Summary

- The Nasdaq Composite has increased by almost 22.5% and the Nasdaq 100 technology sector index has increased by 41.19% on a YTD basis as on July 27, 2023.

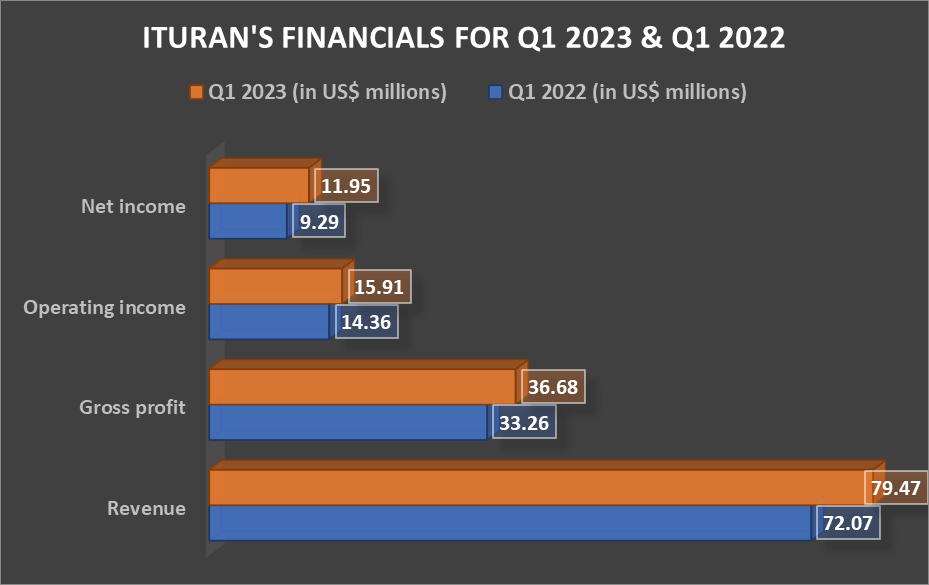

- Ituran Location and Control Ltd., a location-based services provider, reported y-o-y revenue uptick of 10% for Q1 2023.

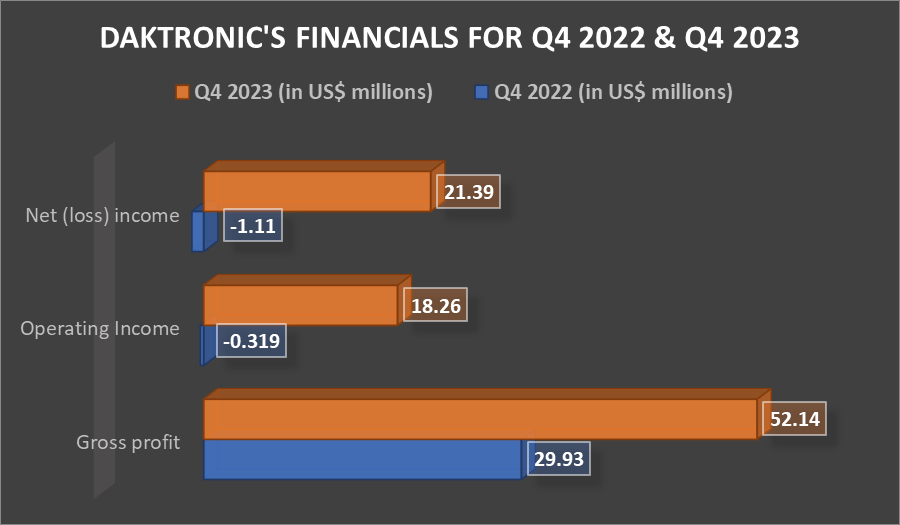

- Daktronics Inc., a manufacturer of electronic scoreboards and display systems, reported a gross profit of US$52.14 million for the three months ended April 29, 2023.

2023 has been the year of tech, with many companies in the sector driving some of the major indexes higher. The tech sector lifted the Nasdaq Composite Index through the first half of the year. On a YTD basis, the Nasdaq Composite has increased by 33% as on July 27, 2023.

Meanwhile, the Nasdaq 100 technology sector index has increased by 41.19% on a YTD basis as on July 27, 2023. By the end of trade on Thursday, the stock rose by almost 80 basis points, as compared to its previous close.

ALSO READ: Should these energy stocks be on your watchlist?

The tech sector’s undeniable strength in the stock market is visible through the performance of the Nasdaq 100 tech index. Let us look at two stocks that have also reported an increase in financial performance alongside robust stock market gains.

Ituran Location and Control Ltd. (NASDAQ:ITRN)

Ituran provides location-based services that include stolen vehicle recovery, fleet management and personal locaters. Ituran’s products also include wireless communications products that can be used over short and medium range.

For Q1 2023, Ituran reported revenue of US79.5 million, an increase of 10% on a year-on-year basis. ITRN’s net subscriber growth for the quarter stood at 49,000. Meanwhile, the company’s net income rose by 30% y-o-y to US$11.4 million in Q1 2023.

Image source: ©2023 Kalkine®; Data source: Company Reports

Ituran’s stock performance has also been interesting, with ITRN rising 30.4% on a YTD basis as on July 27, 2023. On Thursday, July 27, 2023, the stock closed 2.10% higher as compared to the previous close. Based on Thursday’s closing price of US$27.80, ITRN has a P/E ratio of 13.91x.

ALSO READ: Do not miss these financial sector stocks

Daktronics Inc. (NASDAQ:DAKT)

Daktronics is engaged in the designing and manufacturing of electronic scoreboards and display systems. These display boards and scoreboards can range in size from small to large multimillion-dollar systems.

Daktronics reported a gross profit of US$52.14 million for the three months ended April 29, 2023, as against US$29.93 million in the April 2022 quarter. The operating income for the April 2023 quarter was US$18.26 million, as against an operating loss of US$319,000 in the April 2022 quarter.

Image source: ©2023 Kalkine®; Data source: Company Reports

DAKT reported YTD gains of 145.8% by the end of trade on July 27, 2023. Meanwhile, its one-month gains stand at 12.48% as on July 27, 2023. Based on DAKT’s closing price of US$7.04 on Thursday, it has a P/E ratio of 48.18x.