The number of shares bought and sold over a certain period of time is usually referred as âtrade volumeâ. If a company has high trade volume, it means that its shares are more active in the stock market and vice versa. Technical analysts usually consider trade volumes while confirming a trend or chart patterns.

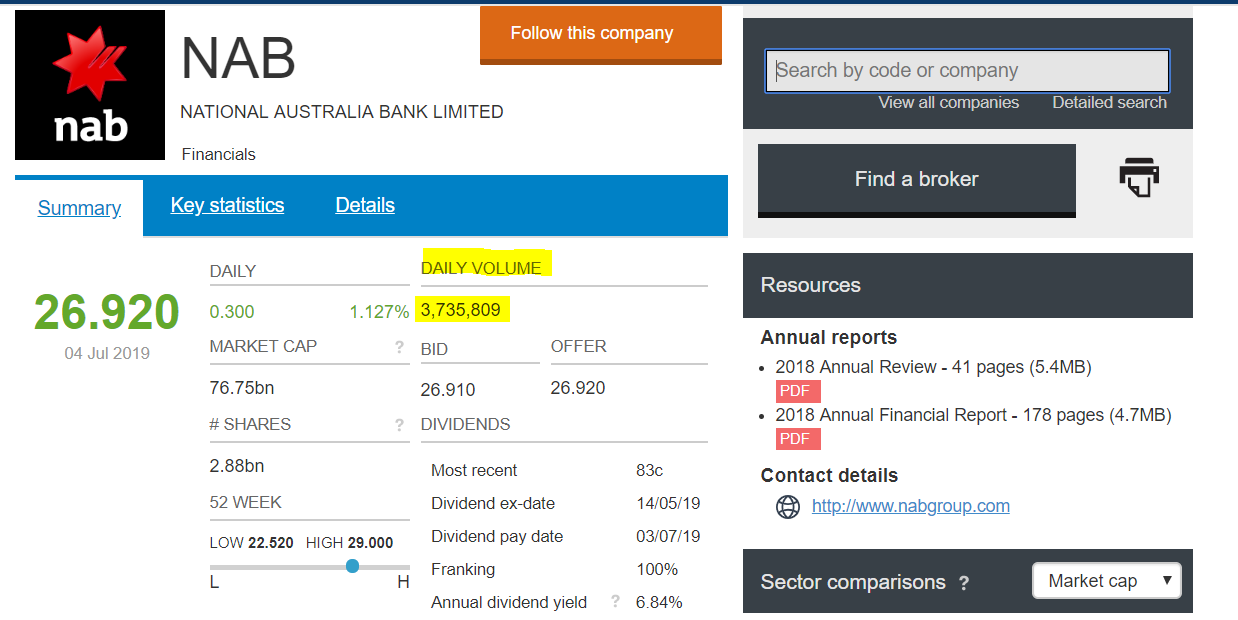

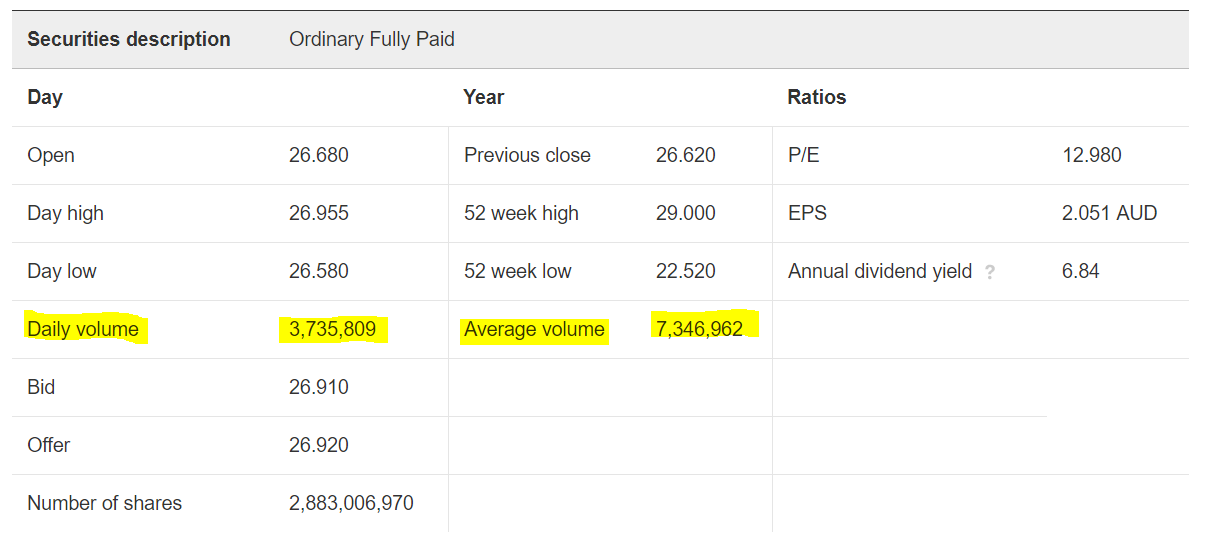

The trade volume numbers can easily be obtained from stock exchanges. Below are the screenshots of the Australian Securities Exchange (ASX) website, where we can see the daily volume and average volume of a particular stock, in this case, it is NAB.

NABâs Daily Volume Number on 4th July 2019 AEST 3:46 PM (Source: ASX)

NABâs Daily Volume Number on 4th July 2019 AEST 3:46 PM (Source: ASX)

NABâs Average Volume Number on 4th July 2019 AEST 3:46 PM (Source: ASX)

NABâs Average Volume Number on 4th July 2019 AEST 3:46 PM (Source: ASX)

The stock trading volume generally goes up with a price movement. It means that if a stock is going up or down on a particular day, the stock trading volume on that day will generally be higher due to the increased number of buying and selling transactions.

Investors can use trading volume numbers to identify a trend in a stock, for example, if an investor sees a stock, which has risen significantly in the past three months. Before investing in this stock, the investor would want to know whether the stock will continue on this trend or not. This is where the trading volume analysis comes into the picture. If a trading volume is increasing with the stock price, it generally will mean that the stock will continue its upward trend. Hence, the stock trading volume analysis is an important criteria in judging the momentum of a stock.

Trading Volume and Share Price Relationship

In a stock market exchange, the price of a security/share is determined through its demand and supply. If a stock is having a higher demand, its price will obviously be on a higher note and vice versa. The demand for a stock can be driven through an announcement or an update, for example, if the company has released positive announcements such as a new contract, increase in earnings, acquisition, etc. The investors, in this case, will try to buy this stock, thereby increasing the trading volume of the stock. Due to the strong demand of the stock, the price of the stock will also rise. On the other hand, if there is any negative news in the market about the company, the shareholders of that stock will try to sell them, which will also increase the trading volume.

Real Life Examples

Pura Vida Energy NL (ASX:PVD)

On 4th July 2019, Australian-based African oil explorer, Pura Vida Energy NL (ASX: PVD) entered into a binding agreement with Gemini Resources Limited to earn into the Gora and Nowa Sol projects (together the Projects) for a 35% interest. Investors were positively influenced by this news, which increased the demand of the stock. The Daily volume of PVD on that day went to 33,440,042 while stock price was up 47.059% during the intraday trade. Before this, the stock had an average volume of 361,577. The sudden increase in the stock trading volume is a testament that trading volumes do get influenced by the market news and stock announcements.

At the time of writing on 5th July 2019 (AEST 01:00 PM), PVDâs stock was trading at a price of $0.024, with a market cap of circa $6.2 million.

Gulf Manganese Corporation Limited (ASX:GMC)

On 4th July 2019, manganese ore and alloy developer, Gulf Manganese Corporation Limited (ASX: GMC) announced that sit has successfully vended the Putra Indonesia Jaya âPIJâ high-grade manganese mine in Timor to its key Indonesian and Singaporean partners. As per the companyâs release, 100% of the ore produced will be supplied to Gulfâs operations in Kupang. It is expected that by Q1 CY2020, the company will be supplying 2,000 tonnes of ore per month.

The company also announced that it is in a continuous dialogue with several potential offtake partners and debt providers for securing requisite capital to fully-fund the completion of the Kupang Smelting Hub Facility construction program. Following recent discussions, it is expected that the construction activity will recommence this quarter, with commissioning of the first two smelters set for March quarter of CY2020.

The Daily volume of FMC on that day went to 16,738,191 while stock price was up by 20% during the intraday trade. Before this, the stock had an average volume of 11,221,808.

At the time of writing on 5th July 2019 (AEST 01:15 PM), GMCâs stock was trading at a price of $0.006, with a market cap of circa $29.46 million.

Speedcast International Limited (ASX:SDA)

On 4th July 2019, the communication solutions provider, Speedcast International Limited (ASX: SDA) announced that its substantial holder IOOF Holdings Limited has increased its voting power to 8.687% from 5.029%. The companyâs another substantial holder Challenger Limited has reduced its voting power to 10.41%.

The Daily volume of SDA on that day went to 16,738,191 while stock price was up by 9.884% during the intraday trade. Before this, the stock had an average volume of 2,418,768.

Trade volumes can also be used to identify the investors sentiment for the stock. If the stock price and its trading volume both are going up, it generally means that there is a bullish scenario. In this case, there is a huge demand of the stock, resulting in a price increase. If volume is moving with the trend, it gives more confidence to investors in stock.

If the relationship between volume and price movements starts to deteriorate, it usually signifies the weakness in the trend, indicating that the recent price movement may be temporary. If a stock has higher trade volume, it generally means that investors are interested in that stock. Investors could be interested in buying or selling the stock, anyway, the stock volume trade will be higher in both cases. Blue chip stocks usually have high trade volumes due to their popularity.

In short, trading volumes analysis can give a better picture in understanding a stock scenario and can help in confirming the trend.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.