Summary

- Indian economy is undergoing a transformational phase, and younger generation is contributing the most.

- Young people are calling for institutional reforms to update the social and political systems for better opportunities in the future.

- Indian government is encouraging digital payments and intends to have a single digital transaction platform for all people, companies and government departments.

- UPI has been a massive success despite the pandemic challenges, and now India intends to take it to the global market.

Indian economy is on the verge of significant changes, and multiple factors are contributing to this transformation. India is a young country with around 65 per cent of its people younger than 35 years. With its large population being young, the Asian country has a huge challenge to provide better employment to young people. However, it offers opportunities, as young minds are contributing to shaping the future of the country.

India is a country with the diversity of religions, beliefs, and social and political systems. There is a massive gap between the rich and the poor, and then is the middle class, which is the actual catalyst to the growth.

Earlier, many people in rural areas were not even connected to the financial system, as they had no bank accounts. However, Pradhan Mantri Jan Dhan Yojana has helped with 399.5 million beneficiaries banked so far and INR 1.3 trillion balance in beneficiary accounts.

Technological Advancement in India

The young generation today has easy access to information thanks to the smartphone and growing internet connectivity. They are now more aware of the world around them, and as a result, they know the kind of opportunities out there.

This has fueled their aspirations for a better quality of life. In this information and social media age, the young middle-class population is aware of the outdated social and political system, and they are calling for reforms in these systems. Young India knows that building skills can drive the growth, and if India can create capabilities for growth, the opportunity in the country and abroad is unlimited.

Not only in India but worldwide, the pandemic is the time for significant technological advancement and innovation. This crisis has thrown new challenges, and technology is helping people in continuing with their work and education while socialising using technological tools.

Government Promoting Cashless Transactions

The Indian government is encouraging digital transactions across the country. The Ministry of Electronics and Information Technology (MeitY) is aiming for cashless, paperless, and faceless services with a particular focus on the rural and remote parts.

MeitY wants a universal e-Governance infrastructure for digital transactional experience for citizens, companies, and internal government functions.

Online Transactions Flourish Amid COVID-19

India is among the hardest-hit countries amid the COVID-19 pandemic, with not much supporting infrastructure to deal with such an unprecedented crisis. However, online transactions have boomed during the pandemic period.

Do Read: Ruling Amid Crisis: 4 Companies Stealing the Show As COVID-19 Uncertainty Prevails

There is also a psychological factor to this change; during the pandemic, when everyone needs to follow social distancing and maintain excellent hygiene, people are avoiding cash payments for transactions. There is a psychological fear of getting the infection through cash payments. Hence, people prefer more of digital transactions.

Also, the prolonged crisis is bringing behavioural changes, so even when the pandemic will end, the online transaction is here to stay.

Must Read: Your Complete Guide: Companies Hitting the COVID-19 Vaccine Charter

India Plans to Take UPI Global

Encouraged by the success of its model for digital payments, India now eyes global market for Unified Payments Interface (UPI), which was rolled out in 2016 and significantly contributed to the growth of online payments in the country of 1.4 billion people.

UPI and the payment card scheme RuPay of National Payments Corporation of India (NPCI) are doing well in India as alternatives to Visa and Mastercard.

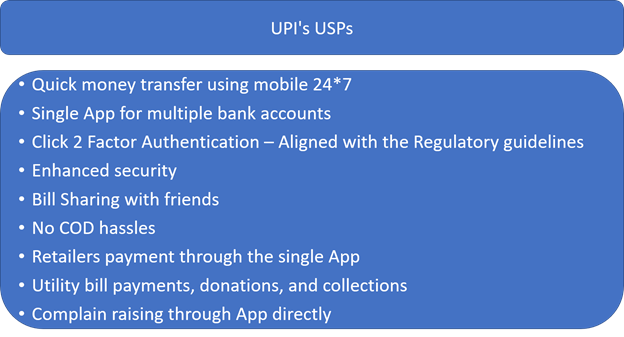

The UPI's transaction volumes rose to a record 1.34 billion in June. It is easy to use, and offers cheap and quick transfers across bank accounts. One can do all kinds of purchasing using the UPI platform. In a developing country like India, where millions of people had no bank account, UPI is helping in increasing financial inclusion. The proponents of this system say that it is more sophisticated than similar systems in other countries.

This system has been set up by the central bank, administered by the National Payments Corporation of India and owned by a consortium of domestic lenders.

Unified Payments Interface powers several bank accounts into a common platform through a single mobile application, consolidating several banking features. The user gets seamless fund routing and retailer payments under one platform. It also offers peer to peer collect request as per the need and convenience. The pilot launch was on 11th April 2016 with 21 member banks participated, and banks started to provide their UPI enabled Apps on Google Play Store from 25th August 2016 onwards.

The pilot has been launched in Singapore, and now India is undergoing initial talks with the Bank for International Settlements, World Bank and the Bill & Melinda Gates Foundation to explore how to proceed further on possible collaborations.

Good Read: Revealed! Four Strong Companies From The Biggest Economies Amid COVID-19