For many years, Mike Maloney, author, and founder of GoldSilver.com, has been a vocal thought leader in the global sound money discussion.

In particular, he expects fiat currencies, including the US dollar to be devalued against real money such as gold and silver.

Currency vs money

As per the US Currency Education Program (CEP) which is managed by the Federal Reserve Board, dollar bills comprise 75% cotton and 25% linen.

So, what gives the dollar so much power over and above that of an ordinary cotton and linen mixture?

Currencies, or fiat currencies derive their legitimacy from the issuer.

They are not tied to a quantity or substance of relatively stable value and continue to be free floating.

The US dollar, for instance, is issued and backed by the authority of the US government.

The credibility of the US government, its institutions and even its military power combine to keep the dollar valuable in the local and global market.

However, this implies that the degree to which the dollar is accepted depends heavily on the quality of stewardship of the government, the relevance of its institutions and the inevitable changes in the wider socio-political-economic landscape that it exists within.

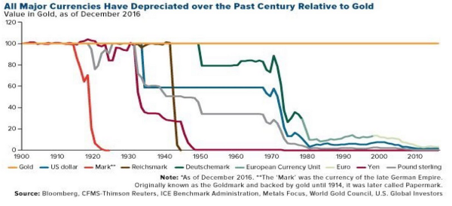

Given all these factors, no government in history has been able to consistently maintain the perceived value of their cotton-linen mixture equivalent, particularly when used as a reserve currency.

For more information on ‘How the dollar became the one to rule them all’, readers may visit this article.

Given that sustenance of a currency’s status is thus at least partly a function of human nature, political urgency usually outweighs economic prudence, accelerating its downfall.

Consequently, without exception, fiat currencies are eventually unable to maintain their value in the eyes of the market.

Money, on the other hand, is different.

Its source of credibility largely sidesteps human intervention, which means that the actions of the government, politicians and institutions become significantly less relevant.

The major forms of ‘real money’ throughout human history include gold and silver, which have consistently maintained their value over thousands of years.

A gold coin used in the Roman era would still be valuable today.

On the other hand, the Venetian ducat for instance was a major reserve currency throughout the 13th century, but if you found one of those coins today, you couldn’t spend it at your local grocery.

It is true that even with money, short-term cycles may cause the market value to vary, but over the long term, money maintains economic energy and never goes to zero (unlike currencies).

In fact, variations are often considered a sign that fiat currencies are fluctuating and not the value of precious metals.

Thus, gold and silver, are often seen as real money due to their store of value properties.

As discussed, this is not the case for fiat currencies and drives Maloney’s expectation that the dollar will inevitably lose its ‘exorbitant privilege’ as the global reserve currency.

‘S-curve rejection’

In his 1926 novel, The Sun Also Rises, writing on how one goes bankrupt, Ernest Hemingway famously wrote, “Gradually and then suddenly.”

This is the basis for Mike Maloney’s notion of ‘S-curve rejection’.

The S-curve is a widely used graph to depict the pace of various processes.

In terms of adoption, this would mean that the acceptance of something new starts very slowly, builds critical mass, then picks up speed suddenly until it has very high adoption and then begins to slow.

This has been seen across the adoption of new technologies, which initially appear slow, difficult, and unpromising until there is a rapid acceleration such as in the case of the microwave, internet, and cell phone.

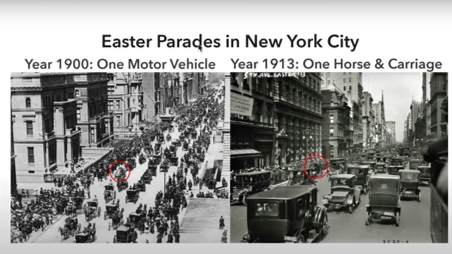

Maloney shares this wonderful picture to illustrate this point.

In the image above, it is clear just how rapid adoption can be, with the switch to automobiles likely being nearly imperceivable in the initial years of the 1900s before exploding and changing the city beyond recognition.

Why the parallel with technology, you ask?

Well, currencies and money are essentially just that.

They store economic energy and enable transactions to occur between even unknown parties, across the globe, instantly or over time.

This traditional S-curve process is what Maloney describes as playing out currently for the adoption of a dollar alternative.

Although the dollar remains central to the global economic system today, this is surely changing, due to increasing concerns about the USA’s unchecked ability and willingness to sanction other countries, as well as other problematic issues such as the threat of capital outflows and exchange rate fluctuation.

For those readers who wish to dig deeper into some of these concerns, I wrote a piece entitled, “No holds barred as China launches frontal assault on American dollar hegemony” in February 2023 which is available on Invezz.

The flip side

As the search for an alternative medium of exchange picks up momentum, Maloney coined the term ‘S-curve rejection,’ which he sees as the mirror opposite of S-curve adoption.

An alternative to the dollar or a new system of exchange is designed to reduce dependence on the greenback.

In other words, the dollar is being replaced, to the extent of the new adoption.

Working on that assumption and reflecting Hemingway’s famed sentence, Maloney expects that the dollar in opposition to the upright S-curve will see a slow decline, before witnessing a sudden crash in favour as the world’s foremost monetary unit.

This contrasts with Janet Yellen’s recent comments, that the dollar would decline but continue to do so gradually over decades.

Commentary on her comments is available in an Invezz article entitled, “7 recent developments that may have tested Janet Yellen’s faith in the dollar“.

Circling back to real money

So where does real money come into all this?

Maloney notes that the world, led by the BRICS, is eager to shift away from the stranglehold that the greenback commands in international markets, to a system that is more stable and largely independent of political interference.

To do so, several countries have been calling for a gold-backed currency system, inspired by the gold standard or gold exchange standard that was in use till 1971.

As Professor Harold James of the Department of History at Princeton University beautifully put it,

Nixon severed the millennia-long link between money and precious metals.

The world’s patience with a free-floating system while the US is at the helm has considerably thinned and continues to do so.

The exact shape or form this new system may take is yet to be determined, and this process will most likely be materially furthered at the BRICS Summit in August 2023.

Momentum in reverse S-curve factors

Maloney pointed to some of the key developments that show that the reverse S-curve is picking up steam.

Putin invite

Since the outbreak of the Ukraine War, Vladimir Putin has been enemy number one as far as most of the NATO countries are concerned.

In March 2023, the International Criminal Court at The Hague, the Netherlands, issued an arrest warrant for the Russian President for his alleged war crimes in Ukraine.

Despite this fact, and the immense pressure Western powers placed on South Africa, the country has extended a formal invitation to Putin and provided diplomatic immunity so that he may attend the upcoming BRICS conference.

The significance of this event cannot be overstated and makes for a powerful symbolic gesture, signalling the waning control of Western authorities.

This decline in influence goes hand-in-hand with the declining favour of the US dollar.

PAPSS

The African Export-Import Bank (Afreximbank) was established three decades ago but has assumed a new strategic significance in aiding the continent’s shift away from the greenback.

The organization along with the African Continental Free Trade Area (AfCFTA) Secretariat developed the Pan African Payment and Settlement System (PAPSS), to enable instant cross-border payment in local currencies.

This new infrastructure is aimed at ushering in an era where countries throughout Africa can trade with each other without resorting to the dollar market.

The Kenyan President, William Ruto, was quoted as saying,

We are not against the US dollar; we just want to trade much more freely.

In another major development, PAPSS and the African Stock Exchanges Association (ASEA) signed an MoU to further collaboration and promote Africa-wide capital infrastructure.

Still, challenges remain, particularly in terms of developing deep bond markets to support liquidity across various currencies.

India goes global

India’s Unified Payments Interface (UPI), a breakthrough technology developed by the National Payments Corporation of India (NPCI), is a single-window mobile payment system that seamlessly enables money transfers between multiple banks, freely and instantly.

With India’s growing economic network, and benefiting from the largest diaspora in the world, the UPI has moved beyond national borders and become widely adopted in other countries.

The most recent addition to the list of countries that now host UPI facilities is France, where the system should be operational later this year.

Other countries where UPI or UPI-based payment mechanisms are already available include the UAE, UK, Oman, Japan, Singapore, Hong Kong, Malaysia, Taiwan, Thailand, Philippines, Vietnam, Cambodia, South Korea, Bhutan, and Nepal.

This is a crucial step towards the internationalization of challenger currencies such as the Indian rupee.

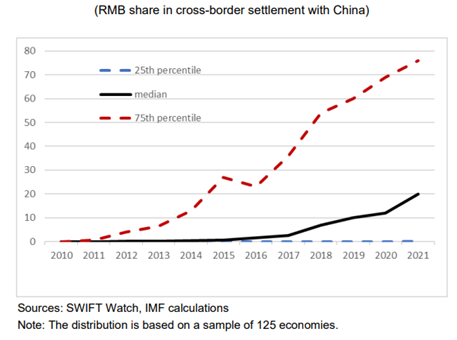

Yuan in China’s cross-border transactions

In a deep-dive entitled, “The shift in the RMB’s reserve currency math”, it was noted,

In a startling turnaround, the yuan outdid the greenback in Chinese cross-border transactions in March 2023, accounting for 48.4% of all transactions, while the dollar slipped to 46.7%.

The incredible speed of the adoption of the yuan over the past decade has caught the dollar wrong-footed.

Of course, the dollar still makes up the majority share of global forex transactions, but its decline vis-à-vis Chinese currency flows remains very significant.

At the same time, RMB bilateral agreements have surged in 2023, and include partner countries such as,

…Brazil, Argentina, Kazakhstan, Bangladesh, Pakistan, and Laos, and is seeking to operationalize new lines in the Middle East.

Further, several reports indicate that the Argentine government repaid part of an IMF loan in yuan, which is one of the five freely usable currencies and can be used to settle obligations with the international body.

A new trading bloc?

In an article dated July 13, 2023, Alasdair Macleod, Head of Research for Goldmoney, a precious metal custodian and investor network, wrote,

It is also beginning to look like there will be another proposal on the Johannesburg agenda, to merge the SCO, the EAEU and BRICS into a supersized trading block. In terms of both combined population and GDP on a purchasing power parity basis, it is already in excess of half the world, dwarfing the western alliance….

The SCO refers to the Shanghai Cooperation Organisation, while EAEU is the Eurasian Economic Union Commission.

In addition, recent news stories also suggest that the list of 36 participating countries expected to be at the BRICS Summit from August 22-24, 2023, has expanded to 41, indicating that the ‘S-curve rejection’ may be at work against the dollar.

Maloney added that since the annual gold supply is relatively fixed,

It is impossible for them to create a gold-backed currency at these prices…the solution is to double triple or quadruple the price of gold (in the not-so-distant future).

The post Mike Maloney observes “S-curve rejection” of the US dollar standard appeared first on Invezz