Wall Street ended with sharp gains on Friday, October 21, with all three major indices notching strong weekly gains, as optimism over the third quarter earnings so far has lifted the market spirits.

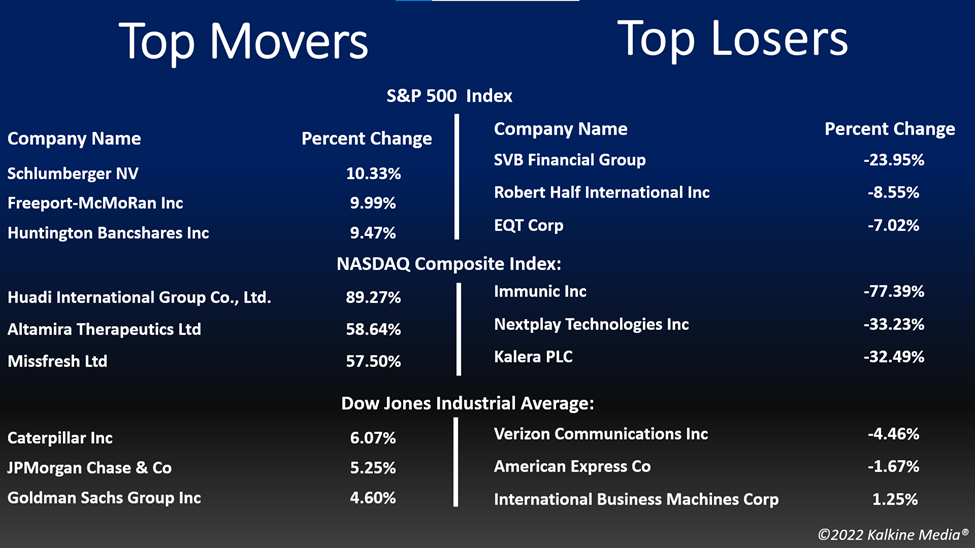

The S&P 500 rose 2.37 per cent to 3,752.75. The Dow Jones was up 2.47 per cent to 31,082.56. The NASDAQ Composite rose 2.31 per cent to 10,859.72, and the small-cap Russell 2000 rose 2.22 per cent to 1,742.24.

The stocks have been highly volatile lately amid a series of uncertainties hovering over the market. However, the third quarter earnings so far have come better than previously anticipated, while lifting the sentiments of the market participants.

Now, investors would keep a close watch on the corporate earnings next week, with a flurry of technology leaders including Microsoft Corporation (NASDAQ:MSFT), and Apple, Inc. (NASDAQ:AAPL), among others scheduled to report their latest quarter earnings.

The energy and materials sectors were the top percentage gainers in the S&P 500 index on Friday, October 21, while the information technology segment provided the highest boost. 10 of the 11 segments of the index stayed in the positive territory, with only the communication services sector as the laggard.

Shares of Snap Inc. (NYSE:SNAP) fell more than 29 per cent in the intraday trading session on Friday, October 21, after the social media company reported a six per cent YoY growth in its Q3 FY22 revenue. The company also didn't provide any revenue or EBITDA guidance, citing the uncertain operating conditions.

Verizon Communications Inc. (NYSE:VZ) lost over four per cent in the intraday trading on October 21, despite the telecommunications firm reporting strong third-quarter earnings results before the market opened. However, the firm noted smaller growth in the postpaid segment due to soaring prices.

American Express Company (AXP) plunged about three per cent in the intraday trading after the credit card service company reported strong financial results for the latest quarter while lifting its annual guidance.

In the materials sector, BHP Group Limited (BHP) increased by 4.15 per cent, Linde plc (LIN) rose by 2.16 per cent, and Rio Tinto Group (RIO) surged by 4.17 per cent. Vale S.A. (VALE) and Freeport-McMoRan Inc. (FCX) advanced 4.33 per cent and 10.03 per cent, respectively.

In energy stocks, Exxon Mobil Corporation (XOM) soared 1.90 per cent, Chevron Corporation (CVX) gained 2.50 per cent, and Shell plc (SHEL) added 1.85 per cent. ConocoPhillips (COP) and BP p.l.c. (BP) jumped 2.22 per cent and 1.36 per cent, respectively.

In the communication services sector, Meta Platforms, Inc. (META) decreased by 1.16 per cent, NetEase, Inc. (NTES) fell by 3.49 per cent, and Twitter, Inc. (TWTR) declined by 4.81 per cent. Baidu, Inc. (BIDU) and Pinterest, Inc. (PINS) plummeted 2.29 per cent and 6.40 per cent, respectively.

Futures & Commodities

Gold futures were up 1.44 per cent to US$1,660.45 per ounce. Silver increased by 3.08 per cent to US$19.265 per ounce, while copper rose 1.99 per cent to US$3.4783.

Brent oil futures increased by 1.26 per cent to US$93.54 per barrel and WTI crude was up 0.71 per cent to US$85.11.

Bond Market

The 30-year Treasury bond yields were up 2.79 per cent to 4.332, while the 10-year bond yields fell 0.22 per cent to 4.217.

US Dollar Futures Index decreased by 0.91 per cent to US$111.790.