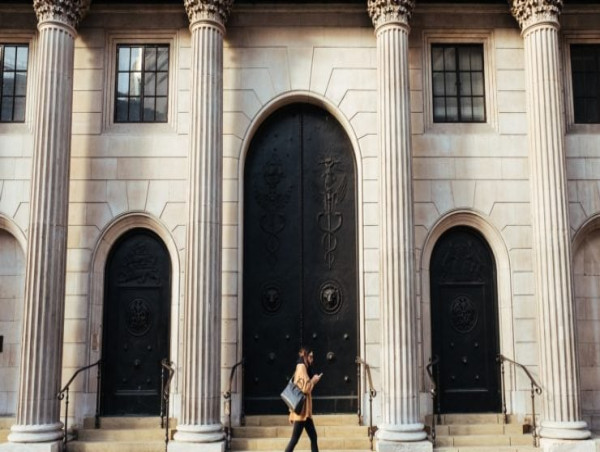

The Bank of England (BOE), the central bank of the United Kingdom, recently released a plan to regulate stablecoins and come one step closer to providing adequate rules for the broader crypto industry.

Both the BOE and the Financial Conduct Authority (FCA), the country’s financial watchdog, intend to follow the rules that the UK government released last week to ensure proper monitoring of the digital asset sector.

UK wants to be the next big crypto hub

The proposal in question said that the country would soon see the arrival of regulations for stablecoins backed by fiat currencies. The regulations are expected to be put into action sometime in early 2024.

According to the UK government’s paper, the Bank of England will be expected to regulate systemic stablecoins while the FCA stays in charge of governing the broader crypto market.

Rishi Sunak, the UK Prime Minister, also announced that he wants the country to become a crypto hub. If so, the country could join the likes of Singapore, Hong Kong, and Dubai as one of the most desirable crypto locations in the world.

However, to reach that level, the UK first requires the introduction of clear rules for crypto companies and digital assets themselves.

These are the goals that the country’s financial institutions and regulators have to focus on first. Furthermore, since the EU and Japan have tried to introduce similar regulations, the UK has some competitors.

Details regarding stablecoin regulations

According to the new paper, the Bank of England intends to focus only on stablecoins backed by the British pound.

This was explained in a letter by the Prudential Regulations Authority (PRA), which said that contagion risks would be lower for stablecoins used in systemic payment systems regulated by the bank than for alternatives such as e-money or other regulated stablecoins captured by the FCA regime.

The FCA also confirmed that anyone seeking to issue a new stablecoin will first require permission from the regulator before their stablecoins start circulating in or from the UK. The paper added that issuers can keep the revenue from interest and return from the backing assets.

However, the FCA noted:

We are conscious that this may be perceived as unfair to consumers, if interest rates continue to remain high and go up significantly (given that the regulated stablecoin backing assets are expected to be protected as client assets).

As the UK and the other mentioned nations continue to make attempts to provide a functional regulatory framework and finally legalize the crypto industry, no such efforts have been made in the US as of yet, causing the country to lag behind many nations on a global scale.

The post Bank of England rolls out stablecoin regulation plans as part of turning Britain into a crypto hub appeared first on Invezz