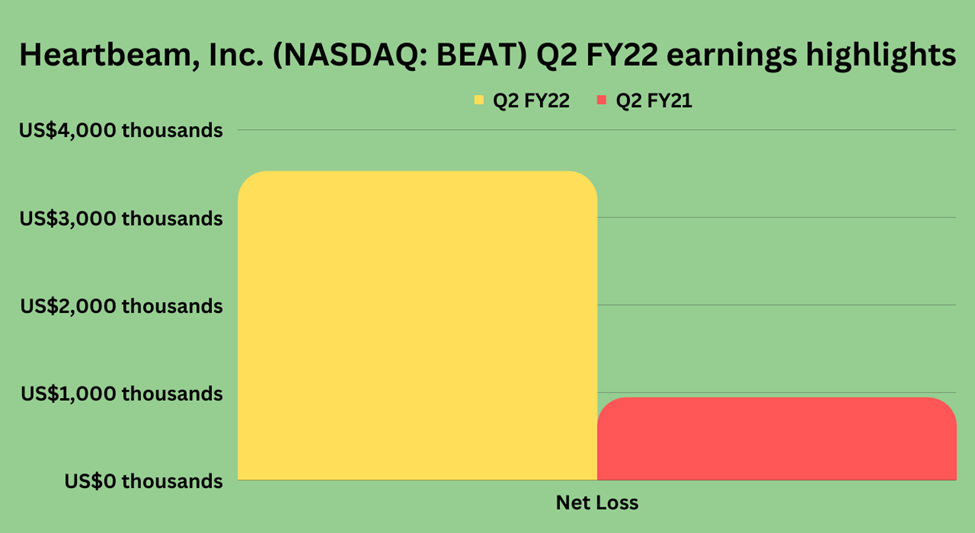

Highlights:

- The BEAT stock jumped more than 40 per cent in the morning trading on Thursday.

- The company announced an expansion of its product portfolio pipeline.

- The price of the BEAT stock rose over 100 per cent this year.

The stocks of Heartbeam, Inc. (NASDAQ:BEAT) seem to be gaining attention from market participants on October 6, as evidenced by the significant jump in the stock price of the digital healthcare firm.

The price of the BEAT stock jumped more than 40 per cent in the morning trading hours on Thursday, October 6, after the company announced an expansion of its product portfolio pipeline.

So, let's dive into the recent developments of the digital healthcare company, while also exploring its stock details:

What's in its broad product portfolio pipeline?

HeartBeam, Inc. is a digital healthcare company specializing in cardiac technology. The company claims to have developed the first and only 3D-vector ECG platform that could detect heart attacks at any given time and any place.

The company's stock soared after it announced the expansion of its product portfolio pipeline to provide its service to the booming cardiac device wearable technology market by introducing proper diagnostic information to patients and healthcare professionals.

The enhanced product in the pipeline would allow the introduction of arrhythmia detection capabilities for addressing the global market worth billions of dollars for atrial fibrillation and other related monitoring.

In its broadened pipeline, it is introducing HeartBeam AIMIGo 3L. It is a 3-lead 3D vector ECG credit-card-sized device that tracks the X,Y,Z cardiac activity and shows signals for clinical review.

In addition to that, it would also enable smartwatch connectivity to the company's platform in future products as an optional monitoring solution for healthcare professionals as well as patients.

Source: ©Kalkine Media®; © Canva via Canva.com

Source: ©Kalkine Media®; © Canva via Canva.com

Bottom line:

The trading price of the BEAT stock was up 40.95 per cent at 9:48 am ET on October 6, to trade at US$ 6.385, while its volume was over 17.32 million at the same time. The BEAT stock closed at US$ 4.53 on Wednesday, October 5.

The stock of the US$ 49 billion market cap company rose over 103 per cent YTD at its current price. Its current trading price was also up from its last 52-week high of US$ 5.4699 noted on November 11, 2021.