Wall Street indices closed mixed on Wednesday, October 26, dragged down by the losses in technology stocks, as investors assessed the downbeat earnings and warnings from the tech behemoths.

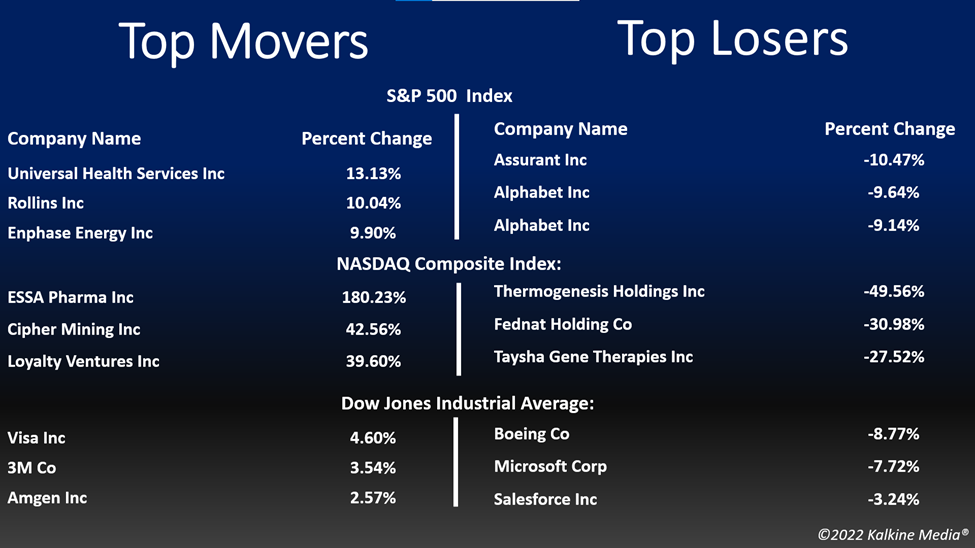

The S&P 500 fell 0.74 per cent to 3,830.60. The Dow Jones was up 0.01 per cent to 31,839.11. The NASDAQ Composite lost 2.04 per cent to 10,970.99, and the small-cap Russell 2000 rose 0.46 per cent to 1,804.33.

However, the Treasury yield continued its fall after a slower-than-anticipated rate jump by the Bank of Canada renewed hopes over smaller hikes in the coming days.

The investors are now anticipating a 75 bps point hike at Fed's September gathering, and then expect the central bank to ease its pace, as the higher rates have already pointed towards a slowdown in the economy's health.

Meanwhile, in economic data, the US Census Bureau reported that the US single-family home sales declined 10.9 per cent in September to 603,000 units at an adjusted annual rate. The decline also indicated that the higher mortgage rates are weighing on the housing market.

The healthcare and energy sectors were the highest percentage gainers in the S&P 500 index on Wednesday, October 26. Six of the 11 segments of the index stayed in the positive territory. The communication services and information technology sectors were the bottom movers.

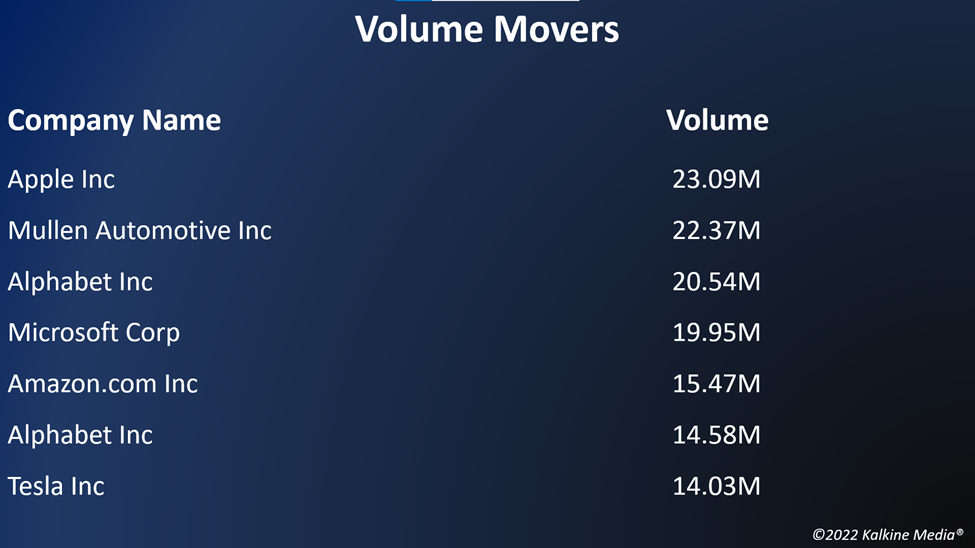

Shares of Alphabet Inc. (NASDAQ: GOOG) lost over eight per cent in the intraday trading, after the tech leader posted a decline in its latest quarter revenue growth. In addition, the company's YouTube video platform noted a slump in its ad sales for the first time in the quarter.

Another leading firm in the technology sector by market cap, Microsoft Corporation (NASDAQ: MSFT) fell over six per cent in the intraday session on October 26, after it reported its slowest revenue growth in around five years. Besides, the company said that it is anticipating a sharp decline in its personal computer sales.

In the healthcare sector, Eli Lilly and Company (LLY) rose 1.83 per cent, AbbVie Inc. (ABBV) gained 1.88 per cent, and Pfizer Inc. (PFE) added 1.04 per cent. AstraZeneca PLC (AZN) and Novartis AG (NVS) advanced 3.69 per cent and 1.39 per cent, respectively.

In communication stocks, Meta Platforms, Inc. (META) decreased by 5.59 per cent, Warner Bros. Discovery, Inc. (WBD) fell 4.20 per cent, and Take-Two Interactive Software, Inc. (TTWO) declined by 1.13 per cent. Live Nation Entertainment, Inc. (LYV) and Spotify Technology S.A. (SPOT) plummeted 3.96 per cent and 13.01 per cent, respectively.

Futures & Commodities

Gold futures were up 0.60 per cent to US$1,667.95 per ounce. Silver increased by 0.76 per cent to US$19.497 per ounce, while copper rose 4.26 per cent to US$3.5418.

Brent oil futures increased by 2.52 per cent to US$94.05 per barrel and WTI crude was up 3.29 per cent to US$88.13.

Bond Market

The 30-year Treasury bond yields were down 2.68 per cent to 4.150, while the 10-year bond yields fell 2.41 per cent to 4.011.

US Dollar Futures Index decreased by 1.16 per cent to US$109.547.