Highlights

- The WTI crude oil price increased by 4.1% to US$110.49 per barrel.

- The Brent crude oil price increased by 3.8% to US$111.55 per barrel.

- Oil stock like Woodside Petroleum was trading in green today.

The Australian share market started the week positively with the ASX 200 Index gaining 0.21% to touch AU$7,090.30 points on Monday (16 May 2022) at 11.03 PM AEST.

Oil prices have also surged higher today. The WTI crude oil price increased by 4.1% to US$110.49 per barrel, while the Brent crude oil price increased by 3.8% to US$111.55 per barrel.

On that note, let us take a look at the performance of some ASX-listed oil stocks.

Woodside Petroleum Limited (ASX:WPL)

Woodside Petroleum Limited, an Australian petroleum exploration and production company, operates in the hydrocarbon business. The company's core focus is on liquefied natural gas (LNG), which it achieves through production, development, and other means (trading and shipping activities).

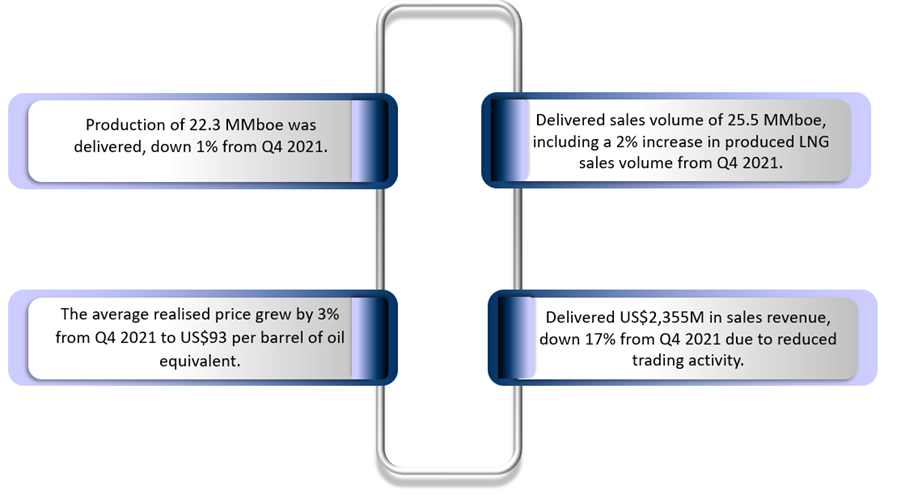

On 26 April 2022, the company shared its financial results for the first quarter of 2022.

Highlights of 1QFY22

Image Source: © 2022 Kalkine Media ®

Data Source- Company announcement dated 26 April 2022

Woodside shares were trading at AU$30.42 each, up 0.1% at 1.06 PM on Monday.

Santos Limited (ASX:STO)

Santos Limited is a natural gas exploration and production company based in Australia. The company sells ethane, gas, liquefied natural gas (LNG), crude oil, condensate, naphtha, and liquefied petroleum gas (LPG).

Last week (on 11 May 2022), NeuRizer Ltd, a wholly-owned subsidiary of Leigh Creek Oil and Gas Pty Ltd (LCOG) announced that Santos will farm-in and take operatorship of Cooper Basin oil and gas permit Authority to Prospect (ATP) 2023.

Santos will receive a 50% stake in the company and will run a three-well gas exploration campaign in the Toolachee Formation.

Santos shares were trading at AU$8.03 apiece, down 0.25% on the ASX today.

Source: © Sardorrr | Megapixl.com

Viva Energy Group Limited (ASX:VEA)

The Geelong Oil Refinery is owned by the Viva Energy Group, which sells Shell-branded fuels across Australia. With 1.29 billion issued shares, the firm has a market capitalisation of AU$4.39 billion at 1.36 PM AEST. The company made AU$15.9 billion in revenue in FY21, up from AU$12.4 billion in FY20.

At 1.21 PM, Viva Energy's shares were 0.35% up at AU$2.84 per share on Monday.