Highlights

- Insignia Systems, Inc. (NASDAQ:ISIG) stock was up by 65.95% on Tuesday.

- The ad company offers in-store and digital advertising solutions to customers.

- The Insignia stock gained around 32% YTD and 116.92% MTD.

Shares of Insignia Systems, Inc. (NASDAQ:ISIG) jumped 65.95% to US$19.15 at 10:23 am ET.

The trading volume rose to 13,229,273, higher than its 90-day average of 2,647,565. The stock hit the highest price of US$35.50 on Dec 9, 2021, and the lowest of US$4.76 on Jan 4, 2021.

The Minneapolis, Minnesota-based ad company offers in-store and digital advertising solutions to retailers, packaged goods manufacturers, marketing agencies, and brokerages. Its products are Insignia Point-of-Purchase Services or POPS, label supplies, and laser printable cardstock.

Also Read: Top stocks under US$1,000 to explore in 2022

Also Read: Top 2 cloud computing stocks to watch in 2022

Company Financials

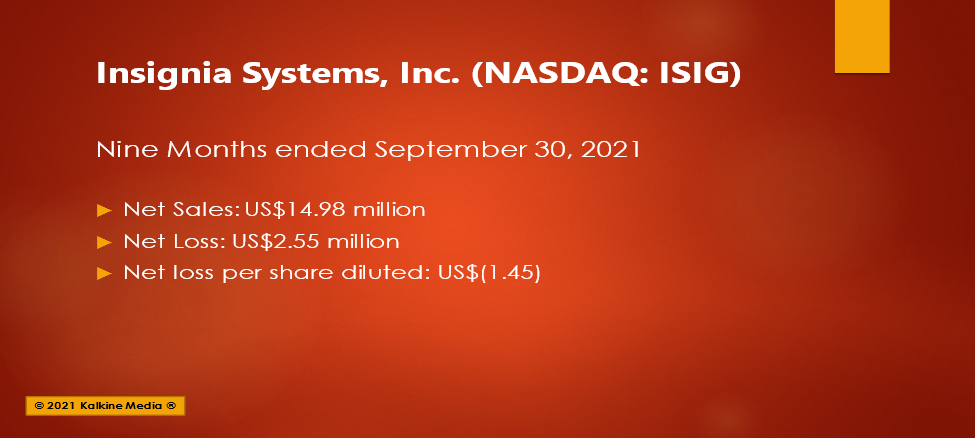

For the quarter and nine months ended Sept 30, 2021, the company reported net sales of US$3.49 million and US$14.98 million, respectively.

The net sales in the Sept quarter of 2020 were US$4.43 million and for the first nine months of 2020 were US$12.42 million.

In addition, it booked a net loss of US$0.921 million in the Sept quarter of 2021, while the net loss was US$2.55 million for the first nine months of 2021

Also Read: Yearender: Top 5 healthcare stocks that grabbed limelight in 2021

The stock closed at US$11.54 on Dec 27, 2021. It gained around 32% YTD and 116.92% MTD. The stock’s 90-day beta is 4.55.

Insignia went public in June 1991. Currently, its market capitalization is US$35.36 million.

Also Read: Top 5 retail stocks to keep an eye on in 2022

Peer comparison

Its peers Quotient Technology Inc. (QUOT) grew 4.71% month-to-date, and AirNet Technology Inc. (ANTE) stock fell 8.88% in the same period.

Also Read: Yearender: Five S&P 500 stocks that gave over 100% return on equity

Bottomline

Tuesday’s stock rally is not based on any updates from the company. The stock grew 32% YTD compared with the S&P 500 Advertising Sub-Industry Index’s gain of 35.14% YTD.