Highlights

- National Bank of Canada (TSX:NA), on Friday morning, February 25, reported its first-quarter results for fiscal 2022 ending January 31 this year.

- Having closed at C$ 100.83 on Thursday, NA stocks were trading about one per cent higher at C$ 102.25 apiece at 9.55AM EST on Friday, following its earnings release.

- The Montreal-based bank said its net profit expanded by 22 per cent year-over-year (YoY) to C$ 932 million in Q1 FY2021.

National Bank of Canada (TSX:NA), on Friday morning, February 25, reported its first-quarter results for fiscal 2022 ending January 31 this year.

Having closed at C$ 100.83 on Thursday, NA stocks were trading about one per cent higher at C$ 102.25 apiece at 9.55AM EST on Friday, following its earnings release.

Let us look at how National Bank performed in Q1 FY2022.

National Bank of Canada (TSX: NA) financial performance in Q1 FY2022

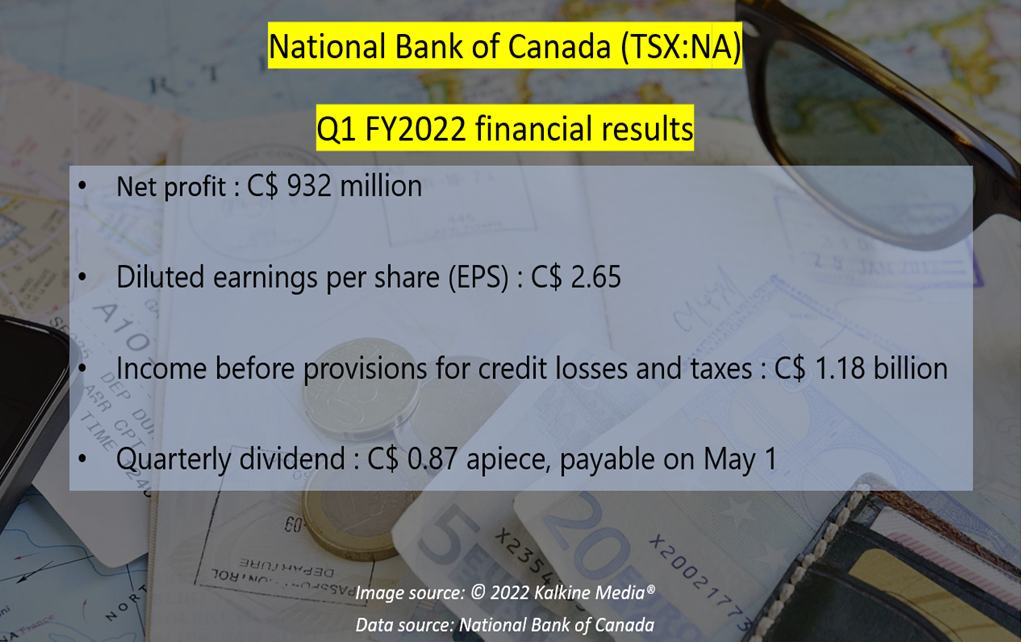

The Montreal-based bank said that its net profit expanded by 22 per cent year-over-year (YoY) to C$ 932 million in Q1 FY2021, while its income before provisions for credit losses (PCL) and taxation was C$ 1.18 billion (compared to C$ 1.04 billion a year ago).

The C$ 34-billion market cap banking company saw its diluted earnings per share (EPS) climb by 23 per cent YoY to C$ 2.65 in the latest quarter.

Also read: Royal Bank (TSX:RY) posts net profit of $4.1B in Q1. Time to buy?

National Bank of Canada also posted a Common Equity Tier 1 (CET1) capital ratio of 12.7 per cent and a leverage ratio of 4.4 per cent under Base III at the end of Q1 FY2021.

How has National Bank of Canada stock been performing?

Stocks of National Bank gained by almost 27 per cent in the last one year.

Currently, NM stock is trading nearly 34 per cent above its 52-week low of C$ 75.32 (February 23, 2021) and almost five per cent below its 52-week high of C$ 106.10 (November 22, 2021).

Bottomline

National Bank of Canada, with approval from its Board members, has announced a quarterly dividend of C$ 0.87 apiece for Q1 FY2021, which will be payable on May 1.

Please note, the above content constitutes a very preliminary observation based on the industry, and is of limited scope without any in-depth fundamental valuation or technical analysis. Any interest in stocks or sectors should be thoroughly evaluated taking into consideration the associated risks.

Also read : Can you buy Medicago stock as its vaccine gets Health Canada nod?