Highlights

- Monger Gold has now been named Loyal Lithium. The company has started trading under the new ticker code, LLI.

- The new name reflects its transition to a lithium-led battery minerals and technology company.

- During and after the September quarter, the Company boosted its lithium project portfolio with the acquisition of the Trieste Lithium Project.

- At its Brisk Lithium project, LLI identified many additional pegmatite outcrops, and thus plans to conduct additional field programs.

- A soil sampling program over the Scotty project has delivered impressive lithium results and further defined the targets.

- The Company held AU$3.054 million in cash at the quarter end, in addition to raising AU$4.5 million in a placement post the quarter.

Loyal Lithium Limited (ASX:LLI) continued to implement its newly developed strategy dedicated to transitioning the business to a lithium-led battery minerals and technology company in the September quarter.

The Company has three high prospective lithium projects in Tier 1 North American Jurisdictions - USA (Nevada), and Canada (James Bay Lithium District).

Loyal triples landholding in James Bay Lithium District

After the quarter, Loyal tripled its landholdings in the prolific James Bay region with the acquisition of the Trieste Lithium Project. The Trieste Project is 14kms east of Winsones’ Adina which has had recently announced a significant pegmatite intercepts and rock chips with high lithium content (up to 4.89% Li2O).

James Bay lithium projects showing Trieste location (Source: Company update, 31 October 2022)

The project area captures the eastern extension of the Trieste Greenstone belt and its inferred eastern continuation and contains an anomalous historical lithium assay (180ppm) among other mapped indicator minerology.

To know more, read here

Loyal wraps up inaugural exploration at Brisk Lithium Project

During the quarter, the Company exercised the option to acquire 100% of the Brisk Lithium Project. The project, which is housed in the James Bay Lithium District, has six prospects with a total of 192 mineral claims covering 9,849 hectares (98.5 km2).

Dahrouge Geological Consulting, the Company’s in-country geological partner, commenced the inaugural exploration program. Summary report is expected in November 2022, however, upon identifying many additional pegmatite outcrops, Loyal plans to conduct additional field programs.

Team strengthened with seasoned CEO

The Company saw value addition in the form of its new Chief Executive Officer, Mr Adam Ritchie, who joined Loyal on 25 July 2022.

He was the former Project Director for the flagship, world-class Pilgangoora Lithium Project of Pilbara Minerals (ASX:PLS).

Firm financial footing

Post the quarter, Loyal raised nearly AU$4.5 million before costs by means of an institutional placement, which saw strong support by new and existing investors worldwide. This speaks volumes of the investors’ significant interest in the Company’s lithium portfolio situated in the tier-1 mining jurisdictions of Canada and the United States.

The Company had AU$3,054,000 in cash at the quarter ended 30 September 2022. Note that this is in addition to the raising of AU$4.5 million (before costs).

Soil sampling at Scotty Lithium Project delivers impressive values

With the Company committed to building a North American lithium business, this project is part of its US-based lithium endeavours.

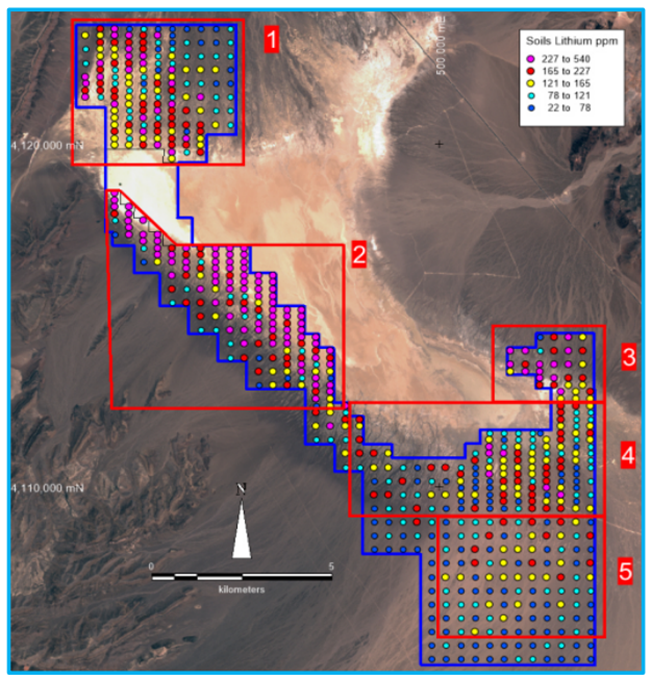

A soil sampling program was designed to help in defining targets to be tested in the maiden drilling program, with planning all set to begin in H2 2022. Five target areas, each with standalone exploration potential as the Company says, have been defined from the soil values.

Scotty Lithium Project with target areas 1 to 5 (Source: Company update, 31 October 2022).

A total of 643 soil samples were taken across the project, of which 177 samples (~27%) recorded greater than 200ppm lithium. Impressive results of up to 540ppm Li max have been achieved.

At target 2, the lithium values found are higher in average with more coherent larger anomalies (>10km2 exceeding 165ppm lithium) than those found in historical soil samples across the adjoining Bonnie Claire Resource.

What’s in name: lithium locus focus

Monger Gold has been rechristened as Loyal Lithium Limited (ASX:LLI). The new name signifies the Company’s transition to a lithium-led battery minerals and technology company.

From the quarterly report, it is evident the Company has been going strength to strength in its quest to tap the burgeoning lithium market.

LLI shares traded at AU$0.610 on 8 November 2022.

To know more about the Company, click here

.jpg)