Metals and Mining Sector

Australia produces approximately 19 vital minerals from 350 operating mines. Australia is one of the major producers of gold, bauxite, lead, diamond and lithium. Metal and Mining industry has been a significant contributor to the economy of Australia.

The Metals and Mining Industry has added approximately $150 billion to the Australia economy growth. The Metal and mining sector has generated a thousand of jobs in Australia and has a plethora of opportunities over the forthcoming years to meet the growing and changing expectations of the stakeholders.

In 2018 coal became a number one export earner, by generating approximately $66 billion of exports with higher prices and higher volumes. Australian Gold industry is also the top performers in the year 2018 with $20 billion of gold exports and new mines being set up in Western Australia.

Recently, Boss Resources Limited, has announced the results of Feasibility Study of its Honeymoon project for the base case restart and expansion of its Honeymoon Uranium Project in South Australia.

S&P/ASX 300 Metal and Mining sector Performance

On 22 January 2020, The S&P/ASX 300 Metals and Mining Index was last traded higher at 4809.0 points, with a rise of 0.33 per cent compared to the previous close. The S&P/ASX 200 Index last traded higher at 7132.7 points, up by 0.94 per cent from its previous close.

Let us have a look at a stock from the Metals and Mining sector and their recent updates.

Boss Resources Limited (ASX: BOE)

Boss Resource Limited is an exploration company. The company is primarily focused on assessing the uranium projects such as Honeymoon Uranium Project in South Australia region. The company also mines gold, nickel and copper.

Honeymoon Feasibility study reveals Outstanding Results

On 21 January 2020, the company has announced outstanding results of Feasibility Study intended for Honeymoon Uranium Project. This was required for indicating possibility of base case restart and expansion of operations in South Australia. The results of the feasibility study conducted by Boss Resources Limited have indicated that Honeymoon is one of the world’s most sophisticated development projects in uranium and can be primed up to re-start operations in twelve months. This can be achieved with low capital investment to capture an expected rally in the uranium market. The projects are fully allowed to export 3.3Mlbs/annum U3O8 equivalent. The market condition shows an improvement in the underlying U3O8 price, and the project is one the few which can take advantage of the market improvement.

Honeymoon Shows Growth Potential

The Feasibility study is limited to the Honeymoon restart area only, including 36Mlbs JORC resource with a restart plan comprising:

Stage 1 - Refurbishing the existing Solvent Extraction plant.

Stage 2 - Adding an Ion Exchange circuit in order to achieve the annual production of 2Mlbs U3O8 equivalent.

Additionally, 36Mlbs of JORC resources are positioned outside the restart Area, which provides the company with genuine growth opportunities for Honeymoon’s mine life and production profile. These additional resources can be utilised by the company to maximise shareholder value.

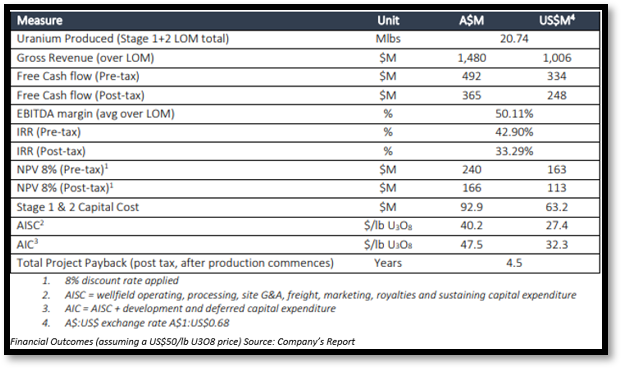

Low Capital and Operating Costs

The study shows a low upfront capital requirement to restart project and become one of the lowest cost uranium producers globally. The base case scenario results show approximately 71 per cent increase in Line of Mine (LOM) to 12 years compared to the Preliminary Feasibility Study (PFS) completed in 2017 and a dip of approximately 7 per cent in upfront capex of US$63.2 million.

Honeymoon Uranium Project Ready to Start Again

The Feasibility Study is the final independent validation for Honeymoon’s restart, having technically de-risked the asset and optimised the process through several phases of study and test work. The company has a strong cash position with no debt, which can fully fund 2020 operations to optimise operating and capital expenditure. The company will also avoid dilutive capital raisings while engaging with utilities for off take of production.

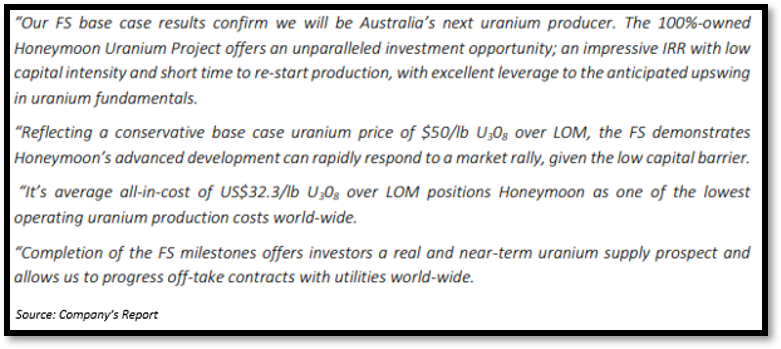

The company’s Managing director and CEO Duncan Craib commented:

Boss Resources Appoints Peter O’Connor as a as Non-Executive Chairman

On 21 January 2020, the company has announced the appointment of Peter O’Connor as Non-Executive Chairman. Mr O’Connor will take up the position from outgoing Chairman Mark Hohnen, who is stepping down having helped transition Boss Resources to be a viable restart operation and Australia’s next uranium producer.

The change in company’s leadership board follows the finalisation of its Feasibility Study for the Honeymoon Uranium Project in South Australia. The newly appointed Chairman, Mr O’Connor, has extensive global experience in the funds management industry and has worked with various public and private companies in the developed and emerging economies,

On Appointment of Mr O’Connor the company will grant him, 7 million unquoted options exercisable at $0.065, 7 million unquoted options exercisable at $0.08 and 7 million unquoted options exercisable at $0.095 with all tranches expiring on 30 June 2023.

Robust Financial Results

- The estimated average all in cost (AIC) US$32.3/lb U3O8 over LOM and all in sustaining cost (AISC) US$27.4/lb U3O8 over the life of mine with a payback period of 1 / 3 of life of mine.

- The Honeymoon project feasibility study has a base case Net Present Value (pre-tax) (NPV) of US$ 163 million and an Internal rate of return (pre-tax) of 42.9 per cent at an average U3O8 price of US$50/lb.

Results of Annual General Meeting

On 11 November 2019, the company has declared the results of Annual General Meeting; below are the resolutions which are passed during the AGM:

- Remuneration Report

- Re-election of Mr Peter Williams as a Director

- Election Mr Bryn Jones as a Director

- Approval to issue Shares to Mr Duncan Craib

- Approval to issue Director Options to Mr Duncan Craib

- Approval to issue Director Options to Mr Bryn Jones

- Approval of 10 per cent Placement Facility

- Renewal of Proportional Takeover Bid Approval Provisions

The last two resolutions were passed with the required 75 per cent majority.

Stock Performance of Boss Resources Limited

The stock of BOE was last traded higher at $0.049 on ASX on 22 January 2020, up by 2.083 per cent from its previous close. The company has approximately. 1.59 billion outstanding shares and a market cap of $76.2 million. The BOE’s, 52 weeks low and high value of the stock is at $0.042 and $0.070 respectively. The stock has generated a negative return of 12.73 per cent in the last six months.