Gold, long considered a beneficial asset, is used to protect and enhance wealth, acting as a hedge against systemic risk, inflation and currency depreciation. It has unique attributes that make this metal outshine other commodities such as it is a scarce metal, un-correlated asset and highly liquid in nature.

The gold market is large and global, and the yellow metal is bought for number of purposes by a diverse set of consumers and investors–

- Gold as a component in high-end electronics;

- Gold as a luxury good;

- Gold as a safe-haven investment or a portfolio diversifier.

Few attributes that set gold apart from other commodities are:

- Gold is considered as a noble metal, as it does not degrade.

- Gold is an extremely malleable metal; an ounce of gold could be flattened out to a 17 Sq metres sheet of gold.

- The unique properties of gold, coupled with its limited availability across the globe has lend itself a good asset class to invest in.

- During difficult times, gold offers effective downside portfolio protection;

Gold as a luxury consumer good

Treasured for its natural beauty and radiance, gold as a precious metal is widely used in making jewellery items, accounting for around half of the total gold demand. By far, the largest gold jewellery markets are India and China, representing more than 50% of the global gold jewellery demand, in terms of volume.

For jewellery making, gold is preferred over others, owing to the fact that this metal doesn’t react with atmospheric moisture when exposed to moist atmosphere, as a result it does not rust. It is non-allergenic, as it also doesn’t react with other elements. It can be moulded into any shape and has a high resale value.

Gold as an investment

Gold is the most popular amongst all the precious metals as an investment, given its inflation-beating capacity, high liquidity, and positive and high returns. There are times, when gold prices go down, but they usually bounce back strongly.

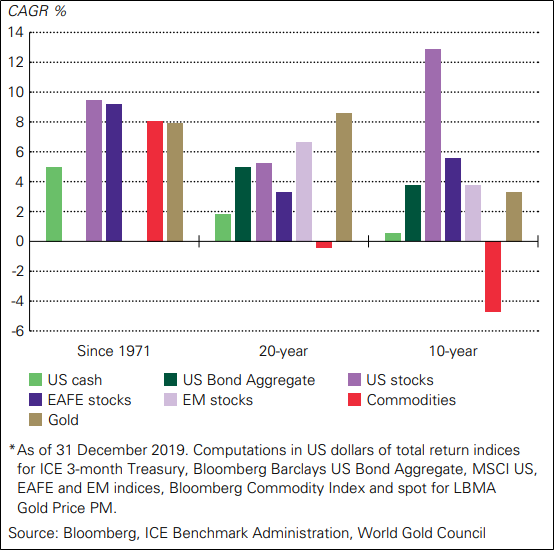

When compared with other commodities, the yellow metal has outperformed most individual commodities, as well as broad-based indices and commodity sub-indices. Moreover, over the over the past two decades, gold has outperformed other major asset classes.

Interesting Read: Major Geopolitical Events to Unfold in 2020; Bearing on Alice Queen's Core Asset - Gold

Alice Queen Limited with Robust Gold Projects

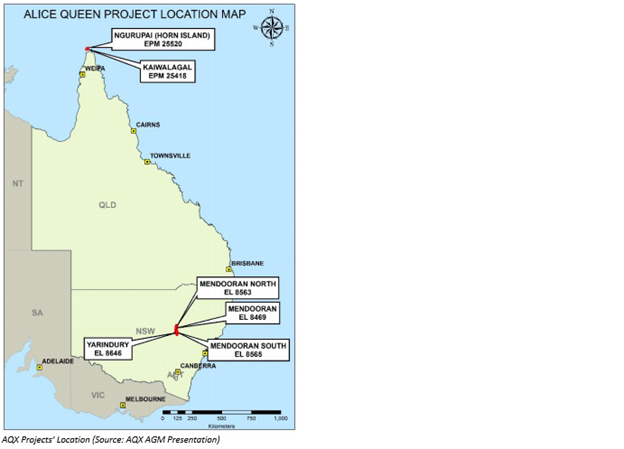

Let us discuss advanced gold explorer Alice Queen Limited (ASX: AQX), which has a portfolio of highly prospective gold projects in Queensland and New South Wales, enabling the Company to gain a name among major gold and copper exploration and mining players.

Flagship Project – Horn Island Gold Project

The flagship property of the Company is located in Queensland and has defined new anomalous soil and rock chip gold zone to the northwest of the existing open pit area, as part of its joint venture with St Barbara Limited (ASX: SBM).

Soil sampling program results delivered –

- A maximum assay result of 2.31g/t Au over the existing Mineral Resource, with 21 samples returning anomalous results of >0.1g/t Au.

Rock chip sampling program delivered –

- A maximum result of 215g/t Au, with 14 samples returning greater than 1.0g/t Au.

Currently, interpretation of results of a DDIP survey conducted at the project in December 2019, in addition to a limited PQ diamond core drill program, are underway.

100% owned Tenements in North Molong

Alice Queen also has a large portfolio of 100% owned tenements in the North Molong, including the Yarindury gold-copper project in New South Wales, where a nine-hole drilling program focusing on high-quality porphyry gold-copper targets, is underway. Of the total, eight holes have been completed so far.

Interesting Read: Alice Queen Riding High on Yarindury Project with Enhanced Prospectivity

Results from logging, sampling and assaying are all underway and are expected in the March quarter.

AQX Stock Performance: 169.23% in Returns in 6 Months

AQX last traded at A$ 0.035 on 14 February 2020, with a market cap of A$ 28.36 million. The last six-month return of the stock was noted at 169.23%.

The securities of AQX have been placed in a trading halt, pending AQX releasing an announcement regarding a proposed capital raise.

Do Read: Alice Queen Releases Update on Exploration Activities at Horn Island and Northern Molong Projects