Blue-chip stocks are the companies which are regarded as the most consistently performing from an investorâs point of view. Australian stock market has various ASX listed health care companies, but the majority of stocks are average performers. Blue-chip stocks are the best stocks available in the market for long term value investment with their market capitalization in billions. These stocks offer higher than average returns and facilitate portfolio diversification. Blue-chip stocks are safer from an investment point of view and provide stable returns. In this article, we are discussing five ASX listed blue-chip healthcare stocks.

Letâs zoom the lens on CSL, RHC, SHL, FPH & RMD

A global specialty biotechnology company CSL Limited (ASX:CSL) is engaged in research, development and marketing of pharmaceutical products for the prevention and treatment of serious human diseases. The company is majorly focused on influenza vaccines and rare diseases. CSL Limited is a rapidly growing protein-based biotechnology company and is a leader in offering in-licensed vaccines.

Financial & business highlights- (year ended 30 June 2019)

The fiscal year 2019 has been a strong year for CSL Limited, the companyâs revenue increased by 11% and it has reported a net profit after tax (NPAT) of US$1,919 million up by 17% at constant currencies. The other highlights for financial year 2019 are-

- CSL Limited opened a new Bio21 research facility in Melbourneâs premier medical research hub.

- Thirty new plasma collection centres opened in the United States.

- The company continued strong growth in its core immunoglobulin and albumin therapies by an increased sale in PRIVIGEN® (up by 23%), HIZENTRA® (up by 22%) and ALBUMIN (up by 15%).

- HAEGARDA® (for Hereditary Angioedema) sale are up by 61%, and IDELVION® (for Haemophilia B) sales are up by 40%.

- The company achieved 24 new product registrations in various countries.

Stock Information-

The CSLâs stock closed at A$273.41 on 25 November 2019 with a market capitalization of A$122.39 billion. The number of shares that are outstanding is 453.87 million. The stock has an Annual dividend yield of 0.99%.

Ramsay Health Care Limited (ASX:RHC)

An ASX listed global health care player Ramsay Health Care Limited (ASX:RHC) was established in 1964, in Sydney, Australia, by Paul Ramsay. The company is engaged in providing high-quality services and in delivering excellent care to patients since the last 50 years.

The company updated the market with its AGM presentation on 14 November 2019 detailing about its performance overview and growth strategy.

- The company generated a revenue of A$11.4 billion increased by 24.4% on prior corresponding period (pcp).

- Ramsay recorded an EBITDA $1.6 billion, up by 14.1% on pcp.

- Core net profit after tax (NPAT) was $590.9 million, up by 2.0% on pcp.

- Core earnings per share were 285.8 cents and it increased by 2.1% on pcp.

- Full year fully franked dividends were 151.5 cents, up by 5.2% on pcp.

Stock Information-

The companyâs stock closed at A$ 73.260 on 25 November 2019, up by 1.09% with a market capitalisation of A$14.64 billion. The stock has an annual dividend yield of 2.09% and P/E ratio stands at 27.360x.

Sonic Healthcare Limited (ASX:SHL)

Sydney headquartered, top-50 ASX listed health care company Sonic Healthcare Limited (ASX:SHL) is engaged in providing laboratory, imaging and pathology services to hospitals, medical practitioners and community health services. Based on the services offered by the company, it is divided into three different divisions- radiology/diagnostic imaging, laboratory medicine /pathology and clinical services.

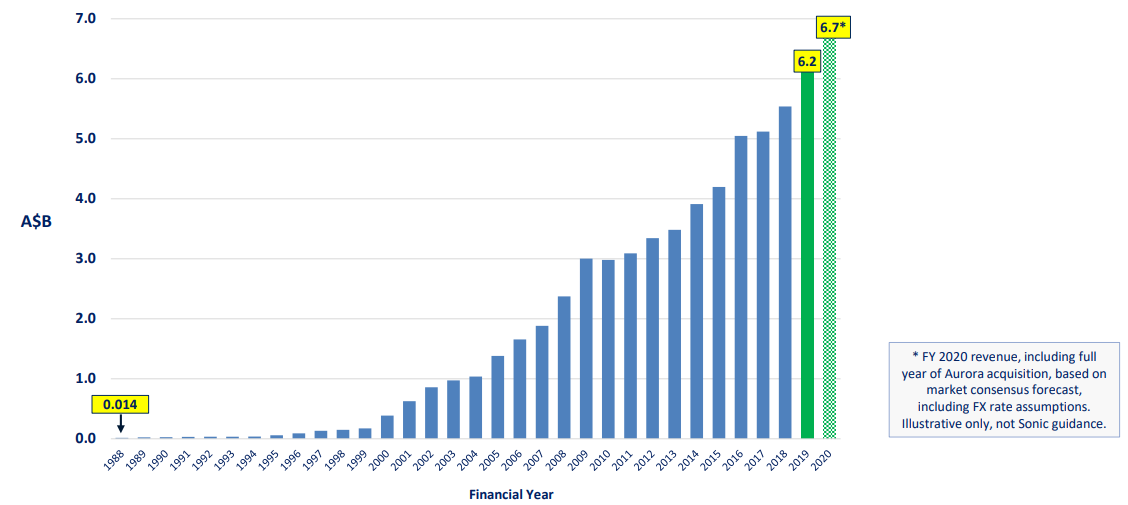

The company released its AGM presentation, highlighting its performance in FY2019 (year ended 30 June 2019)-

- The company generated revenue of A$6.2 billion, up by 11.6%,

- The underlying EBITDA growth was 6.7%.

- The EBITDA was registered at A$1.1 billion, up by 13.3%.

- The company recorded a Net profit growth of 15.6% to A$550 million.

- Sonic Healthcare Limited completed the acquisition of Aurora Diagnostics in January 2019.

- Strategic divestment of non-core GLP Systems was completed in June 2019

Annual Revenue (Source: AGM presentation)

Outlook-

- The company has a planned pipeline of acquisitions, contract opportunities and joint ventures.

- The geographical diversification made in FY2019 offers more growth opportunities.

Stock Information-

The SHLâs stock closed at A$29.850 on 25 November 2019, up by 0.269% with a market cap of A$14.14 billion. The stock has an annual dividend yield of 2.82 % and P/E ratio stands at 24.300x.

Fisher & Paykel Healthcare Corporation Limited (ASX:FPH)

An ASX listed health care company Fisher & Paykel Healthcare Corporation Limited (ASX:FPH) is a leader in providing medical devices for use in respiratory care and for the treatment of Obstructive Sleep Apnea (OSA). The company is engaged in designing innovative medical devices and therapies for use in critical care of patients. FPH offers a variety of devices and systems applicable to respiratory systems of patients in more than 120 countries globally.

Announcement of half-year results on 27 November 2019-

The company would release its half-year 2020 (ended 30 September 2019) financial results on Wednesday, 27 November 2019.

Guidance upgradation

The company upgraded its revenue and earnings guidance for the financial year ended 31 March 2020 on release of new obstructive sleep apnea (OSA) mask in USA.

According to the full-year guidance provided previously in August 2019, which was based in a NZ:US exchange rate of 64 cents, the estimated operating revenue was nearly NZ$1.17 billion and net profit after tax (NPAT) at ~NZ$245-NZ$255 million.

Now, Fisher & Paykel expects full year operating revenue to be NZ$1.19 billion and NPAT to be in the range of approximately NZ$255-NZ$265 million by assuming a NZ:US exchange rate of nearly 63 cents for the rest of the year.

Stock Information-

The companyâs stock settled at A$19.620 on 25 November 2019 up by 1.5%, with a market cap of A$11.1 billion. The stock has an Annual dividend yield of 1.14%, and its P/E ratio stands at 55.310x.

ResMed Inc (ASX:RMD)

A leading health care sector player ResMed Inc (ASX:RMD) which is engaged in providing cloud-connected medical devices for patients having sleep apnea, COPD and other respiratory problems. The company is continuously working towards improving quality of life by providing excellent quality of care to the patients and provides its services in 120 countries worldwide.

First Quarter 2020 Highlights (ended September 30, 2019)

- The companyâs revenue increased to US$681.1 million up by 17% (constant currency basis)

- The gross margin expanded 120 bps to 59.5%.

- The income from operations of the company increased by 19%.

- The companyâs GAAP and non-GAAP diluted earnings per share were US$0.83 and US$0.93, respectively.

- The cash flow provided by operating activities for the quarter was US$162.4 million from operations.

- The companyâs net income and diluted earnings per share increased by 14% each from the corresponding prior-year period.

Stock Information-

The RMDâs stock closed the day at A$21.460 on 25 November 2019 with a market capitalization of A$30.92 billion. Annual dividend yield for the stock is 0.71%. The P/E ratio of the stock stands at 53.510x.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.