Highlights

- Helloworld Corporate has been purchased for AU$175 million by Corporate Travel Management.

- Consideration for the transaction includes AU$100 million in cash and around 3.6 million CTD shares to Helloworld.

- The integration of Helloworld's entertainment and corporate brands, including Show Group, QBT, AOT Hotels, TravelEdge, Atlas Travel, APX, will begin instantly after the acquisition.

Shares of the travel firm, Corporate Travel Management Limited (ASX:CTD) are on investors’ radar as the company updated on the AU$175 million corporate acquisition of another travel company, Helloworld's travel units.

CTD shares post-announcement, were spotted trading marginally lower at AU$23.610 a share (at 12:30 PM AEDT).

On the other hand, riding high on the announcement, shares of Helloworld Travel Limited (ASX:HLO) were spotted trading 0.420% higher at AU$2.390 per share at 12:00 PM AEDT.

Today, CTD is trading in tandem with the larger consumer discretionary sector, which is down 1%, whereas HLO is trading in the opposite direction with a positive note.

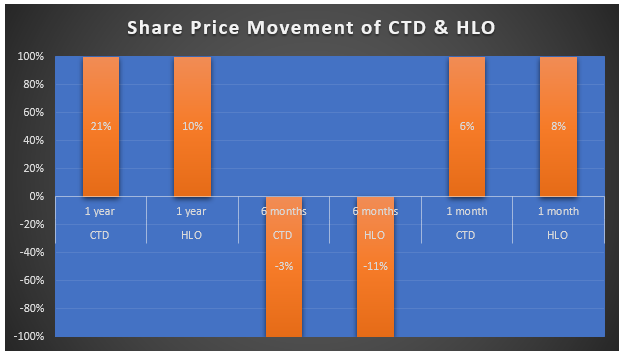

With 21% and 10% growth, respectively, both CTD and HLO have been on a positive streak from past one year. However, both CTD and HLO failed to continue their bullish momentum in the last six months, shedding 3% and 11% of their value, respectively. Although both companies struggled in the middle of the year, they have since rebounded, with CTD up 6% and HLO up 8%.

Image source: © 2022 Kalkine Media®

At the time of writing, S&P/ASX 200 Consumer Discretionary (AXDJ) is trading 0.79% lower at 3,130.40.

Good read: QAN, FLT, HLO: Three ASX travel shares with over 5% rise in past five days

About the companies

Helloworld is a prominent travel distribution firm that offers freight and coach operations, retail leisure and corporate travel networks, destination management services (inbound), air ticket consolidation and wholesale travel services.

Corporate Travel Management is a global provider of cost-effective and innovative business travel management solutions to the corporate sector.

Acquisition funds placed aside

Corporate Travel Management Limited has announced that it has completed its acquisition of Helloworld Travel Limited's entertainment and corporate travel business in New Zealand and Australia. The acquisition was reported to the ASX on 15 December 2021.

The acquisition, which brings together Helloworld Corporate and CTM, was reached to free up funds for HLO, allowing it to capitalise on what it claims is pent-up customer demand for leisure travel services.

The acquisition's AU$175 million purchase price was paid for in the following ways:

- The revenues were a fully underwritten equity offering, including an AU$75 million Share Purchase Plan and an AU$25 million institutional placement.

- Helloworld has been issued 3,571,429 new CTM shares.

Business integration

The integration of Helloworld's entertainment and corporate brands, including Show Group, QBT, AOT Hotels, TravelEdge, Atlas Travel, APX, will begin instantly.

After the acquisition, the focus would be on optimising travel policies using CTM's technology, service and scale, developing consumer engagement plans and welcoming employees and consumers.

The purchase places CTM as the travel management provider for more than a quarter of ASX 200 listed firms. It also increases its technology and service offerings in the education and government sectors.

Management remark

Andrew Burnes AO, HLO Managing Director and CEO, stated:

Bottom line

HLO believes the sale of the firm's corporate travel unit coincides with the tourism sector's recovery from COVID-19 disruption. As per them, this strategy will help their company stand out.

Good read: Aussie travel sector gets funding boost; Hong Kong lifts flight ban