Benchmark US indices reversed their three-day losing streak on Tuesday, February 15, after broad gains across sectors amid Russia’s decision to withdraw troops from the Ukraine border.

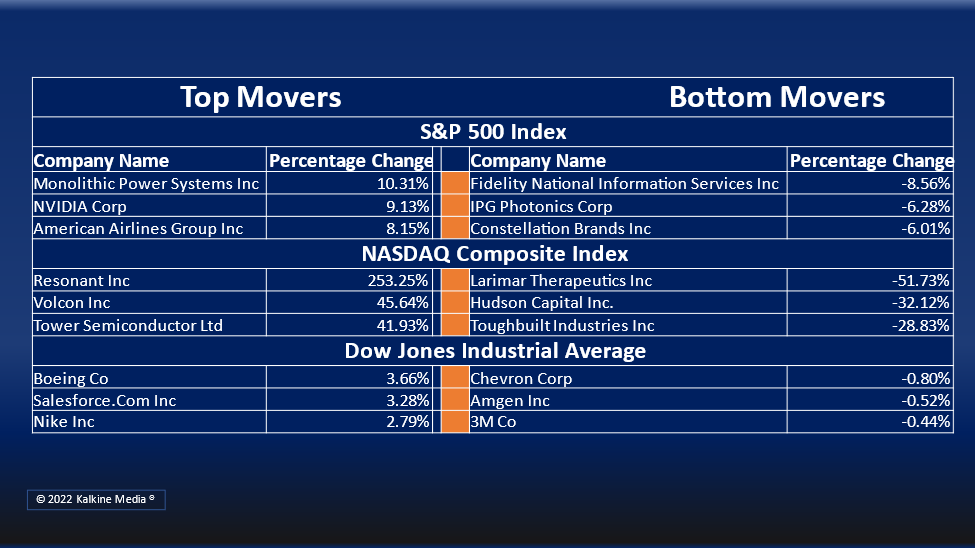

The S&P 500 surged 1.58% to 4,471.07. The Dow Jones rose 1.22% to 34,988.84. The NASDAQ Composite rose 2.53% at 14,139.76, and the small-cap Russell 2000 was up 2.76% to 2,076.66.

The Russian defense ministry on Tuesday said troops were returning from the border after training. The military build-up had troubled the market over fears of supply disruption.

Meanwhile, the Labor Department said the US producer prices increased 1% in January on a seasonally adjusted basis from the previous month, the highest increase in past eight months.

On a yearly basis, the prices rose 9.7% as the cost of food, vehicles, hospital care, etc., grew. The producer prices are what suppliers charge from businesses and customers.

Nine out of 11 sectors of the S&P 500 closed in the positive territory. Technology, consumer discretionary and material stocks were the top gainers. Energy and utility sectors trailed.

The Marriott International (MAR) stock jumped over 5.2% after its fourth-quarter revenue almost doubled to US$4.45 billion.

Shares of Tower Semiconductor Ltd. (TSEM) rose over 42% in intraday trading after it announced that Intel Corporation (INTC) is acquiring it for around US$5.4 billion.

Semiconductor company Resonant Inc. (RESN) stock rose over 250% after announcing its acquisition by Murata Electronics North America, Inc., a wholly-owned subsidiary of Japan-based Murata Manufacturing Co. Ltd.

The Virgin Galactic Holdings, Inc. (SPCE) stock shot up 30% in intraday trading after announcing the re-opening of its space travel ticket sales from Feb 16. Each ticket costs US$450,000, including an initial deposit of US$150,000.

In the technology sector, Apple Inc. (AAPL) stock jumped 1.94%, Microsoft Corp. (MSFT) rose 1.66%, and Nvidia Corporation (NVDA) surged 9.04%. ASML Holding N.V. (ASML) and Broadcom Inc. (AVGO) increased by 4.44% and 4.59%, respectively.

In the consumer discretionary sector, Amazon.com Inc. (AMZN) stock surged 0.56%, Tesla Inc. (TSLA) gained 4.68%, and Nike Inc. (NKE) rose 2.63%. The Home Depot Inc. (HD) rose 0.41%, and Lowe’s Companies Inc. (LOW) was up 1.00%.

In the energy sector, Exxon Mobile Corporation (XOM) fell 1.34%, Chevron Corporation (CVX) declined 0.86%, and ConocoPhillips (COP) decreased by 2.21%. EOG Resources Inc. (EOG) was down 2.23%, and Shell Plc (SHEL) plunged 1.79%.

The global cryptocurrency market was up 5.37% to US$1.98 trillion, as per coinmarketcap.com at 3:47 pm ET. Bitcoin (BTC) price rose 4.40% to US$44,089.13 in the last 24 hours.

Also Read: Genesis Unicorn Capital Corp IPO: All you need to know

Also Read: S&P 500’s top oil and gas stocks to watch as prices shoot up

Also Read: Moneygram (MGI) stock soars on US$1.8 bn purchase offer by Madison

Futures & Commodities

Gold futures declined 0.85% to US$1,853.50 per ounce. Silver futures decreased by 1.97% to US$23.380 per ounce, while copper futures jumped 0.41% to US$4.5256.

Brent oil futures decreased by 3.59% to US$93.02 per barrel and WTI crude futures were down by 3.82% to US$91.83.

Bond Market

The 30-year Treasury bond yields increased 2.80% to 2.365, while the 10-year bond yields were up 2.64% to 2.049.

US Dollar Futures Index fell 0.39% at US$95.985.

.jpg)