Pfizer Inc (NYSE:PFE) opened about 9.0% down on Wednesday after its management issued guidance for the coming year that fell short of Street estimates.

Pfizer’s earnings and revenue outlook for 2024

The pharmaceutical behemoth forecasts its revenue to be in the range of $58.5 billion and $61.5 billion in 2024 on up to $2.25 of per-share earnings.

Analysts, in comparison, were at $62.6 billion and $3.17 a share, respectively. Albert Bourla – the Chief Executive of Pfizer also said in a press release today:

We expect our cost realignment programme to deliver savings of at least $4.0 billion by the end of 2024, which puts us on a path to potentially regain our pre-pandemic operating margins.

The New York listed firm is scheduled for an investor day later on Wednesday. Pfizer stock is now down close to 50% for the year.

Watch here: https://www.youtube.com/embed/_4UF2dBq45c?feature=oembedPfizer expects meaningful contribution from Seagen

Pfizer spent $43 billion to acquire Seagen Inc and expand its footprint in oncology this year.

On Wednesday, the drugmaker said it has received all required regulatory approvals for that transaction which it now expects will complete in a day or two.

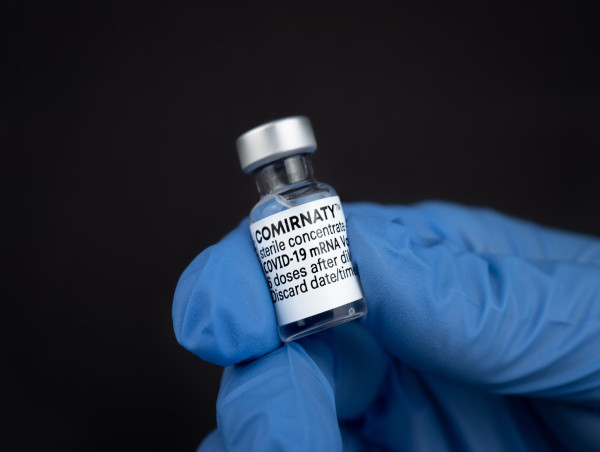

Pfizer Inc is convinced that Seagen will generate some $3.1 billion to its revenue in 2024. Comirnaty – its COVID vaccine along with Paxlovid (antiviral) will contribute about $8.0 billion as well, it added.

Earlier in December, the pharmaceutical giant shuttered development of its twice-daily weight-loss drug as Invezz reported here. Wall Street currently has a consensus “overweight” rating on Pfizer stock.

The post Why is Pfizer stock being punished this morning? appeared first on Invezz