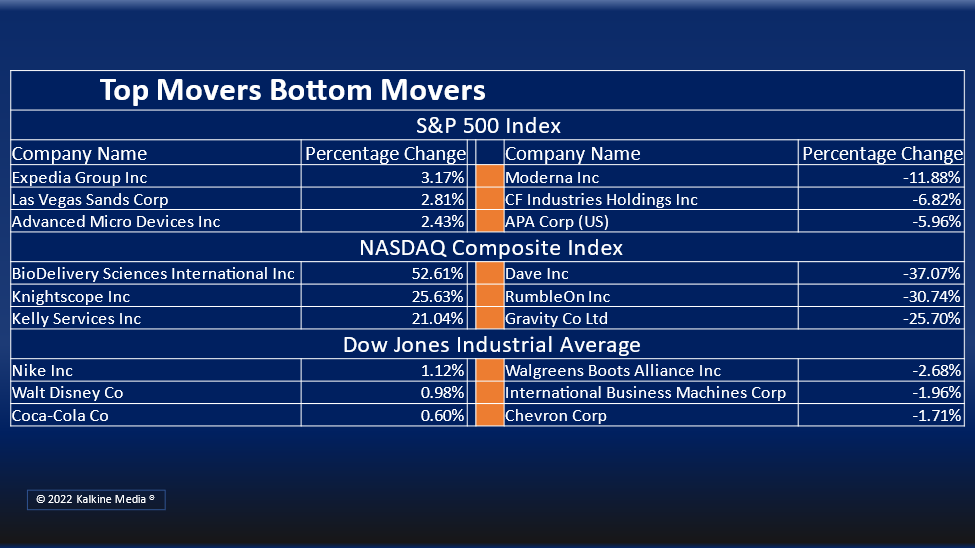

The S&P 500 declined 0.38% to 4,401.65. The Dow Jones fell 0.49% to 34,566.17. The NASDAQ Composite traded flat at 13,790.92, and the small-cap Russell 2000 fell 0.16% to 2,026.86.

The vast Russian military build-up on the Ukrainian border has deepened fears of an imminent invasion. The US State Department ordered its embassy officials to leave the capital Kyiv. The US embassy will likely operate from the town of Lviv near the Polish border.

Meanwhile, senior central bank officials held a closed-door meeting possibly to discuss the high inflation and a potential rate increase. Their discussions were kept under wraps. On Friday, oil prices rose to a record high since 2014, further pushing up the inflationary graph.

The uncertain macroeconomic and geopolitical factors drove the stocks toward a bearish direction. On Monday, nine out of the 11 sectors of the S&P 500 closed in the red.

Consumer discretionary and communication services were the top gainers, while energy, financials, and healthcare sectors were the bottom movers.

Sea Limited (SE) stock fell more than 17% in intraday trading after India banned its popular mobile gaming app Free Fire among 54 other apps.

Rivian Automotive, Inc. (RIVN) stock gained over 7% after reports that the company received a large investment from Soros Fund Management in the fourth quarter of FY2021.

The healthcare company Moderna, Inc. (MRNA) stock declined 12.7%, and Pfizer, Inc. (PFE) was down over 2.4% in intraday trading. On Friday, the US health regulators reportedly delayed a decision on the first vaccine for children under five years.

Zurn Water Solutions Corporation (ZWS) surged over 12% after announcing a definitive agreement to merge with Elkay Manufacturing Company in an all-stock transaction. The new company will be named Zurn Elkay Water Solutions Corporation.

In the consumer discretionary sector, Amazon.com Inc. (AMZN) stock surged 1.77%, Tesla Inc. (TSLA) gained 1.90%, and Nike Inc. (NKE) rose 1.21%. The Home Depot Inc. (HD) rose 0.48%, and Lowe’s Companies Inc. (LOW) was up 0.46%.

In the communication services sector, Alphabet Inc (Googl) advanced 1.07%, Walt Disney Company (DIS) increased by 1.28%, and Netflix Inc. (NFLX) rose 2.02%. T-Mobile US Inc. (TMUS) and Charter Communications Inc. (CHTR) were up 0.65% and 0.73%, respectively.

In the energy sector, Exxon Mobile Corporation (XOM) fell 1.87%, Chevron Corporation (CVX) declined 1.66%, and ConocoPhillips (COP) fell 2.32%. EOG Resources Inc. (EOG) was down 3.01%, and Shell Plc (SHEL) plunged 1.77%.

The global crypto market was down 6.29% to US$1.77 trillion, as per coinmarketcap.com at 3:47 pm ET. Bitcoin (BTC) fell 0.12% to US$42,256.00 in the last 24 hours.

Also Read: From TWTR to U: Web3 stocks in focus after LeBron ad creates buzz

Also Read: What made Wallbox (WBX), Cue Health (HLTH), Polestar pop on Monday?

Also Read: From UPS, RTX to HON: Top industrial stocks to explore in 2022

Futures & Commodities

Gold futures surged 1.72% to US$1,873.70 per ounce. Silver futures increased by 2.13% to US$23.865 per ounce, while copper futures fell 0.30% to US$4.4932.

Brent oil futures increased by 1.61% to US$95.96 per barrel and WTI crude futures were up by 1.98% to US$94.94.

Bond Market

The 30-year Treasury bond yields increased 2.09% to 2.302, while the 10-year bond yields were up 2.40% to 1.998.

US Dollar Futures Index surged 0.26% at US$96.325.

.jpg)