Leading Australian & New Zealand travel distribution company, Helloworld Travel Limited (ASX: HLO) is mainly involved in providing domestic and International travel products and services to clients around the world. The company has three main operating segments:

- New Zealand Segment

- Australia Segment

- Rest of World Segment

In the last two years, the company has made a number of strategic business acquisitions to complement the companyâs existing operations and expand future product offerings to an increased network of agents, suppliers and customers.

The company is now going to acquire Australiaâs leading privately-owned corporate travel management company, TravelEdge.

TravelEdge Acquisition

In an announcement made on 24 September 2019, Helloworld Travel Limited confirmed that it has agreed to acquire TravelEdge for a total consideration of $28.0 million which will be funded from a new bank facility. The consideration is representing an FY19 EBITDA multiple of approximately six times.

TravelEdge is Australiaâs highly respected corporate travel management company which generated more than $300 million of TTV (Total Transaction Value) in FY19.

TravelEdge operates through six divisions:

- TravelEdge Corporate offers the full range of end to end solutions for the corporate travel market;

- Communico Services offers tailored in-house travel management solutions for corporate clients;

- TravelEdge Events offers event management, groups travel, conference and meetings services;

- Business Travel by STA offers travel management services for leading Australian learning institutions;

- TravelEdge Holidays provides exclusive offers and packages for leisure travelers; and

- Granted Worldwide offers travel prizes and employee incentive programs for corporate clients.

Helloworld believes that this acquisition will be earnings accretive in FY20 and beyond will allow it to expand in the corporate and education travel sectors. Kim Wethmar, the current CEO of TravelEdge will continue to run the business from its Sydney headquarters.

Upsides of TravelEdge Acquisition

- The acquisition will allow HLO to expand in the corporate and education travel sectors;

- TravelEdge business will complement Helloworldâs existing corporate operations in Australia and New Zealand with additional expertise knowledge and capability;

- With the addition of TravelEdge to Helloworldâs wholly owned TMC operations, the companyâs trans-Tasman corporate TTV on an annualised basis will be approximately $1.55 billion in FY20

Previous Acquisition:

Show Group

In December 2018, Helloworld acquired a leading travel management specialist and freight logistics organization, Show Group business which complemented Helloworld Travelâs growing travel management business and expanded its specialised travel and logistics segments.

Williment Travel Group

On 5 June 2019, Helloworld Travel New Zealand acquired 100% of the Williment Travel Group for a total consideration of $0.8 million. As Williment Travel Group is a New Zealandâs premier sports tour specialist for a broad range of sporting codes, its acquisition will add a new dimension to the New Zealand business.

HLO FY19 Performance

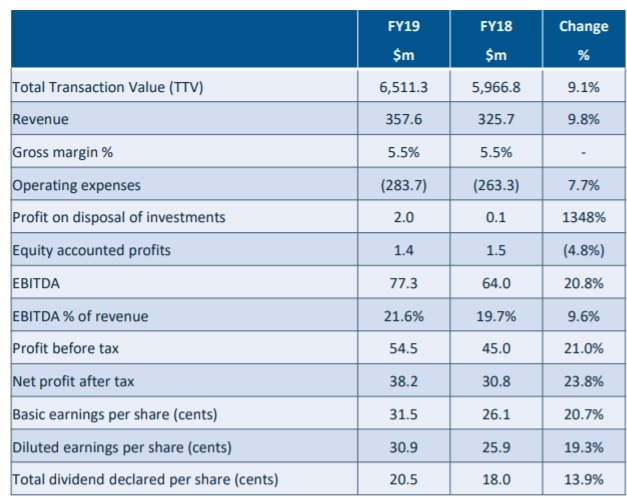

In the last financial year, the company witnessed strong growth in TTV (Total Transaction Value), revenue, EBITDA and net profit before income tax expense as compared with the prior year.

For the year ended June 2019, the company earned a TTV a $6,511 million, which was 9.1% higher than the prior year. The company reported a revenue growth of 9.8% and EBITDA growth of 20.8% in FY19.

During 2018 and 2019 HLO made a number of strategic business acquisitions to complement the Groupâs existing operations and expand future product offerings to an increased network of agents, suppliers and customers. The TTV and revenue in FY19 benefited from business expansion, including Magellan Travel, Asia Escape Holidays, Flight Systems, Show Group and Williment Travel, combined with strong performance from the retail division.

FY19 Results Snapshot (Source: Company Reports)

FY19 Business Highlights:

- Significant new accounts won by HLO corporate business;

- QBT appointed sole provider of travel management services for the SA Government;

- Two year extension for providing travel management services to the Whole of Australian Government;

- Reappointment of APX for five years to the panel that provides travel management services to New Zealand All of Government;

- Show Group proving a valuable addition to HLO, with both travel and freight businesses performing well in the second half of FY19;

- Inspire Travel Management appointed provider of travel management services for Australia Post;

- Strong sales results from enhanced ReadyRooms platform rolled out across Australia & New Zealand

Helloworld recently declared a fully franked dividend of 12.5 cents per share, bringing total dividends declared to 20.5 cents per share in FY19, an increase of 2.5 cents per share or 13.9% from the prior year. The total dividends is representing a dividend payout ratio of 67.0% for the year ended 30 June 2019.

Outlook: The Travel Industry grew strongly during the last year in all segments in which the company operates, however, growth slowed towards the end of FY19, and it is now expected that the economic growth both domestically and globally, will continue at more moderate rates and may flow through to the travel markets.

International tourist arrivals to the companyâs markets have consistently outpaced global economic growth, and all indications are that this trend will continue. The number of outbound trips is also expected to continue to grow.

In FY19, the company is focused on growing its revenue and margins and extracting further efficiencies in its operations and cost base to improve key profitability margin metrics. The company believes that in FY2020, it will again deliver strong results. For FY20, the company is expecting its EBITDA to be in between $83 million to $87 million.

Stock Performance: In the past six months, HLOâs stock has provided a return of 6.91% as on 23 September 2019. The stock is trading at a PE multiple of 14.730x with an annual dividend yield of 4.42%. The stock has a 52 weeks high price of $6.450 and 52 weeks low price of $4 with an average volume of 73,871. At market close on 24 September 2019, HLOâs stock was trading at a price of $4.700, up by 1.293% intraday, with a market capitalisation of $578.7 million.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.