Highlights:

- Black Rock Mining has struck a deal with US-based Urbix.

- Urbix is focused on manufacturing lithium-ion battery anode materials.

- Black Rock initially signed an MOU with Urbix on 1 July 2021 to explore working together.

Shares of Tanzanian graphite developer Black Rock Mining Limited (ASX:BKT) were spotted trading 25.862% higher at AU$0.182 apiece at 1:15 PM AEST on ASX on Friday (9 September 2022).

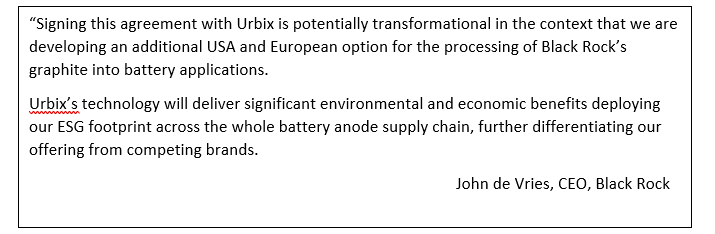

The company shared that its 84% owned Tanzanian subsidiary, Faru Graphite Corporation Limited, has signed an agreement with US-based Urbix, Inc. The conditional deal is for material from Module 2 of the Mahenge Graphite Project.

Key highlights from the deal announcement

- As per the deal, both firms will come together in forming a new supply chain to fulfil the demands of the US and European battery industries.

- Now Black Rock Mining can start construction of Module 2 simultaneously with Module 1. Urbix will be facilitating Black Rock with a considerable prepayment and/or equity support for exclusivity of offtake of 100 natural flake graphite fines from Module 2.

- The deal underlines the strength of underlying demand for Mahenge’s high-quality graphite concentrates.

- The agreement also suggests that Black Rock’s board is quite methodical in increasing the shareholder value around the establishment of alternative supply chains suitable for American and European battery makers.

- As per the deal, Black Rock has given Urbix trade exclusivity for Module 2 fines for 150 days.

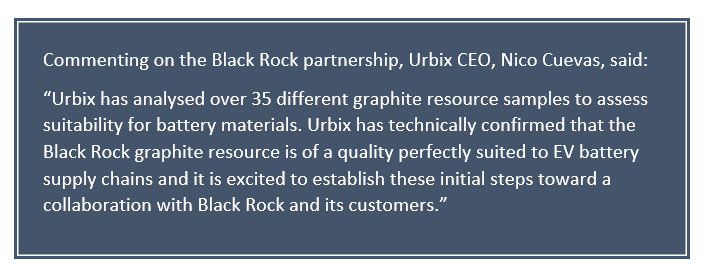

Meanwhile, Urbix processing technology will deliver some vital benefits to Black Rock and its customers. These include:

- Materially lower energy consumption;

- Elimination of hydrofluoric acid use;

- Higher product yield;

- Ability to incorporate at the particle level appropriate levels of synthetic graphite material to produce a blended anode material as a drop-in product for cell manufacturers;

- Extensive third-party assessment confirming Urbix’s anode electrochemical performance.