Highlights

- High-grade gold intercepts extend mineralisation depth

- Drilling targets new zones for upcoming resource estimate

- Strong momentum resumes post-weather disruption

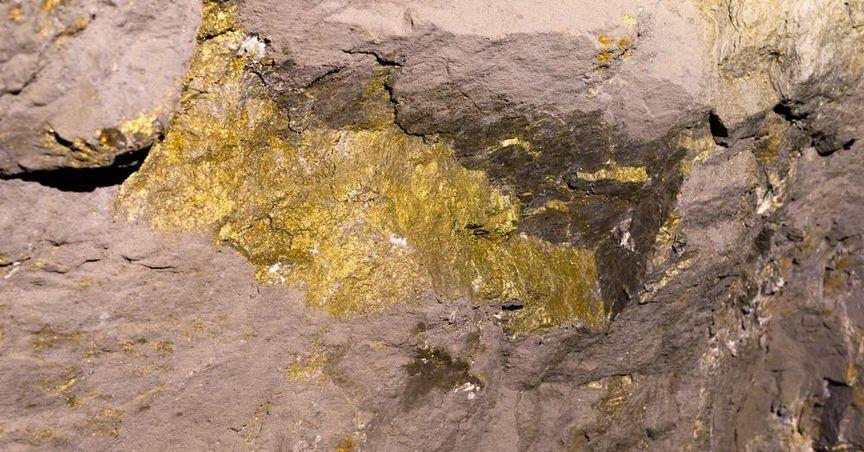

Titan Minerals Ltd (ASX:TTM) has announced promising results from ongoing drilling efforts at its 100%-owned Dynasty Gold Project in southern Ecuador, highlighting further growth opportunities and solidifying its position in the region’s emerging gold narrative.

Deepest Gold Intercepts Achieved

At the Cerro Verde prospect, the company recently recorded its deepest mineralisation to date. Drill hole CVDD24-122 intersected gold as deep as 400 metres, with notable assays including 2.9 metres at 21.9 g/t gold from just 16.9 metres and 13 metres at 4.5 g/t gold from 330.6 metres. These high-grade results underscore the untapped depth potential of the Dynasty system.

Follow-up holes, such as CVDD25-123 and CVDD25-126, validated lateral and depth continuity, with intervals including 3.7 metres at 2.9 g/t gold from 293.1 metres and 7.8 metres at 2.5 g/t gold from 218.2 metres. These outcomes provide greater confidence in extending the known resource envelope and lay the groundwork for upgrades in classification.

Momentum Resumes After Operational Pause

Following a two-month delay due to heavy rainfall, drilling has now resumed at full pace. Titan has deployed three diamond rigs targeting high-priority zones within Cerro Verde, which currently hosts 1.9 million ounces of Dynasty’s total 3.1 million-ounce resource.

The company is actively working toward a resource update scheduled for the third quarter of 2025. This includes infill and extensional drilling aimed at converting inferred or unclassified material to support a future Ore Reserve estimate.

Strategic Workstreams to Enhance Value

As part of its strategic roadmap, Titan has enlisted Entech Mining to deliver the upcoming Mineral Resource Estimate (MRE) update and Knight Piesold to assess tailings storage options. In parallel, other technical workstreams—such as metallurgical testing, permitting, and cost studies—are progressing to support project advancement.

Importantly, the Dynasty Gold Project aligns with broader interest in large-scale mineral assets in Ecuador. With increased M&A activity and foreign investment entering the gold space, Titan’s 100% ownership of this growing project enhances its strategic relevance.

The exploration campaign also reinforces the broader narrative around long-term exposure to gold, positioning Titan as a compelling entry in the context of emerging ASX dividend stocks and gold-linked growth stories within the S&P/ASX200 landscape.

As systematic drilling continues and new down-plunge and infill targets are tested, Titan Minerals (TTM) is poised to redefine the value potential of the Dynasty Project. With the next wave of assays and modelling updates on the horizon, market watchers are keeping a close eye on what lies beneath this high-grade Ecuadorian gold system.