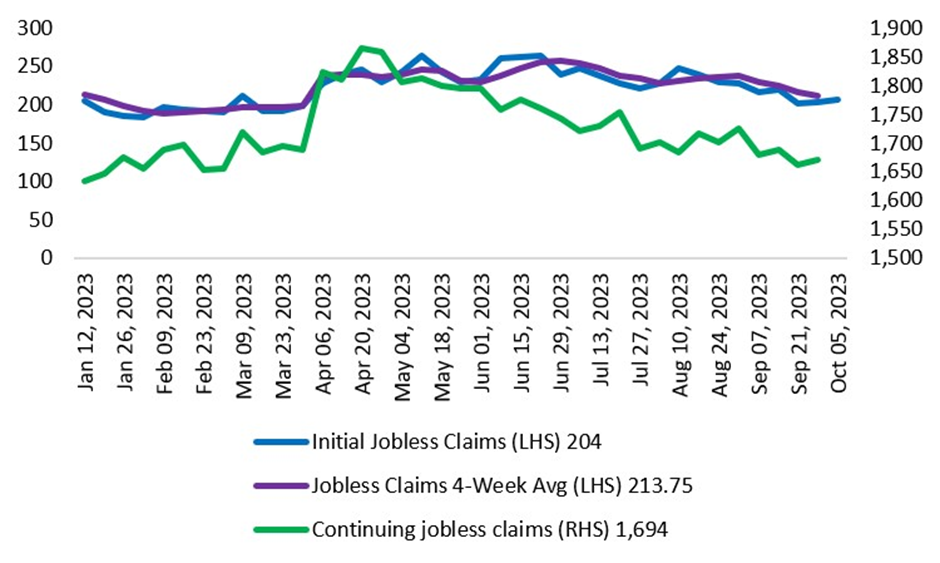

As investors continue to be concerned about the possibility of resurgent inflation in the US economy, the latest initial jobless claims figures for this week showed an uptick from 205,000 to 207,000.

Initial jobless claims track the number of people who have applied for unemployment insurance benefits for the very first time.

These are considered an important proxy for layoffs and a crucial leading metric to better understand the health of the labour market and to update inflation projections.

Although higher, the number remains in the vicinity of the 7-month low of 202,000, pointing to relative strength in the labour market.

The previous week’s reading was revised marginally higher from 204,000.

Despite registering a 3-week high, initial claims were below consensus estimates of 210,000 as reported by TradingEconomics.com.

Jobless Claims 4-week Average

The 4-week average moved in the opposite direction to initial claims, slipping from 211,750 in the previous report to 208,750, and coming in marginally under forecasts of 209,250 as published by analysts at TradingEconomics.com.

In a promising trend, the 4-week average continued to decline steadily for five consecutive weeks in a row since coming in at 237,750 on August 27th.

Continuing Jobless Claims

Continuing claims represent the total number of people who are continuing to receive unemployment benefits.

Continuing jobless claims lag the initial jobless numbers by a week, and were marginally lower at 1,664,000 from the previous week’s report of 1,665,000.

The latest figure was significantly below consensus expectations of 1,675,000 as reported by TradingEconomics.com.

However, by staying near an 8-month low, this may indicate that a large number of laid-off workers are being reabsorbed into new roles, while the labour market appears to be relatively immune to the prevailing high-interest rate environment.

Alternative US labour data indicators

Openings in the JOLTs report published earlier this week surged to 9.6 million in August, indicating continued demand in the labour market, despite the Fed’s aggressive monetary policy.

This was supported by the report published by Challenger, Gray, and Christmas, Inc. earlier today which noted a steep decline in job cuts in September 2023 to 47,457 from the previous month’s 75,151.

The data point fell sharply below expectations of 86,000 as per analysts at TradingEconomics.com.

However, the report acknowledged in Q3, job cuts ballooned 92% compared to the same interval during the previous year.

The labour market picture was also somewhat mixed due to the ADP report that came out yesterday which showed an increase of only 89,000, considerable weaker than market forecasts of above 150,000.

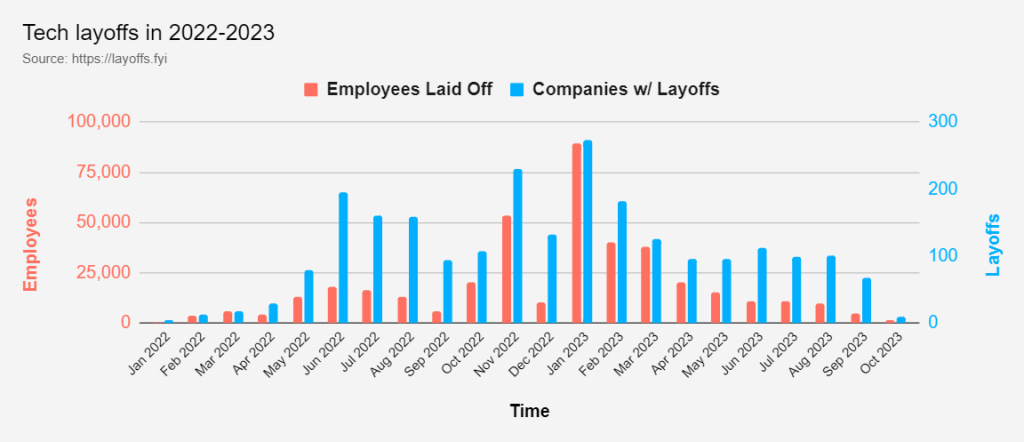

Tech sector layoffs

The tech sector, along with retail, consumer, finance, and real estate is highly susceptible to elevated interest rates.

Layoffs.fyi tracks data on job losses in the technology sector throughout the United States.

In 2023, job cuts have seen a marked downtrend since peaking at 89,554 across 274 firms in January, falling to just 4,632 workers being laid off by a combined 68 companies in the month of September.

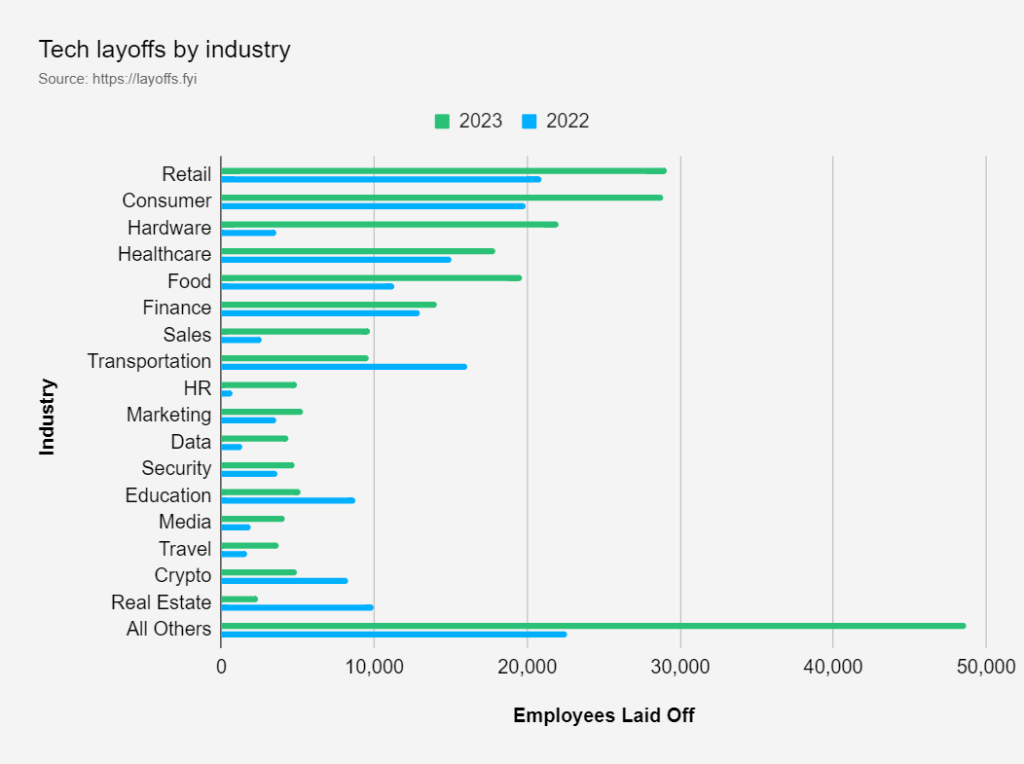

Industry-wise layoffs

Year-to-date, retail, and consumer industries have been the hardest hit in terms of layoffs, incurring 29,111 and 28,873 losses, respectively.

Both these sectors are vulnerable to higher retail inflation, and with concerns about increasing prices, they may continue to be pressured in the near future.

Hardware, which was the third most impacted sector saw layoffs surge from 3,605 in 2022 to 22,015 in 2023 YTD.

Outlook

Initial claims data saw a subdued uptick this week, and encouragingly, continuing jobless claims have remained muted compared to the highs of April 2023.

Further, data from layoffs.fyi suggests that the very worst of the job cuts are likely behind us, although this may potentially lead to higher wage pressures and stubborn inflationary forces.

With the job market picture remaining somewhat mixed, equity investors will keep a close eye on the BLS’s nonfarm payroll (NFP) data and unemployment data which are scheduled to be published tomorrow.

Consensus estimates suggest that NFP data will come in at 170,000, moderately lower than the 187,000 recorded in August 2023.

Analysts at TradingEconomics.com forecast that the unemployment rate will remain unchanged at 3.8%, while consensus projections suggest this may tick downward to 3.7%.

Tomorrow’s employment situation report will be crucial to updating the near-term projections for both the labour market and inflation, particularly as the Fed continues to remain hawkish while maintaining the possibility of a further hike this year.

At the time of writing, as per the CME FedWatch Tool, there is a 79.6% probability that Governor Powell will maintain rates as is in the November meeting, while there is also a sizeable 20.4% implying that a quarter-point rate hike could be on the cards.

The job market appears relatively robust despite the high interest rate environment, which may in turn leave the economy prone to higher inflation, and consequently additional interest rate hikes.

An NFP surprise to the upside will significantly raise the likelihood of a 25 bps hike in the Fed’s next meeting.

The post US initial jobless claims and relatively robust labour market indicators stoke inflationary concerns appeared first on Invezz.