The surge in US liquefied natural gas (LNG) exports is showing no signs of slowing down, reaching new heights as recently developed projects ramp up production.

This trend is not only bolstering the US’s position in the global LNG market but also has the potential to alleviate the soaring energy prices that have been gripping Europe and Asia, Bloomberg reported on Thursday.

Increased supply to stabilise market

The increased availability of US LNG on the international market could help to stabilize prices by providing a much-needed alternative to traditional energy sources and reducing dependence on suppliers with volatile pricing strategies.

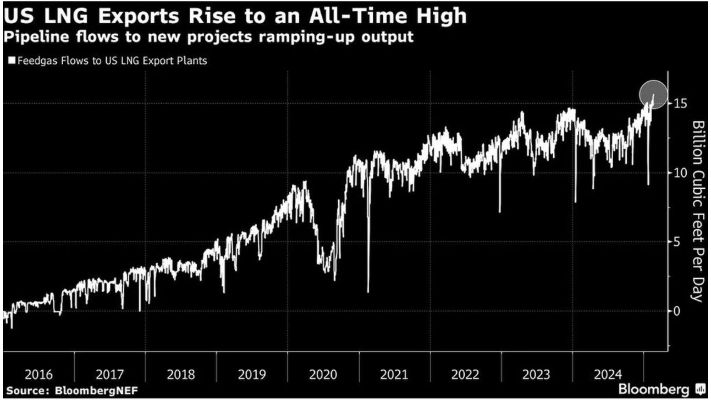

Pipeline gas flows to LNG export plants have seen a significant surge, reaching a record-breaking 15.7 billion cubic feet on Tuesday.

This remarkable figure, based on data from BloombergNEF, represents an almost 20% increase compared to the same period last year.

This substantial rise in gas flows to LNG export plants highlights the growing demand for LNG in the global market.

The increase could be attributed to various factors, including heightened LNG exports to meet rising energy needs in certain regions, geopolitical developments impacting gas supply chains, and potentially, increased production and availability of natural gas.

US emerges as the dominant LNG supplier

The surge in US LNG exports has solidified the country’s position as the dominant global supplier of liquefied natural gas, a fuel widely used for power generation and heating.

This significant increase in exports is driven by rising international demand, particularly from European nations seeking to replace Russian pipeline gas following the 2022 invasion of Ukraine.

Moreover, a deal to transit Russian gas through pipelines to Europe via Ukraine came to an end on December 31. This raised concerns over shortages in Europe as Ukraine refused to renew the deal with Russia due to the ongoing war between the two countries.

The substantial growth in US LNG production is expected to continue, with projections indicating a potential doubling of output by the end of the decade.

This expansion in US LNG exports not only strengthens the country’s energy sector but also plays a crucial role in reshaping global energy markets and reducing reliance on traditional pipeline gas sources.

Increased US supply may lower LNG prices for buyers in Europe and Asia, who have been facing surging costs, according to the report.

The European benchmark gas price reached a two-year high this month, partly due to decreased Russian pipeline flows.

US LNG supply rising

US supply is increasing due to Venture Global LNG Inc.’s Plaquemines plant, which exported its first cargo in December, and Cheniere Energy Inc.’s Corpus Christi project, which started production from the first phase of its expansion at the end of last year.

US President Donald Trump, to expand the United States’ LNG supply, is actively encouraging other countries to increase their purchases of the fuel.

This strategy is part of his broader aim to address trade imbalances.

In a move to facilitate this expansion, Trump has lifted a pause on new permits for LNG export plants, a policy that had been implemented during the Biden administration.

Furthermore, Trump has granted conditional approval for a new LNG facility that is planned to be built near Cameron, Louisiana.

This combination of policy changes and infrastructure development underscores the Trump administration’s commitment to bolstering the US LNG industry and leveraging it as a tool in international trade negotiations.

The post US LNG supply increase could lower prices for Europe and Asia appeared first on Invezz