In the recent article on the Australian Renewable Energy space, we have stated that the current Morrison government is optimistic towards Australiaâs successful transition into becoming the new energy future. The knockout Underwriting New Generation Investments Program has been thriving towards achieving the target of a 25 to 30 per cent reduction of wholesale charges in the National Electricity Market regions by 2021.

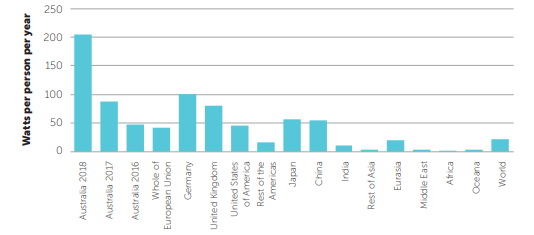

The transformation of the Renewable sector in Australia to have it tagged as a low carbon economy has been at its peak, with the electricity grid accelerating. Considering the record-breaking year of 2018 and as seen in the below image, Australia is installing solar and wind so rapidly, that it is presently a leader amid the other countries of the world with regards to per capita deployment rate for renewables and has left Germany and the United Kingdom behind.

Global per capita renewables deployment rate, 2018 (Source: Clean Energy Regulator)

Further, 2018 marked the year of fundamental shift to solar for households, businesses and large utility-scale power stations. Moreover, this has cropped new employment opportunities with the creation of approximately 13,000 jobs, a large proportion in the regional areas. Besides, international investors have been constantly attracted towards this sector of the Aussie economy, with innovation and use of technology driving this growth.

What is the target Australia is trying to achieve?

Australia has two targets to reduce greenhouse emissions under international agreements. The first one is to go 5 per cent below 2000 levels by 2020 (under the Kyoto Protocol) and secondly, to go 26â28 per cent below 2005 levels by 2030 (under the Paris Agreement).

Is the Renewables Boom in Australia Fading?

On the contrary, a recent flip side has questioned the boom of the renewable space of Australia. The famous proverb which states that âexcess of anything is badâ is comprehending its meaning in the current state of Australiaâs renewable energy. The price impact with the arrival of renewables into the NEM is posing threats to the renewable space, signalling that a probable end of the solar and wind investments is around the corner, given that the economics of some plants are damaged.

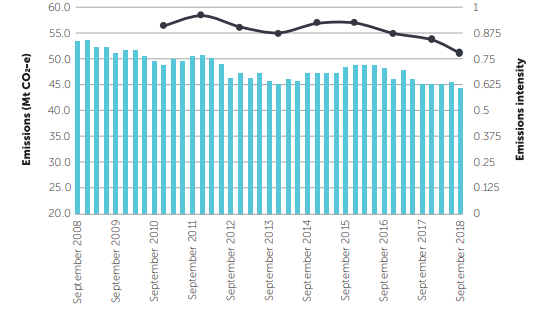

Quarterly electricity emissions and NEM emissions intensity (Source: Clean Energy Regulator)

Quarterly electricity emissions and NEM emissions intensity (Source: Clean Energy Regulator)

In a nutshell, the concern is the path that the demand and supply graph would take. The total solar power generation has significantly soared in the last few weeks, this year, driving down the wholesale prices to zero across the NEM areas and other parts of the country, in a period when the electricity demand has been low. Prices slumped in the tmajor cities, given the subdued demand of electricity, making coal and other renewable plants vulnerable.

The concern has been expressed by the federal Energy Minister Angus Taylor himself, who has been determined to slash wholesale power prices to $70 per megawatt hour. Its bothersome that there is a hoard of renewables projects in the market pipeline.

The Market experts are awaiting the summer season to anticipate if the demand and supply is in sync with the rising heatwaves. Also, solutions have been suggested in the form of a large-scale storage to absorb and store the surplus renewable energy when the supply is high, but the demand being low, has toppled with pumped hydro and firming technology.

How are the Energy Stocks Performing on ASX?

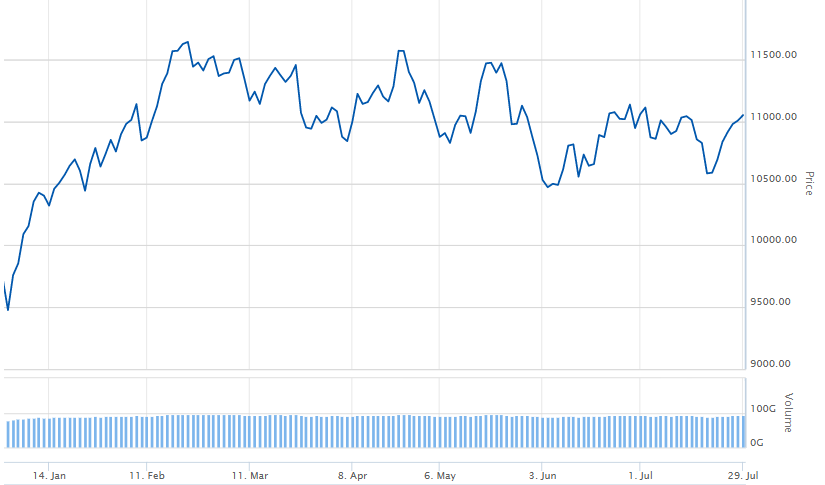

The ASX energy stocks have witnessed a good 2019 so far, with share prices uplifted and positive YTD returns yielded, which has been a blessing for the shareholders of the energy sector. However, the threat of oversupply and a probable regulatory intervention may lead to price and trade volatility in the coming times.

On 31 July 2019, S&P/ASX 200 Energy Sector (XEJ) was trading at 11,143.6 points, up by 0.74 per cent or 82.2 points (at AEST 12:47 PM). The sector has depicted a sinusoidal movement in 2019, with the YTD return of 13.14 (considering the values of 31 December 2018 and 30 July 2019).

YTD Return of XEJ (Source: ASX)

YTD Return of XEJ (Source: ASX)

In this backdrop, let us look at the performance of a few energy stocks on the Australian Securities Exchange on 31 July 2019 (at AEST 12:53 PM), and understand the impact that this anticipation might have made on the investments end:

| Company Name | Stock Value (A$) | Status (%) | YTD Return (%) |

| Mercury NZ Limited (ASX: MCY) | 4.39 | Up by 2.093 | 21.13 |

| AGL Energy Limited (ASX: AGL) | 20.66 | Down by 2.593 | 4.48 |

| Origin Energy Limited (ASX: ORG) | 7.95 | Up by 1.145 | 24.37 |

| Woodside Petroleum Limited (ASX: WPL) | 34.75 | Up by 0.231 | 13.71 |

| WorleyParsons Limited (ASX: WOR) | 16.09 | Up by 0.5 | 41.18 |

The 2018 Renewable Energy Target Administrative Report

Continuing the context of Renewable energy, The Australian Governmentâs Clean Energy Regulator issued The Acceleration in Renewables Investments in 2018 Report on 24 July 2019.

The purpose of the Renewable Energy target is to encourage investment in the field of renewable energy while reducing greenhouse gas emissions. This is achieved by creating a market for renewable energy certificates, which helps drive investment in the sector.

As per the report, Australia was on the right path to meet the Large-scale Renewable Energy goal in 2020, as at the close of last year, adequate utility-scale renewables capacity was commissioned and producing or was under construction phase. The production was most likely to increase from ~22,000 gigawatt hours of last year to ~30,000 gigawatt hours this year and 40,000 gigawatt hours in next year. Following this upliftment, consumers are becoming more informed about the options available to them.

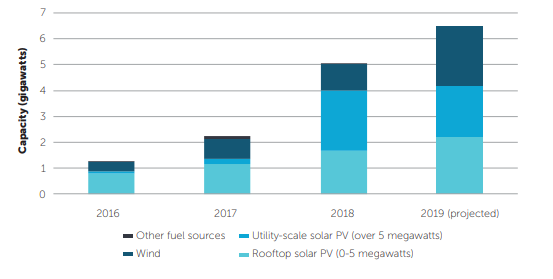

Australia is paving its way into becoming a powerhouse of the solar and wind electricity grid, with rapid installations. Renewable capacity installed under the Renewable Energy Target has soared from 2.2 gigawatts in 2017 to 5 gigawatts last year. This can be better understood from the fact that a record- breaking number of 3455 megawatts of large-scale renewable energy projects were installed in 2018, which were above the triple of the previous record- 1113 megawatts installed in 2017.

On the bleak end, there has been a decline in the level of the support from subsidies under the Small-scale Renewable Energy Scheme. Chairman, Clean Energy Regulator, David Parker AM stated that the transition to renewables does not come with complete optimism and there are a few challenges to the operation of the electricity grids and this transition is changing the economics of thermal generation. Amalgamated with storage technologies, renewables offer flexible capacity to sync with the changing profiles of supply and demand. There is a rise in batteries at all scales, pumped hydro projects and proposed investments in the grid infrastructure.

New renewable capacity, 2016 to 2019 (Source: Clean Energy Regulator)

The National Energy Market emissions intensity was 15 per cent below the 2008 level, with wind and solar continuing to displace gas and brown coal generation, and now starting to displace black coal generation.

Amid the speculations surrounding the Renewable Energy Sector in Australia, market experts and investors are early waiting for the reporting season of August, wherein ASX listed companies would release their earnings, yearly or half-yearly reports. The future moves and events for 2020 and beyond would also be outlined. The energy sector is a vital component of the Australian economy, and it would be enthralling to be part of its future revolutions.

Having said this, even in the phase where the renewables sector might appear to be in doldrums, its long-term benefits should not be ignored. The strategic portfolios of players involved in the renewable sector has appeared promising yet, and the future unfolding bears potential to be equally impactful.

Disclaimer

This website is a service of Kalkine Media Pty. Ltd. A.C.N. 629 651 672. The website has been prepared for informational purposes only and is not intended to be used as a complete source of information on any particular company. Kalkine Media does not in any way endorse or recommend individuals, products or services that may be discussed on this site. Our publications are NOT a solicitation or recommendation to buy, sell or hold. We are neither licensed nor qualified to provide investment advice.

_06_19_2025_05_49_07_385844.jpg)