The stock markets around the world have retreated with the fears prevailing around the fallout on global growth outlook due to China's coronavirus outbreak.

On 25 January 2020, China’s Ministry of Culture and Tourism enforced greater travel restrictions, instructing Chinese travel agents to suspend all tour groups, both domestically and to other countries. The sale of flight and hotel packages overseas have also been stopped, effective 27 January 2020, to contain the spread of the Novel (new) coronavirus (2019-nCoV) that has originated from the central Chinese city of Wuhan in Hubei province.

Read: Market Pessimism Grows Stronger Over Coronavirus; Risky Assets Under Pressure, Gold Near Record Peak

Amidst all the disturbances, Australia-based AuMake International Limited (ASX:AU8) that provides Asian customers an authentic Australian and New Zealand experience, has assured the investors that it is financially well-positioned with a strong diversified customer base to handle any potential disruptions to the business. Having dealt with the SARS (severe acute respiratory syndrome) epidemic in 2003, the Company is confident that its management team is experienced enough to manage disruptions in the travel industry and meet financial commitments in the foreseeable future.

The company’s management is receiving updated and accurate information via relationships developed over the last 20 years with over 50 travel agents in China, placing the Company in a position to manage the situation adequately.

AuMake specialises in offering authentic products and services to Asian tourists, local residents and Daigou through a multichannel distribution network with strategically located retail stores on Australia’s east coast and in New Zealand. On the back of long-lasting relationships established in the Asian tourism industry, and online through owned and third-party channels, AuMake also organises inbound tour groups.

The Company’s own brand portfolio includes 3 key brands being AuMake, Broadway and KiwiBuy, across four main categories of products offered - dairy products and baby food (including infant formula); skin, body care and cosmetics; healthcare (supplements and food); and wool and leather products.

For now, AuMake’s main priority is to ensure a safe environment for its staff as well as customers with appropriate health and safety procedures implemented since becoming aware of 2019-nCoV developments in China. The Company said that it will continue to assess the impact of 2019-nCoV as more information emerges and will update the stakeholders accordingly.

December Quarterly Results: AuMake Delivers Record Financial Performance

A significant improvement in the underlying performance of both the Broadway and AuMake businesses was recorded for the three months to 31 December 2019, yielding financial results beyond the traditional positive impact of high season.

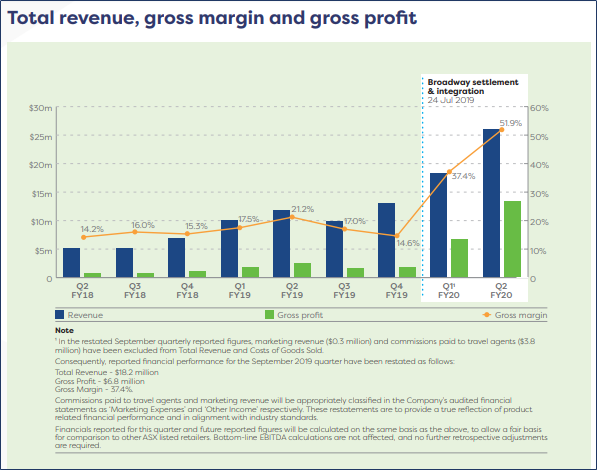

Total Revenue, Gross Margin up Over 2x and Gross Profit up Over 5x

The Revenue for the period increased by 120% to $ 26.0 million as compared to $ 11.8 million in December 2018 quarter (prior corresponding period (pcp)) while the Gross margin substantially expanded by 144% to 51.9% vs 21.2% recorded in pcp. The Gross Profit recorded an uptick of a significant 440% to $ 13.5 million as compared to $ 2.5 million in the pcp.

Source: Company’s December Quarterly Report

EBITDA turns Black

The company has informed to have recorded positive operating EBITDA (inclusive of all expenses including rental expenses) for the months of October and November. The momentum carried over into the month of December and the December 2019 quarter is anticipated to be the Company’s first quarter of positive operating EBITDA, subject to audit.

Underlying Growth Drivers

Asian inbound tour group visitation: By leveraging existing and forming new relationships with Asian travel agents, Broadway grew inbound tour group visitation by 120% on pcp that is expected to rise with a significant pool of untapped travel agents in China yet to be engaged.

In September 2019, AuMake also engaged with Korean travel agents and initiated Korean tour groups visiting the Broadway store network. On that note, Korean tour group visitation is also anticipated to increase in calendar year 2020.

Gross margin improvement strategies: In October 2019, four (4) AuMake branded community stores were shut down in Sydney which led to improvements in total gross margins for the quarter as the sales of lower gross margin products (including infant formula and popular health supplement brands) went down. What compensated for sales from these closed stores was loyal customers migrating to AuMake’s online store.

The remaining AuMake branded stores delivered an increase in revenue of 22% on pcp on the back of key drivers being growing customer familiarity with AuMake store locations and additional word-of-mouth referrals which increased Asian tourist and local customer traffic. Not only that, the Company also implemented a number of operational and service-related initiatives during the quarter to push up gross margins.

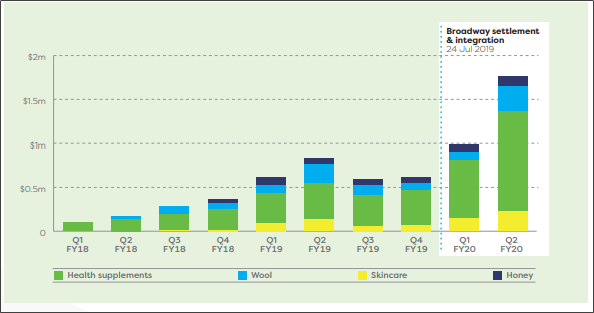

Owned Brand Revenue: The Company ‘s owned brand product sales grew by 112% to $1.8 million as compared to $ 850,000 recorded in the December 2018 quarter due to increased Asian Free Independent Traveller (FIT) visitation rates to AuMake stores and additional distribution of owned brand products via the Broadway store network.

Source: Company’s December Quarterly Report

Online and Marketing Revenue

The online revenue for the period grew by 18% to $ 4.6 million as compared to the September 2019 quarter owing to AuMake’s ability to re-direct its growing store traffic to also shop online.

In addition to revenue derived from product sales, the Company also receives marketing revenue from third parties that market their brands to the Company’s customers. This additional revenue was $ 0.5 million for the December 2019 quarter (September 2019 quarter: $ 0.3 million). Generally, minimal commitment of AuMake resources is required to service and grow this additional revenue stream, as any necessary investments are borne by the third party.

Lens Over Company’s Cashflow

Operating Cashflow: On account of increased operational profitability, continued inventory reduction and streamlining of store/corporate labour costs, AuMake achieved a second consecutive quarter of positive cashflow (+ $ 2.7 million) with cash at bank of $ 12.1 million at the end of the period.

Outlook: AuMake is highly encouraged with the December 2019 quarter business performance and the early indications of success with the dedicated and strategic focus on servicing the unique retail requirements of Asian tourists.

Going forth, the March 2020 quarter would be a traditional high season for Asian tourist visitation as it includes the Chinese New Year holiday period. Although, forward tour group bookings at this stage have been only marginally impacted by the recent Australian bushfires, however the Company will continue to monitor the situation closely.

Stock Performance: AuMake International Limited has a market capitalisation of around AUD 31.25 million with ~ 332.44 million shares outstanding. On 29 January 2020, the AU8 stock settled the day’s trade at AUD 0.098, zooming up 4.25%, with approximately 1.14 million shares traded. AU8 has delivered a positive return of 9.52% in the last one month.