Highlights

- International Consolidated Airlines Group witnessed a revival in passenger capacity in the last quarter of 2021. During the fourth quarter of 2021, capacity was 58% of the 2019 level.

- The company’s total revenue for the year ended 31 December 2021 stood at €8,455 million with a 4.6% growth in passenger revenue to €5,830 million.

Passenger airlines company International Consolidated Airlines Group S.A. (LON: IAG), which owns British Airways and other airlines brands, announced its full-year results for the year ended 31 December 2021, witnessing a revival in passenger capacity in the last quarter of 2021.

During the fourth quarter of 2021, the FTSE100 listed aviation company’s capacity was at 58% of 2019 levels due to the ease of travel restrictions in the US and other countries. Overall, full-year passenger capacity was 36% of the 2019 level.

The total revenue during the period stood at €8,455 million for the company with a 4.6% growth in passenger revenue to €5,830 million. Revenue from the cargo segment also increased significantly by 28.1% to €1,673 million. At the peak of the Covid-19 pandemic, revenue from the cargo segment continued to support the company’s business operations.

IAG was able to narrow down its business losses. The total operating loss was down by 62.9% to €2,765 million (FY 2020 operating loss: €7451 million). The lower loss during the period indicates a significant revival in business following the ease in travel restrictions and a sign of a bounce back from the Covid-19 pandemic.

The company has a positive outlook for 2022 as it expects higher passenger capacity at around 65% of 2019 levels in the first quarter, supported by higher bookings for Easter and summer 2022. The full-year capacity outlook for 2022 is around 85% of 2019 capacity. Also, the company plans a Capex of €3.9 billion in 2022 and expects delivery of 25 new aircraft during the year.

Will stock price bounce back to pre-pandemic levels?

The Covid-19 pandemic had severely impacted the IAG’s stocks price, which witnessed a drastic fall following travel restrictions across the globe. Before the pandemic, the company’s shares used to trade above GBX 400 level in January 2020.

The current revival in passenger capacity and ease in travel restriction might support the business recovery. Also, the company is expected to reach total passenger capacity by 2023, as indicated by the management outlook. In addition, a gradual drop in coronavirus cases and a higher rate of vaccination support the conviction that there may not be another lockdown-like situation that would adversely impact the business and the stock price.

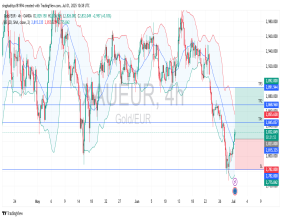

Recent Share price performance

(Image Source: Refinitiv)

The company’s stock has been witnessing good buying interest from investors in the last couple of months with an increase in travel demand due to eased restrictions and testing rules. IAG shares currently trade at GBX 148.30, up by 1.2% on 25 February 2022 at 11:30 pm GMT+1, with a market cap of £7,314 million.

The stock has given a year-to-date return of 4.5% to shareholders, despite rising conflicts between Russia & Ukraine, which can significantly impact the aviation sector.

.jpg)