Syrah Resources Limited

Syrah Resources Limited (ASX: SYR) together with its wholly owned subsidiary is primarily engaged in the Production ramp-up of the Balama Graphite Operation in Mozambique. The company is also in the continues development of logistics and sales of natural flake graphite.

Current Status of Graphite Market

Even with positive medium to long term demand growth outlook, the graphite market is filled with the challenges

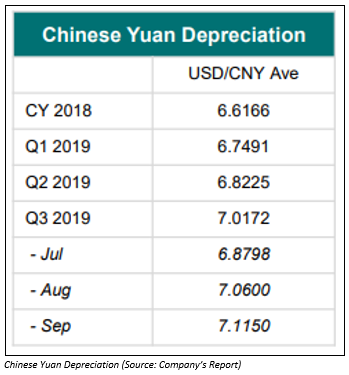

· In Q3 FY19, Syrah has experienced reduction in prices of natural graphite, which was led by sudden and material fall in spot natural flake graphite prices throughout all flake sizes in China.

· In addition, vagueness in the pricing of graphite is anticipated to remain in Q4 FY19 as well as in the starting of 2020.

· These factors reflect, supply of graphite has overtaken demand in the current market, in spite of growth in demand.

First Production of Purified Spherical Graphite

· The company through a release dated 4th November 2019 notified the market participants that its Battery Anode Material (BAM) has produced purified spherical graphite by utlising natural graphite from Balama.

· Moreover, this production has reflected achievement of a significant milestone at BAM project of the company, as well as the execution SYR’s strategy of developing a vertically integrated natural graphite anode material production capability.

· The company also mentioned that internal process optimisation, product testing and quality control assessment would continue in the upcoming period.

Also Read: A look on shift in the graphite market.

Key Position in Anode Supply Chain

The company stated that it is leveraging the globally significant Balama asset for developing an integrated Battery Anode Material as well as industrial products business.

· Balama happens to be a worldwide significant resource, having globally significant flake graphite resource including ore reserves of 113.3Mt at 16.4% TGC2. It’s is a simple open pit operation having low stripping ratio and design production capability of 350kt flake graphite per annum.

· Also, the near-term focus of the company revolves around to adapt Balama market conditions including focus on reduction of cost.

Strategic Context of Syrah

The company operates the largest natural graphite mine in the world and established a position of a globally significant natural graphite producer as well as the first major exporter into China.

Safety as Prime Priority

· With respect to Balama, as at 30th September 2019, the company reported strong safety record with total recordable injury frequency rate of 0.6.

· The production at the Balama stood at 45kt in Q3 FY19 with strategic reduction in production volume in September quarter.

· Balama Graphite operation reported growth in production optimisation yielding to 69% and achieved 71% in Sept 2019 quarter. However, the growth in fixed carbon grade reached to 96% and product mix of 16% coarse flake.

· At the end of September 2019 quarter, the cash balance of the company stood at US$65.5 million

Syrah’s Plans for 2020

Q3 FY19 report, the company has notified the market about the plans for future:

· Pursuant to Balama Graphite Operation, it is expected that future years of the company would witness ramp up in production at Balama and optimisation of the same as well. Production of natural flake graphite of around 250,000 tonnes is targeted for 2019.

· When it comes to the company’s plan for Q4 of financial year 2019, the company has significantly decreased production to around 5kt per month and subject to market conditions, the company has planned production in the ambit of 120kt to 150kt for 2020.

· Considering the immediate market lookout, the continuing production ramp up is diminished and on-going lower production volumes demands for structural changes to operating philosophy.

A Look at Changes in Substantial Holdings

· The company recently announced that Credit Suisse Holdings (Australia) Limited on behalf of Credit Suisse Group AG and its affiliates has made change to the holdings in the company on 13th December 2019 and the current voting power stands at 5.05% as compared to the previous voting power of 6.62%.

· Bank of America Corporation and its related bodies corporate has also made a change to substantial holdings in the company and their current voting power in SYR stands at 7.75% as compared to the previous voting power of 5.32%.

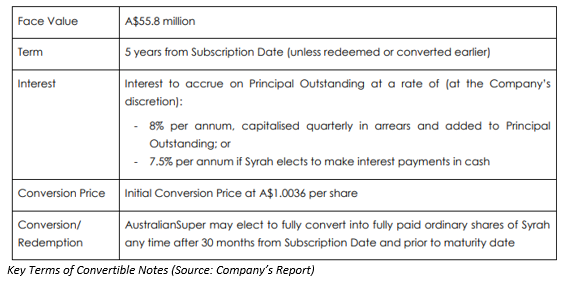

In another update, the company through a release dated 14th October 2019 notified the investors that an issue notice of convertible note has been delivered to AustralianSuper Pty Ltd in consideration (full face value) amounting to A$55.8 million. However, the proceeds from the convertible notes have been received by the company on 28th October 2019.

Following the issue of notes, the company possesses additional liquidity as well as greater flexibility to manage its Balama Graphite Operation production in line with global demand, allowing orderly price discovery from the convertible note proceeds and 30 months non conversion period.

The stock of SYR closed the day’s trading at $0.440 per share on 27 December 2019 up by 4.762% from its previous closing price. The company has a market capitalisation of $173.67 million. The total outstanding shares of the company stood at 413.49 million, and its 52-week low and high is $0.350 and $2.048, respectively.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

.jpg)