Highlights:

- Recent earnings report showed a larger-than-expected decline in performance.

- Financial ratios indicate challenges in managing debt and liquidity.

- Stock has seen a downward trend in recent months.

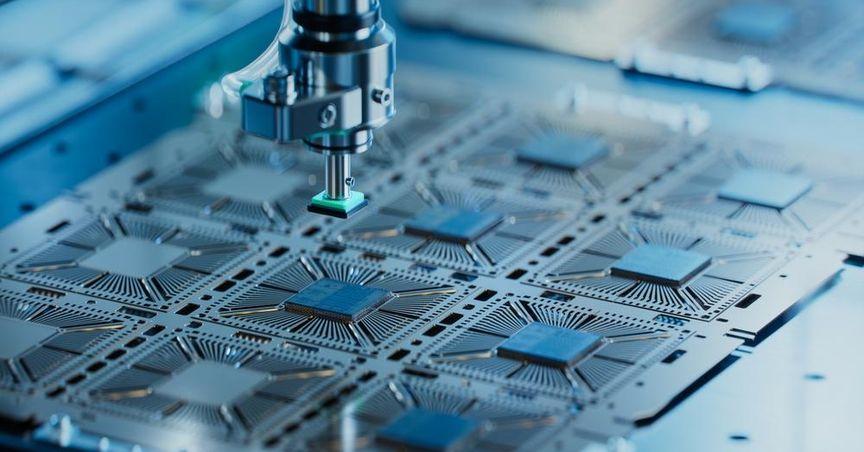

Wolfspeed (NYSE:WOLF) operates within the semiconductor sector, focusing on advanced materials for power and radio frequency applications. The company is known for its silicon carbide technology, which is widely used in electric vehicles, renewable energy, and industrial applications. Despite its presence in a high-growth industry, recent financial data highlights certain challenges.

Recent Financial Performance

The latest earnings report reflected a decline in performance, with earnings per share missing expectations. Revenue trends have not aligned with earlier projections, and profitability metrics showed continued struggles. Negative return on equity and a significant net margin decline indicate ongoing financial pressures.

Stock Trends and Moving Averages

The stock has been on a downward trajectory over recent months, with both short-term and long-term moving averages reflecting a declining price trend. The gap between the short-term and long-term averages suggests a shift in market sentiment.

Financial Stability and Debt Levels

Debt management remains a key focus, as the debt-to-equity ratio highlights the company’s reliance on borrowed capital. Liquidity ratios indicate that short-term obligations can be covered, but the overall capital structure suggests an emphasis on debt financing rather than organic growth.

Broader Market Implications

The semiconductor sector has experienced fluctuations due to supply chain constraints and shifting demand patterns. Wolfspeed’s performance may reflect broader industry trends, as well as company-specific factors affecting its ability to expand operations efficiently.