Wall Street’s major indices fell sharply on Tuesday, March 1, after Russia intensified bombings in Ukraine, raising the spectre of a violent attack as the world watched the events in horror.

Oil prices climbed again above the US$100 per barrel mark as geopolitical tensions rose.

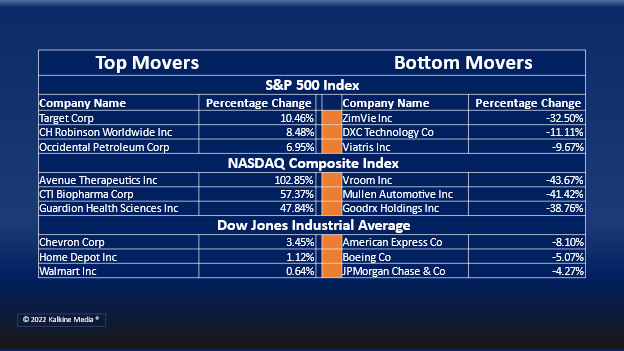

The S&P 500 fell 1.55% to 4,306.18. The Dow Jones fell 1.77% to 33,294.35. The NASDAQ Composite declined 1.59% at 13,532.46, and the small-cap Russell 2000 fell 2.38% to 1,999.39.

Analysts expect a topsy-turvy trading week with no sign of the crisis abating. Investors have pulled out of risky equities as the country braced for a long diplomatic battle over Ukraine.

On Tuesday, the International Energy Agency said it would release up to 60 million barrels of oil from its emergency stockpiles to ensure global supplies.

Ten out of 11 sectors of the S&P 500 declined. The energy segment was the top mover. Financials, basic materials, and technology were the bottom movers.

Shares of Target Corporation (TGT) jumped over 10% in intraday trading after posting strong earnings. Its comparable sales increased by 12.7% year-on-year in fiscal 2021.

The Kohl's Corporation (KSS) stock surged more than 2.5% after it said its revenue grew by 21.8% YoY in fiscal 2021. Food-chain operator Albertsons Companies, Inc. (ACI) stock rose over 8% after it announced an internal strategic review to boost its business.

In technology stocks, NVIDIA Corporation (NVDA) fell about 3% after it said it suffered a cyberattack in which hackers leaked information about employees and the company.

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) stock rose around 0.8%.

Energy stocks were the top gainers on Tuesday. Chevron Corporation (CVX) stock rose 3.5% after raising the share buyback limit and better cash flow forecast through 2026.

Exxon Mobile (XOM) rose 0.66%, and ConocoPhillips (COP) gained 2.25%. EOG Resources Inc. (EOG) and Pioneer Natural Resources Company (PXD) were up 1.51% and 0.27%, respectively.

In the financial sector, JP Morgan Chase & Co. (JPM) stock plunged 4.10%, Bank of America Corporation (BAC) fell 3.80%, and Wells Fargo & Company (WFC) decreased by 5.12%. Visa Inc. (V) and Morgan Stanley (MS) were down 3.53% and 3.40%, respectively.

In the material sector, Linde Plc (LIN) stock fell 3.69%, Sherwin Williams Company (SHW) decreased by 2.94%, and Ecolab Inc. (ECL) declined 3.25%. Nutrien Ltd (NTR) and Air Products and Chemicals Inc. (APD) fell 1.49% and 2.29%, respectively.

The global cryptocurrency market was up 5.16% to US$1.93 trillion at 3:18 pm ET, as per coinmarketcap.com. Bitcoin (BTC) price surged 5.89% to US$43,825.06 in the last 24 hours.

Also Read: Why is Harmony (ONE) crypto migrating wallet to MetaMask?

Also Read: Top 5 green energy stocks to watch in March: NEE to TSLA

Also Read: BAC, BX, MS among top financial stocks to explore in March

Futures & Commodities

Gold futures surged 2.46% to US$1,947.40 per ounce. Silver futures increased by 4.82% to US$25.543 per ounce, while copper futures jumped 2.36% to US$4.5597.

Brent oil futures increased by 7.97% to US$105.78 per barrel and WTI crude futures were up by 9.09% to US$104.42.

Bond Market

The 30-year Treasury bond yields decreased 3.66% to 2.101, while the 10-year bond yields were down 6.62% to 1.717.

US Dollar Futures Index surged 0.74% at US$97.405.