The shift towards electric mobility, especially in China, is expected to create headwinds for the oil market, the International Energy Agency said on Wednesday.

“China has been the engine of oil market growth in recent decades, but that engine is now switching over to electricity,” the IEA said in its World Energy Outlook report.

China’s oil use for road transport is projected to decline in the “Stated Policies Scenarios” (STEPS), although it could be offset by a large increase in oil use in the petrochemical sector, IEA said.

Cost-effective EVs making inroads

The Paris-based energy watchdog said cost-competitive electric vehicles–many of them manufactured by China–are making inroads in a range of markets.

However, the agency is not sure how fast the share of EVs will grow.

IEA said:

EVs currently have a share of around 20% in new car sales worldwide, and this rises towards 50% by 2030 in the STEPS (a level already being achieved in China this year), by which time EVs displace around 6 mb/d (million barrels per day) of oil demand.

The agency said if the market share of electric cars were to rise more slowly, remaining below 40% by the end of 2030, this would add 1.2 million barrels per day to the projected oil demand in 2030.

But, there would still be a visible flattening of the global oil demand trajectory.

Oil supply in near-term

“Additional near-term oil supply is coming mainly from the Americas – the United States, Brazil, Guyana, and Canada – and this is putting pressure on the market management strategies of the OPEC+ grouping,” the agency said.

If the Organization of the Petroleum Exporting Countries and allies want oil prices to be around $75-$80 per barrel, this would mean more production cuts and a further rise in spare production capacity.

The spare production capacity of OPEC+ is already near historic highs of 6 million barrels per day.

Meanwhile, the agency said that India will become the main source of oil demand growth, adding almost two million barrels per day to its consumption by 2035.

How high will electricity demand go?

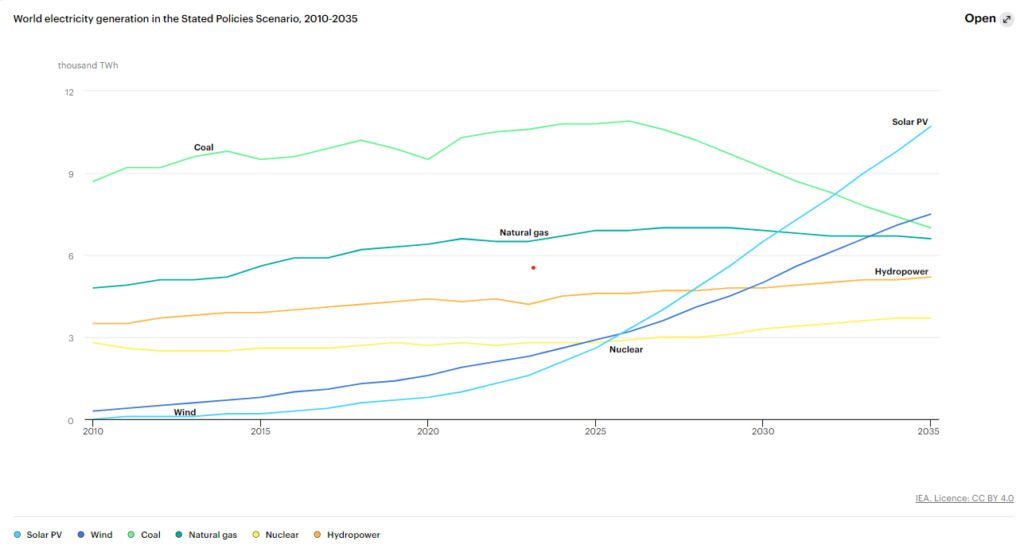

IEA said in its report that electricity demand has grown at twice the pace of overall energy demand over the last decade.

Two-thirds of this increase has come from China, according to IEA’s report.

“Electricity demand growth is set to accelerate further in the years ahead, adding the equivalent of Japanese demand to global electricity use each year in the STEPS, and rising even more quickly in scenarios that meet national and global net zero goals,” the agency said.

The projections for global electricity demand in STEPS are 6%, or 2,200 terawatt-hours (TWh), higher in 2035 than in last year’s outlook, the agency said.

The rise will be driven by light industrial consumption, electric mobility, cooling, data centers, and AI, IEA further said.

The post Shift to EVs, especially in China, to create headwinds for oil market, says IEA appeared first on Invezz