Lithium compounds are mostly used in the manufacturing of ceramics, glass and consumer electronics, among others, and are an essential cathode material for long-life lithium-ion batteries used in the hybrid and electric vehicles, as well as the mass energy storage systems. Three important Lithium stocks are Orocobre Limited, Galaxy Resources Limited and Pilbara Minerals Limited. Letâs see how the recent developments of these companies are impacting their stock performance.

Orocobre Limited (ASX:ORE)

Orocobre Limited (ASX:ORE) has an engagement in the exploration, development and production of lithium at the companyâs flagship Olaroz Lithium Facility and the operation of Borax. The company recently announced the issuance of 727,722 performance rights pursuant to the terms of the Orocobre Performance Rights and Options Plan. In another update, the company presented its business prospects at the Macquarie Australia Conference, wherein it highlighted that the company achieved a highest March quarter production to-date despite rainfall and lower evaporation rates and expects FY19 production to be similar to FY18. The companyâs Project Debt reduced by US$82 million as a result of repayment, causing a 43% reduction in Project Debt. Chinese exports also witnessed growth due to weak domestic prices. Q3 FY19 Key Highlights: The company witnessed the best March quarter production of 3,075 tonnes at Olaroz. When compared to the prior corresponding period, the production went up by 10% and year-to-date production at Olaroz stood at 9,150 tonnes. Sales revenues for the quarter amounted to US$33.4 million, up 4% Q-o-Q. After the expenditures incurred on expansion activities, corporate expenses, debt repayment, etc., the company had US$265.7 million in cash as at 31st March 2019.

By the end of the quarter, the Final Investment Decision for the Naraha Lithium Hydroxide Plant was approved by Toyota Tsusho Corporation and Joint Venture Boards, where 75% of economic interest in the project will be held by Orocobre. Stage 2 expansion of its Olaroz Lithium Facility is under process with the construction of harvest ponds, new evaporation and new roads, etc. In the case of Borax Argentina, the sales revenue increased by 4% Q-o-Q. Overall sales volume in the March quarter increased by 44% to 13,041 tonnes as compared to pcp. This also accounted for 2,312 tonnes of low value mineral sold during the period.

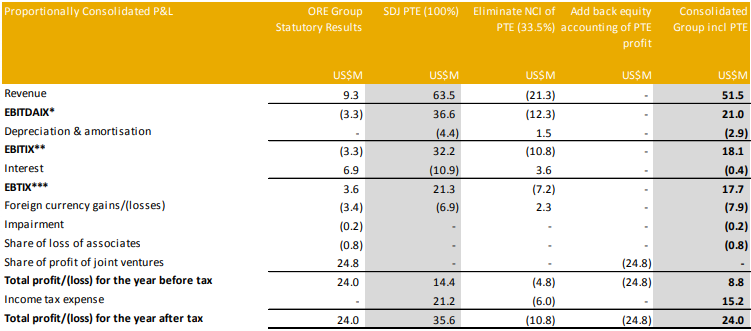

H1 FY19 Financial Performance: Groupâs revenue increased to US$9.29 Mn in H1 FY19. Its net profit after tax increased to US$24.05 Mn in H1 FY19.

H1FY19 P&L Statement (Source: Company Reports)

FY19 Guidance: FY19 production is expected to be approximately the same as FY18 production of 12,470 tonnes. The production at Borax Argentina is expected to remain in the range of 35,000 - 40,000 tonnes for FY19. The capital expenditure for FY19 is expected to be around US$1 Mn to US$2 Mn. OREâs corporate costs for FY19 is expected to be around US$7 Mn to US$8 Mn.

On the stock information front, at market close on June 28, 2019, the stock of Orocobre was trading at $2.820, up 0.356%, with a market capitalisation of ~$735.32 Mn. Its current PE multiple is at 30.61x, with earnings per share at $0.192 AUD. Today, it reached dayâs high and low at $2.870 and $2.805, with a daily volume of 1,495,039. Its 52 weeks high and 52 weeks low price stands at $5.720 and $2.750, with an average volume of 1,417,948 (yearly). Its absolute returns for the last six months, three months, and one month are -6.95%, -12.73%, and -15.36%, respectively.

Galaxy Resources Limited (ASX:GXY)

Galaxy Resources Limited (ASX:GXY) has an engagement in the exploration of minerals in Australia, Canada and Argentina along with production of lithium concentrate. The company recently announced that its Director, Martin Ronald Rowley acquired 50,000 Ordinary Shares at a value consideration of $64,750 effective from June 20, 2019, taking the final holdings to 1,058,603 Fully Paid Ordinary Shares, 4,000,000 Unlisted Options exercisable at $2.78 on or before 14/6/2020, along with indirect interest of 1,541,031 Fully Paid Ordinary Shares with Rowley Super Investments Pty Ltd and 1,969,712 Fully Paid Ordinary Shares with Jaeger Investments Pty Ltd.

March â19 Quarter Key Highlights: GXY reported production of 41,874 dry metric tonnes of spodumene concentrate. Production in the month of March â19 was reported at ~17K dry metric tonnes equivalent to an annualised run rate of over 200K dry metric tonnes. The average cash cost was reported at US$453 per dmt for the period. At the end of the March â19 quarter, the company reported cash and liquid assets of US$285.3 million, with zero debt.

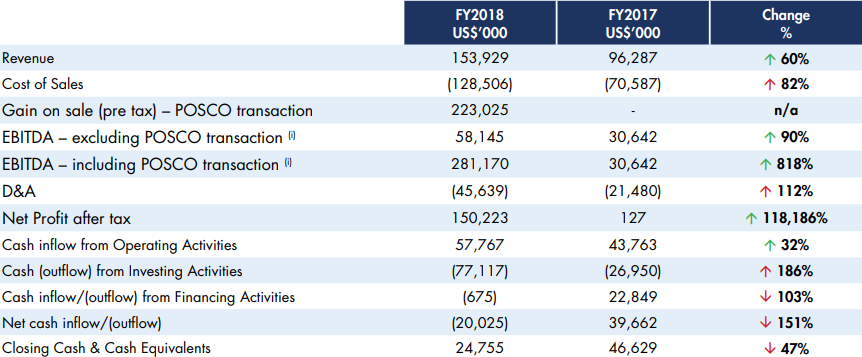

FY2018 Financial Performance: The companyâs revenues increased by 60% pcp to US$153.9 Mn. Net profit after tax for the period was reported at US$150.22 Mn.

FY2018 Key Financial Metrics (Source: Company Reports)

Q2 FY19 Production Guidance: As per the release, in Mt Cattlin, total spodumene production volumes guidance for Q2 FY19 is estimated at 45,000 dmt to 50,000 dmt, whereas for the full calendar year 2019, the production guidance is estimated to be in the range of 180,000 dmt to 210,000 dmt.

On the stock information front, at market close on June 28, 2019, the stock of Galaxy Resources was trading at $1.225, down 2.778%, with a market capitalisation of ~$515.77 Mn. Its current PE multiple is at 2.410x, with EPS of $0.198. Today, it reached dayâs high and low at $1.270 and $1.215, with a daily volume of 5,619,862. Its 52 weeks high and low price stands at $3.320 and $1.210, with an average volume of 4,354,211 (yearly). Its absolute returns for the last six months, three months, and one month are -41.67%, -31.52%, and -18.97%, respectively.

Pilbara Minerals Limited (ASX:PLS)

Pilbara Minerals Limited (ASX:PLS) has an engagement in the development and exploration of mineral resources majorly at the Pilgangoora Project. The company recently announced Pilgangoora production and sales update, wherein it highlighted that the company continues to optimise its production at the Pilgangoora Lithium-Tantalum Project. This was due to moderation in the June quarter sales of spodumene concentrate on the back of delays in the construction, commissioning, and buildout of the companyâs offtake customer chemical conversion capacity in China.

Marchâ19 Quarter Key Highlights: Despite the impact of Tropical Cyclone Veronica, quarterly spodumene concentrate was reported at 52,196 dry metric tonnes (dmt) as compared to 47,859 dmt in the previous quarter. Spodumene concentrate sales for the period stood at 38,562 dry metric tonnes (dmt) as compared to 46,598 dry metric tonnes (dmt) in the previous quarter, majorly due to the delay in one of the shipments, following the Tropical Cyclone âVeronicaâ. Tantalite concentrate sales for the quarter period was reported at 30,356 lbs as compared to 27,821 lbs in the December quarter. The period also witnessed an improvement in the lithia recovery rate, which contributed to higher spodumene concentrate production during April as compared to the March quarter.

As per the Scoping Study for Stage 3 project expansion, post-tax Net Present Value (NPV) is expected to be around $3.73 Bn. The LOM project revenues and EBITDA is expected to be $16.6 Bn and $10.3 Bn. Processing capacity is expected to increase around 7.5 Mtpa. The average annual production of SC6.0 spodumene concentrate is expected to be around 1.2 Mtpa and around 1.1 Mlbspa of 30% tantalite concentrate over a mine life period of 15 years. The competitive LOM operating cost is expected to be around US$291/tonne CIF.

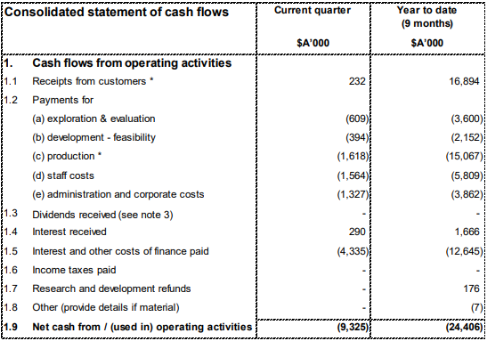

During the period, PLS was involved in the exercise of options to participate in an incorporated downstream joint venture (DJV) with POSCO to develop a 40ktpa LCE chemical conversion facility in South Korea, which is subject to final due diligence and financing. In the period, receipts of $50 Mn were reported from Jiangxi Ganfeng Lithium Co. Ltd. The cash balance at the end of the quarter amounted to $103.9 Mn as compared to $70.2 Mn on December 31, 2018. Major expenditures in the period were due to Pilgangoora Project operation and costs associated with the development and construction of both Stage 1 and Stage 2 of the Project, which was reported to be around $54.1 Mn. This amount was offset by $12.04 Mn received under the contractual claim for a delay in achieving a construction milestone for Stage 1. DSO mining costs associated with the prior quarter activities were reported at $1.6 Mn, and expense associated with the interest and financing payments was reported at $4.3 Mn.

March â19 Quarter Net Operating Cash Flow Data (Source: Company Reports)

On the stock information front, at market close on June 28, 2019, the stock of Pilbara Minerals was trading at $0.545, up 0.926%, with a market capitalisation of ~$999.77 Mn. Today, it reached dayâs high and low at $0.555 and $0.540, with a daily volume of 9,902,130. Its 52 weeks high and low price stands at $1.125 and $0.535, with an average volume of 10,324,279 (yearly). Its absolute returns for the last six months, three months, and one month are -12.90%, -22.86%, and 26.03%, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.