Benchmark US indices closed mixed on Tuesday, January 3, weighed down by technology, healthcare, and consumer discretionary segments after a solid start to the first trading week of 2022.

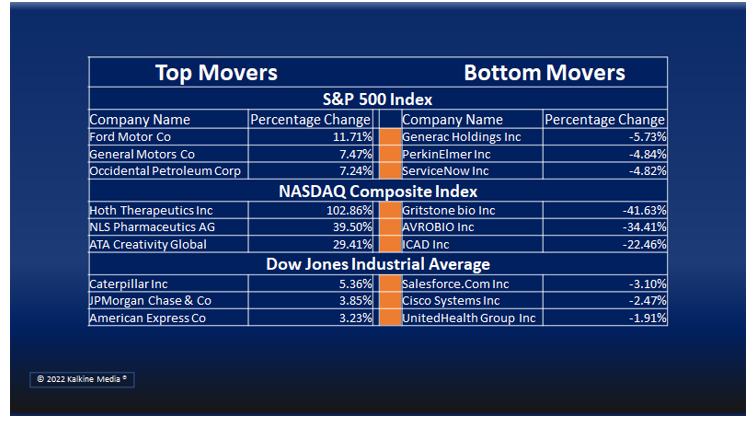

The S&P 500 declined 0.06% to 4,793.54. The Dow Jones rose 0.59% to 36,799.65. The NASDAQ Composite was down 1.33% to 15,622.72, and the small-cap Russell 2000 rose 0.02% to 2,273.10.

Oil prices rose on indications that there was no damaging impact from the Omicron variant.

On Tuesday, the Organization of the Petroleum Exporting Countries (OPEC) and the non-OPEC states led by Russia said they would maintain the production level at the previously decided amount.

Separately, the Labor Department's monthly jobs report (JOLTS) showed the voluntary quits rose by 370,000 to 4.5 million in November. At the end of the month, there were around 10.6 million job openings, indicating wages could remain high for some time.

Meanwhile, a private survey of the US manufacturing sector indicated that supply-chain problems might ease due to several macro-economic factors, including labor market recovery, in the coming months.

Six of the 11 S&P 500 sectors closed in the positive territory. Energy, financials, and industrials were the top gainers. Technology, healthcare, and consumer discretionary stocks were the bottom movers.

Apple Inc. (AAPL) stock plunged over 1% after briefly crossing the US$3 trillion mark on Monday.

In travel stocks, United Airlines Holdings, Inc. (UAL) gained 1.76% and Delta Air Lines, Inc. (DAL) advanced 1.02%.

The shares of General Motors Company (GM) surged more than 7% on Tuesday after fourth-quarter sales declined to 440,745 vehicles compared with 771,323 a year earlier.

Plus Therapeutics, Inc (PSTV) stock jumped more than 60% after announcing a collaboration with IsoTherapeutics Group and completing a technology transfer deal with Piramal Pharma Solutions.

The Hoth Therapeutics, Inc. (HOTH) stock rose more than 102% after reporting the proof-of-concept data supporting its Alzheimer’s drug efficacy.

In the energy sector, Exxon Mobile Corporation (XOM) jumped 3.75%, Chevron Corporation (CVX) rose 1.87%, and ConocoPhillips (COP) rose 4.49%. EOG Resources Inc. (EOG) was up 4.89%, and Schlumberger N.V. (SLB) increased by 5.34%.

In the financial sector, JP Morgan Chase & Co. (JPM) stock surged 4.06%, Bank of America Corporation (BAC) rose 4.15%, and Wells Fargo & Company (WFC) increased by 3.83%. Morgan Stanley (MS) and Charles Schwab Corporation (SCHW) were up 4.24% and 5.51% respectively.

In the technology sector, Microsoft Corp. (MSFT) stock declined 1.67%, Nvidia Corporation (NVDA) fell 3.44%, Adobe Inc. (ADBE) decreased by 2.71%, and Accenture Plc (ACN) fell 0.01%.

The global cryptocurrency market was up 1.60% to US$2.23 trillion, as per coinmarketcap.com. Bitcoin (BTC) price rose by 0.79% to US$46,287.06 in the last 24 hours to Tuesday evening.

Also Read: Global investment firm TPG IPO is set in motion, eyes US$9 bn valuation

Also Read: Top fake meat stocks to keep an eye on in 2022

Also Read: Top EV stocks to explore after robust vehicle deliveries

Futures & Commodities

Gold futures climbed 0.86% to US$1,815.50 per ounce. Silver futures increased by 1.24% to US$23.093 per ounce, while copper surged 1.14% to US$4.4720.

Brent oil futures increased by 1.18% to US$79.91 per barrel and WTI crude futures were up 1.17% to US$76.97.

Bond Market

The 30-year Treasury bond yields increased 3.24% to 2.082, while the 10-year bond yields were up 1.48% to 1.654.

US Dollar Futures Index surged 0.09% at US$96.293.