Highlights

- The benchmark ASX 200 index was down 0.63% at 6,644.00 points at 2.00 PM AEST today.

- Many investors prefer to invest in ASX dividend shares during times of growing uncertainty and volatility.

Australian equities opened in red on Wednesday (15 June), extending yesterday's selloff with the benchmark ASX 200 index closing 1.27% down at 6,601.00 points today.

However, many investors gravitate to ASX dividend shares during times of growing uncertainty and volatility because they have the potential to generate consistent returns that may outpace share price gains.

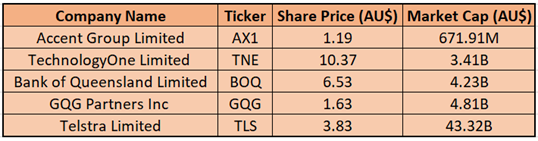

On that note, let's look at these five ASX shares which remained in limelight today. These include Accent Group Ltd, TechnologyOne Ltd, Bank of Queensland Limited, GQG Partners Inc, and Telstra Corporation Ltd.

Image Source: © 2022 Kalkine Media ®

Accent Group Ltd

Accent Group Limited (ASX:AX1) operates in Australia and New Zealand. The company retails, distributes, and franchises lifestyle footwear, clothes, and accessories. The Athlete's Foot, Platypus Shoes, Hype DC, Skechers, Merrell, CAT, Vans, Dr. Martens, Saucony, Timberland, Sperry, Palladium, Stance, Supra, Subtype, The Trybe, PIVOT, Stylerunner, Glue Store, and Autry are among the company's brands and banners.

The shares of Accent Group closed at AU$1.18 each, down 5.24% on ASX today. The company's shares have recorded a negative growth of more than 50% YTD. The company is expected to pay a fully franked dividend of 5.8 cents in FY22.

TechnologyOne Ltd

TechnologyOne Ltd (ASX:TNE) is an Australian-based software solutions business. The firm specialises in developing, marketing, selling, implementing, and supporting fully integrated enterprise business software. The three segments through which it operates are software, consulting, and corporate.

On May 24, 2022, TechnologyOne announced that it would pay a 60% franked dividend of AU$0.042 per share. The dividend will be paid on 17 June 2022, and the record date for the dividend was 16 June 2022.

TechnologyOne’s shares last traded at AU$10.26 each, down 2.75% on ASX today. The company’s shares have fallen almost 20% YTD.

Bank of Queensland Limited

Bank of Queensland Limited (ASX:BOQ) is an Australia-based regional bank. Its operating segments include Retail Banking and BOQ Business.

The banking stock is frequently neglected in favour of its larger banking peers. It, however, provides many of the same advantages as its larger peers, including a sizable dividend yield. Based on recent prices, BOQ shares currently have a trailing and fully-franked dividend yield of 6.73%.

Bank of Queensland's shares last exchanged hands at AU$6.51 per share today, down 0.46% on ASX. The bank's shares have recorded a negative growth of over 19% on YTD basis.

Source: © Alexkalina | Megapixl.com

GQG Partners Inc

GQG Partners (ASX: GQG), an investment management firm, focuses on global & emerging markets equities.

Based on Tuesday's closing price of AU$1.63, the company is predicted to pay a dividend yield of 7.3% in FY22 and 7.9% in FY23.

Shares of GQG Partners last exchanged hands at AU$1.58 apiece, down 3.07% on ASX today. The shares have fallen around 10% YTD.

Telstra Limited

Telstra Corporation Limited (ASX:TLS) serves domestic and international customers with telecommunications and information services. Telstra Consumer and Small Business (TC&SB), Telstra Enterprise (TE), Networks and IT (N&IT), and Telstra InfraCo are the company's four segments.

Shares of Telstra closed at AU$3.83 per share, up 2.13% on ASX today. However, the shares have fallen around 8% on YTD basis.

Also Read: From RMD, TNE to CRN: These 5 ASX companies to pay dividend in June 2022