Summary

- Bank of Canada announced a 25 basis point rate hike in early June, taking the trendsetting rate to a 15-year high of 4.75%.

- A similar rate hike is anticipated in July as per the central bank of Canada.

- Home Capital Group and Clairvest Group are two TSX-listed financial stocks that can be examined in July 2023.

The Bank of Canada conducted a 25-basis-point rate hike in early June, ending its 4-month long spell of no interest rate changes for the economy. The central bank had halted its rate hike policy in January this year to examine whether inflation had been brought down to more palatable levels.

With inflation inching higher at a faster-than-expected pace, the central bank hints at another rate hike in July. The central bank’s trendsetting rate current stands at 4.75% after June’s rate hike. However, as inflationary pressure builds, Bank of Canada could add another rate hike of 25 basis points, taking the trendsetting rate to 5%.

The financial sector is expected to be at an advantage from any upward movements in the interest rate. On that note, here are two financial stocks to examine in July 2023.

ALSO READ: Generate passive income with these TSX-listed stocks

Home Capital Group Inc (TSX: HCG)

Home Capital operates through its principal subsidiary Home Trust, which offers mortgage lending as well as credit card services.

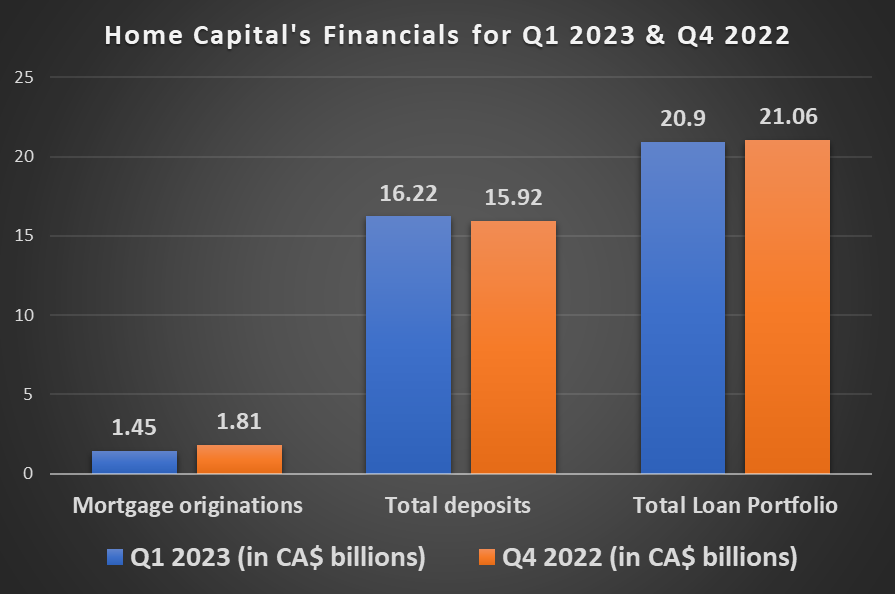

Home Capital saw a net income of CA$ 51.8 million for the first quarter of 2023. This represented diluted earnings per share of CA$ 1.34 for the quarter which marked a 55.8% jump from Q4 2022. Meanwhile, the adjusted net income for this quarter was CA$ 53 million.

Image source: ©2023 Kalkine®; Data source: Company Reports

Home Capital also declared a dividend of CA$ 0.15 per common share, as an “eligible” dividend.

ALSO READ: Watch these mid-cap stocks this earnings season

Clairvest Group Inc. (TSX: CVG)

Clairvest is a Canadian equity investment company that partners with businesses that can be promising ventures in their industries. The company not only contributes with financial support but also through strategic expertise.

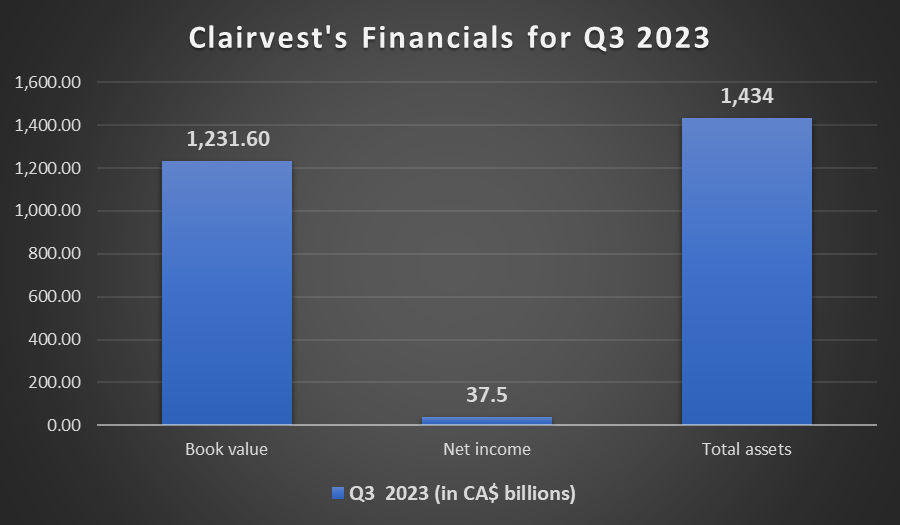

For the third quarter of fiscal 2023, Clairvest reported total revenue of CA$55.19 million and a net income of CA$ 37.46 million. The company’s EBIT during the quarter was CA$ 41.24 million.

Image source: ©2023 Kalkine®; Data source: Company Reports

Clairvest’s financial report highlighted that the company’s book value per share rose 5.6%, which included CA$ 0.783 per share of dividends paid in July 2022.